The global essential oils market size is projected to reach USD 11.19 Billion by 2022, at a CAGR of 8.83% from 2017 to 2022. The shifting trend towards preventive healthcare, coupled with an improved standard of living among consumers, are the major factors driving the market. Also, increasing cases of depression and anxiety disorders among consumers are seen to be contributing to the growing demand for essential oils from the aromatherapy industry. The market has been segmented based on product type, method of extraction, application, and region.

The objectives of the study include the following:

- To define, segment, and measure the size of the essential oils market concerning its product type, method of extraction, application, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders

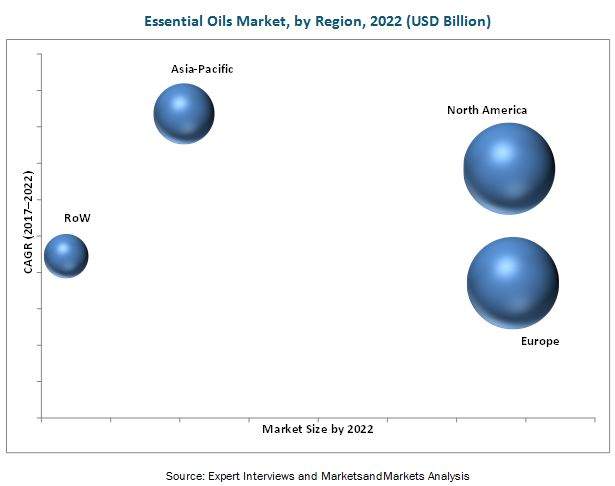

- To project the size of the market in terms of value and volume, for four regions (along with their respective key countries), namely, North America, Europe, Asia-Pacific, and the Rest of the World (RoW)

- To strategically profile the key players and comprehensively analyze their core competencies

- To analyze the competitive developments such as new product launches & developments, acquisitions, mergers, expansions & investments, agreements, and joint ventures in the market

Download PDF Brochure:

Aromatherapy projected to be the fastest-growing segment in the essential oils market, by application, during the forecast period 2017–2022

Essential oils are volatile liquid substances extracted from aromatic plant material by different types of extraction methods. They have potent antioxidant and anti-microbial properties and can be used to treat depression and stress-related diseases. Different types of essential oils used in aromatherapy include tea tree oil, jasmine oil, rosemary oil, and lavender oil. These oils are used in massage therapies, acupuncture, and topical care. Changing lifestyles and their consequences, such as high stress and depression, along with increasing disposable incomes, result in an increase in demand for aromatherapy.

On the basis of method of extraction, the distillation segment is estimated to be the largest market in the essential oil industry in 2017

Distillation is the process of separating components of a mixture by evaporating and then condensing the vapor into liquid. It is a technique which is slightly volatile, where the water-insoluble substances are separated from nonvolatile materials by means of distillation. Different types of distillation methods are used such as water distillation, water & steam distillation, and steam distillation for extraction of oils. Distillation is one of the primary methods used for extraction in essential oil industries.

Speak to Analyst:

Significant growth for essential oil is observed in the Asia-Pacific region

The Asia-Pacific region is segmented into China, Japan, India, Australia & New Zealand, and Rest of Asia-Pacific. The increase in preference of consumers for natural essential oil ingredients such as peppermint & spearmint and rise in purchasing power parity in the region is driving the demand for essential oils in applications such as aromatherapy, health care, and food & beverages.

This report includes a study of marketing and development strategies, along with the product portfolio of leading companies in essential oils market. It includes the profiles of leading companies such as Cargill (U.S.), E.I. du Pont de Nemours and Company (U.S.), Koninklijke DSM N.V. (Netherlands), and Givaudan SA (Switzerland).