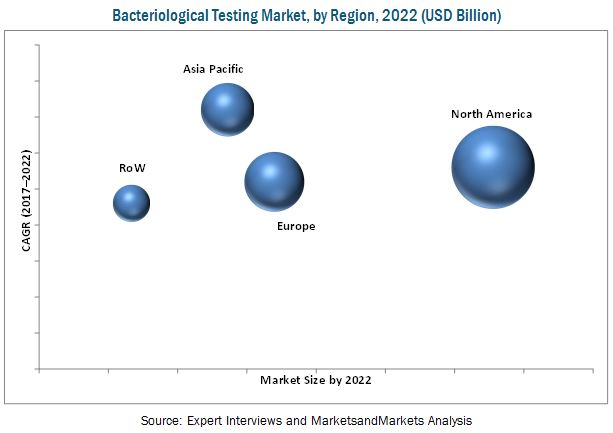

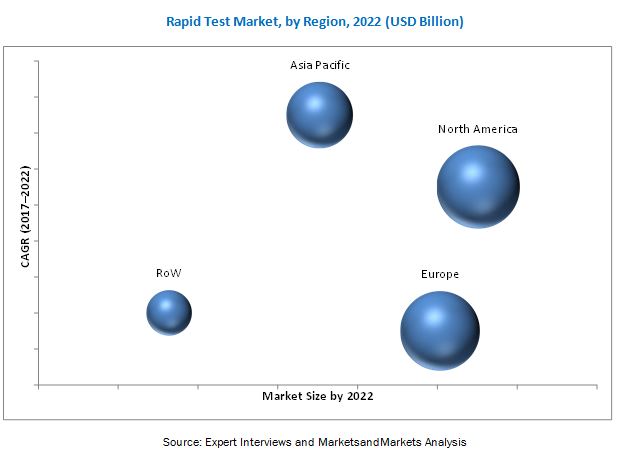

The report “Bacteriological Testing Market by Bacteria (Coliform, Salmonella, Campylobacter, Legionella, Listeria), Technology (Traditional, Rapid), End-use Industry (Food & Beverage, Water, Pharmaceutical, Cosmetics), Component, and Region – Global Forecast 2022″, The bacteriological testing market, by services, is estimated to be valued at USD 9.58 Billion in 2017, and is projected to reach USD 13.98 Billion by 2022, at a CAGR of 7.8%. The market is driven by a globally observed increase in outbreaks of foodborne illnesses, implementation of stringent food safety regulations in developed economies, and rise in incidences of microbial contamination in water reservoirs, due to increased urban & industrial waste. Lack of food control systems, technologies, infrastructure, and resources in developing countries and reluctance of municipal bodies to adopt new technologies are the main factors restraining the growth of this market.

The objectives of the report:- To define, segment, and project the global market size for bacteriological testing

- To define, segment, and forecast the size of the bacteriological testing market with respect to bacteria, end-use industry, technology, component, and region

- To analyze the market structure by identifying various subsegments of the global bacteriological testing market

- To provide detailed information about the crucial factors that are influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To forecast the size of the global bacteriological testing market and its various submarkets with respect to four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective key countries

- To strategically profile the key players and comprehensively analyze their core competencies

- To analyze the competitive developments such as mergers & acquisitions, expansions & investments, and new service & product launches in the bacteriological testing market

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=238062451