The report "Medicated Feed Additives Market by Type (Antioxidants, Antibiotics, Probiotics & Prebiotics, Enzymes, Amino Acids), Livestock (Ruminants, Poultry, Swine, Aquaculture), Mixture Type, Category, and Region - Global Forecast to 2022", The global medicated feed additives market is projected to grow at a CAGR of 5.41% from 2016 and reach USD 15.32 Billion by 2022. The market is driven by factors such as the growing consumption of meat and dairy products, shift of the livestock industry from an unorganized sector to an organized one and growing concerns about the health of livestock and industrialization of animal processed products. Moreover, the growing global population drives the meat consumption growth over the forecast period in developing countries thereby driving the growth of the medicated feed additives market. As a result, many multinational players have entered into the production of various products of medicated feed additives that protects the health of the animal and provides nutritional ingredients.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=186173723

On the basis of livestock, the poultry segment is estimated to dominate the medicated feed additives market in 2016. On a global level, the poultry production has been increasing with the rise in consumption of poultry products; it has become important for meat producers to focus more on the quality of additives fed to these birds. This boosts the medicated feed additives market to provide complete nutritional feed for poultry birds.

On the basis of mixture type, the supplements segment accounted for the largest market share in 2015. Supplements include trace elements and micro feeds such as protein supplements, which are included in animal diet to overcome deficiencies.. They are a concentrated source of nutrients and therefore have higher nutritive value than fibrous fodder, making them the most preferred mixture type for medicated food additives.

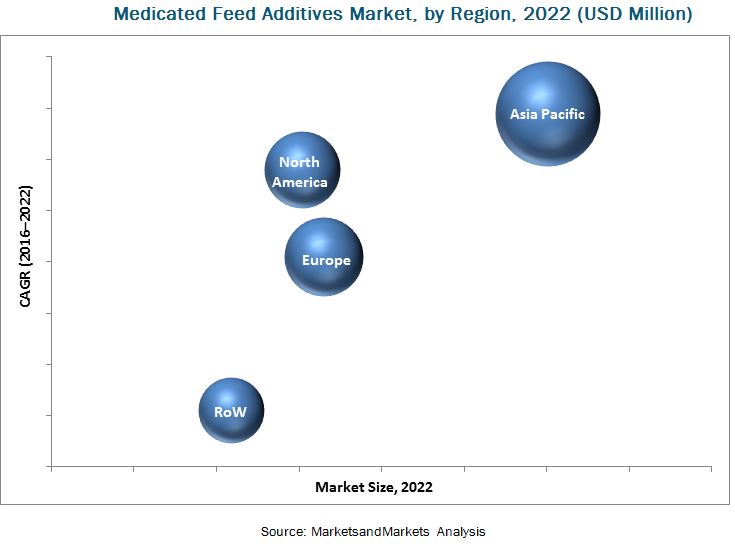

The Asia Pacific region accounted for the major market share for medicated feed additives between 2016 and 2022. Asia Pacific records the maximum consumption of medicated feed additives due to the increase in population and rise in disposable income. Key players focus on research & developments to develop products conforming to European regulations for medicated feed additives, since these regulations are considered to be benchmarks in terms of certain feed additives such as antibiotics.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=186173723

This report includes a study of marketing and development strategies, along with the product portfolio of leading companies. These companies include Archer Daniels Midland Company (U.S.), Cargill (U.S.), CHS Inc. (U.S.), Zoetis Inc. (U.S.), and Purina Animal Nutrition (Land O’ Lakes) (U.S.); these are well-established and financially stable players that have been operating in the industry for several years. Other players include Adisseo France SAS (France), Alltech Inc. (Ridley) (U.S.), Zagro (Singapore), Hipro Animal Nutrition (Turkey), and Biostadt India Ltd. (India).

Targeted Audience:

- Supply side: Medicated feed ingredients manufacturers, formulators, traders, distributors, and suppliers

- Demand side: Animal feed manufacturers, food processing industries, feed producers, large animal husbandry companies, large-scale ranches & poultry farms, and researchers

- Other related associations, research organizations, and industry bodies: the Food and Agriculture Organization (FAO), the International Feed Industry Federation (IFIF), Agriculture and Agri-Food Canada.