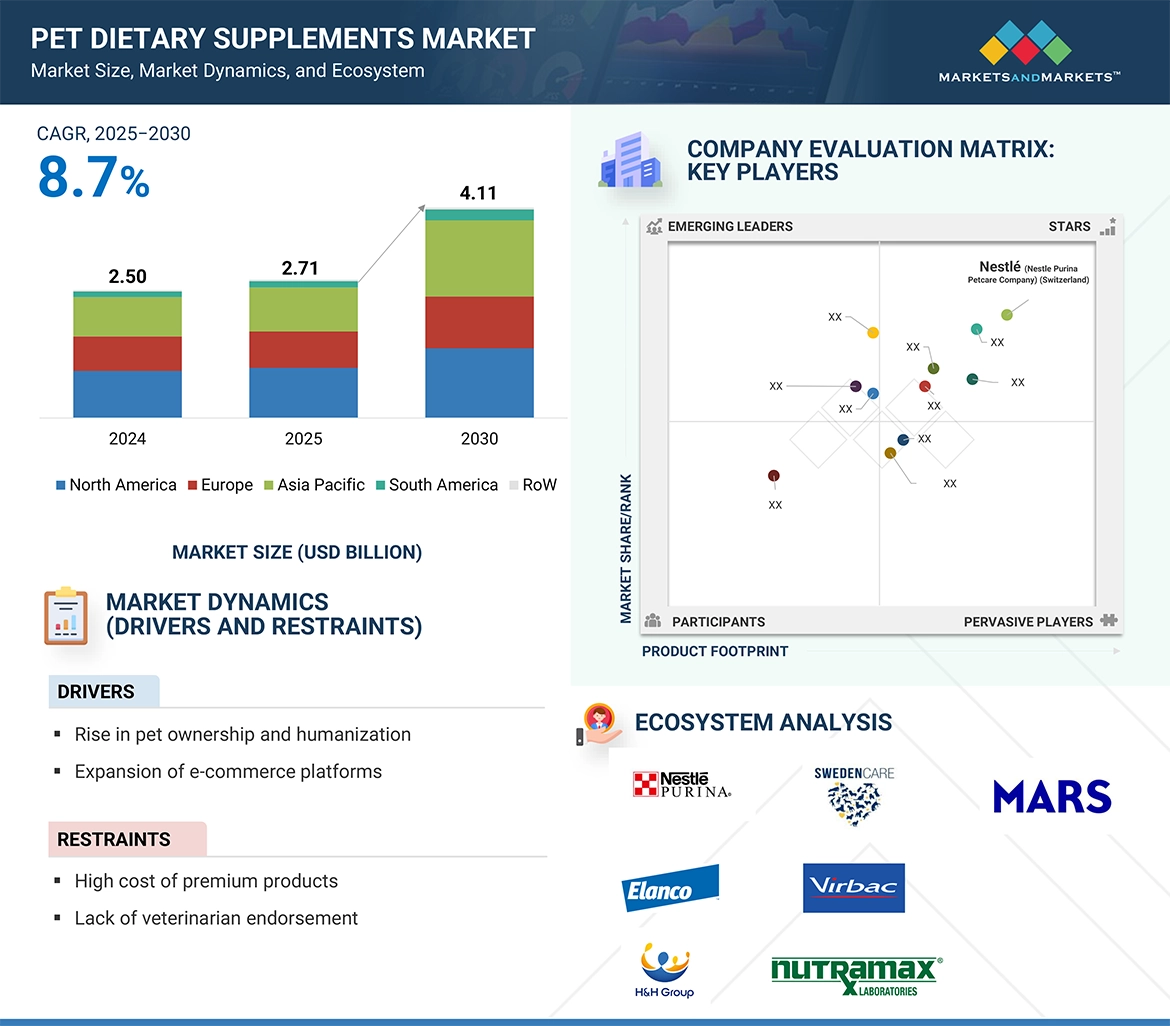

The global pet dietary supplements market is valued at USD 2.71 billion in 2025 and is expected to grow to USD 4.11 billion by 2030, registering a compound annual growth rate (CAGR) of 8.7% during the forecast period. While traditional supplements such as vitamins and minerals remain popular, there is a growing demand for products targeting specific health concerns in pets, including anxiety, stress, and weight management. This shift has fueled the development of specialized formulations tailored to the unique health needs of individual pets. From enhancing digestion and joint flexibility to strengthening immune systems, dietary supplements are becoming an essential component of daily pet care routines.

The growing accessibility of these supplements—via both brick-and-mortar and online retail channels—has further contributed to market expansion. In particular, e-commerce platforms have played a pivotal role by offering consumers the ability to compare products, read user reviews, and enjoy the convenience of home delivery. This ease of access has encouraged more pet owners to integrate supplements into their pets’ daily health regimen.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=264349399

Cats Represent a Significant Share of the Pet Supplement Market

Among all pet categories, cats account for a notable portion of the pet dietary supplements market. Increased awareness of feline-specific nutritional needs has led to rising demand for supplements that support various aspects of cat health, including joint function, digestion, and skin and coat care. Pet owners are increasingly turning to these solutions to manage common feline conditions, driving growth in both product innovation and market size within this segment.

Omega-3 Fatty Acids Hold a Strong Position Among Supplement Types

Omega-3 fatty acids represent a key segment within the pet supplement market, known for their multifaceted health benefits. These essential fatty acids support immune function, which is especially crucial as pets age and become more vulnerable to illness. Their anti-inflammatory properties are highly effective in managing chronic conditions such as arthritis, joint pain, and skin issues, thereby improving comfort and mobility in aging pets.

In addition to internal health benefits, omega-3s play a major role in enhancing the appearance and health of pets' skin and coats. Regular supplementation can reduce shedding, alleviate dry skin, and promote a shiny, well-conditioned coat. Pets suffering from allergies or skin sensitivities often experience relief from omega-3s, which help soothe inflammation and support skin repair. As a result, omega-3 supplements have become a go-to option for many pet owners seeking comprehensive wellness support for their animals.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=264349399

Europe Emerges as a Key Growth Region

The European market is poised for substantial growth, driven by a high level of awareness among pet owners regarding the health benefits of dietary supplements. Consumers in the region increasingly favor premium, natural, and organic products that align with broader lifestyle trends emphasizing wellness and sustainability. Supplements designed to address joint health, digestion, skin and coat care, and cognitive function are in particularly high demand.

Europe’s strong regulatory standards and widespread availability of certified, high-quality products have enhanced consumer trust in pet supplements. Pet owners are willing to invest in advanced formulations, including omega-3s, vitamins, and herbal blends, to support their pets’ longevity and overall well-being. The region's dynamic mix of traditional offerings and cutting-edge products positions it as a leading force in the evolving global pet supplements market.

Leading Pet Dietary Supplements Companies:

The report profiles key players such as Nestlé (Nestlé Purina Petcare Company) (Switzerland), Elanco (US), H&H Group (Hong Kong), SwedenCare (Sweden), Mars, Incorporated (US), Nutramax Laboratories (US), Virbac (France), General Mills Inc. (US), Zoetis Services LLC (US), Wellness Pet, LLC (US), NOW Foods (US), Vetoquinol (France), Affinity Petcare S.A (Spain), FoodScience (US), and Thorne Vet (US).