The milk protein market is projected to grow at a CAGR of 6.5%, in terms of value, from 2017 to reach a projected value of USD 13.38 Billion by 2022. The multifunctional nature of milk protein, ease of incorporation in a wide range of applications, increase in demand for high protein food, and increase in consumption of premium products are the factors driving the global market. Increase in awareness with regard to the importance of high nutritional food and its rising applications among the global population, fuels the demand for milk protein.

Whey protein concentrates projected to be the largest segment

Whey protein concentrates segment is estimated to be the largest market share in the milk protein market in 2017, due to their wide range of applications in the food & beverage industry. The multifunctionality of whey protein concentrates, finds use in a broad spectrum of applications such as confectionery, bakery, infant nutrition, sports nutrition, and desserts.

Download PDF Brochure:

Sports nutrition: The most widely preferred milk protein application

The sports nutrition segment accounted for the largest share in the milk protein market, in terms of value, in 2016. Multifunctionality of milk protein increases its adoption in end-use applications, increased consumption of premium products, increase in demand for healthy food, growth in demand for high protein products, and increase in investments for research & development to develop new products for the market are the key drivers of the milk protein market. The milk protein market is considered to be one of the fastest-growing segments of the dairy ingredients market due to the growing trend toward reducing the fat content and calorie content, thereby increasing the protein content in food products. With the increase in awareness about health & nutrition products among the global population, wide applications of milk protein and positive investigations for health benefits create a platform for newer applications of protein, which drives the increase in demand and market growth for protein-based food products.

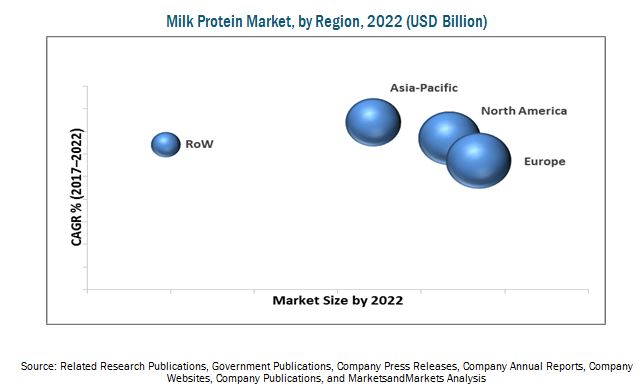

Europe estimated to be the most lucrative market for milk protein

In 2017, the Europe region is estimated to hold a significant share in the global milk protein market whereas Asia-Pacific is projected to grow at the highest CAGR during the forecast period. The major drivers for this significant share of the European region are increase in consumer expectations for innovation and convenience. Development of milk protein for making low fat food products is one of the latest trends in the food & beverage industry of countries such as Germany and France. Positive investigations for health benefits create a platform for newer applications of milk protein and increase in consumer awareness regarding value-added products. The Asia-Pacific market is driven by the growing demand for processed food products in developing countries such as India, China, Australia, and New Zealand.

This report includes a study of marketing and development strategies, along with the product portfolios of leading companies. It includes the profiles of leading companies such as Groupe Lactalis (France), Fonterra Co-Operative Group (New Zealand), FrieslandCampina (Netherlands), Arla Foods (Denmark), and Saputo Incorporated (Canada).

Make an Inquiry:

Target Audience:

- Milk protein importers and exporters

- Dairy manufacturers and processors

- Secondary sources, which include the following:

- The Food and Agriculture Organization (FAO) and the International Dairy Food Association(IDFA)

- The European Food Safety Authority (EFSA) and the Food and Drug Administration (FDA)

- Food safety agencies

- End applications, which include the following:

- Bakery products, confectionery products, and convenience foods

- Dairy products