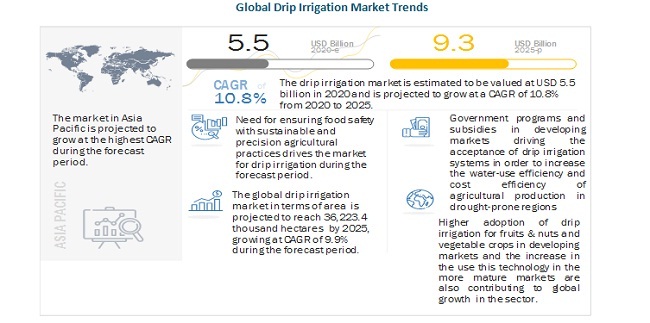

The global drip irrigation market is projected to grow from USD 5.5 billion in 2020 to USD 9.3 billion by 2025, at a CAGR of 10.8%. The rise in the popularity of drip irrigation solutions can be attributed to government initiatives, water conservation activities, enhancement of production, and decrease in production cost. Markets such as China and India are among the key markets targeted by drip irrigation manufacturers and distributors due to the large agriculture sector driven by regional demand and exports that are adopting drip irrigation services in the region.

Market Dynamics:

Driver: Government programs and subsidies driving acceptance of drip irrigation systems

Developing countries such as India and China are among the major countries adopting drip irrigation systems, and the key driver is the support from government agencies and public-private partnerships through prominent industry participants. Government programs such as India’s Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) seeks to extend the coverage of micro-irrigation in the country through subsidies on kits and systems to improve acceptance among farmers. State-sponsored projects are another factor that continues to drive the growth of drip irrigation systems in developing countries.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=217216582

Challenge: Soil salinity hazards and bio clogging in drip irrigation systems

Drip irrigation systems are often limited by the presence of high saline content in water, which poses a threat to the crops being grown. The excess of salt content is one of the major concerns with water used for irrigation. A high salt concentration present in the water and soil would negatively affect the crop yields, degrade the land, and pollute groundwater. The use of drip irrigation systems causes no foliar accumulation of salts; however, the salt accumulates near the periphery of the wetted area. This salt accumulation is a cause for concern when the emitter placement does not coincide with the location of the plant row, particularly for crops that are sensitive to soil salinity.

Increasing concerns over water withdrawal and government initiatives are the key factor driving the growth in the drip irrigation market during the forecast period

Drip irrigation helps minimize water loss due to evaporation by distributing water through a network of valves, pipes, tubing, and emitters. Drip irrigation methods are known to offer a significant advantage in efficiency against other conventional irrigation methods, including sprinkler and flooding. The adoption of micro irrigation technology has helped achieve higher cropping and irrigation intensity, which has made a significant impact on resource saving, cultivation cost, crop yield, and farm productivity. This technology has received considerable attention from policymakers and government for its perceived ability to contribute significantly toward agricultural productivity and economic growth.

Asia Pacific is projected to account for the largest market size during the forecast period

The Asia Pacific drip irrigation market is estimated to be the largest between 2020 and 2025 and is projected to grow at the highest CAGR. Asia Pacific was the largest consumer of drip irrigation in 2020. The region is marking a dramatic shift from the installation of basic irrigation facilities to the adoption of precision irrigation systems through technological upgrading. The focus of agriculture has shifted from traditional crops to more commercial crops. Due to these changes, irrigation facilities are expected to modernize their irrigation management and preferably their infrastructure. Drip irrigation has become an essential aspect as commercial crops are sensitive to the amount of water required and the time taken for its delivery.

Make an Inquiry:

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=217216582

Key Market Players:

The key drip irrigation manufacturers in this market include Jain Irrigation Systems Ltd. (India), Lindsay Corporation (US), The Toro Company (US), Netafim Limited (Israel), Rain Bird Corporation (US), Chinadrip Irrigation Equipment Co. Ltd. (China), Elgo Irrigation Ltd. (Israel), Shanghai Huawei Water Saving Irrigation Corp. (China), Antelco Pty Ltd. (Australia), EPC Industries (India), Microjet Irrigation (South Africa), KSNM Drip (India), Sistema Azud (Italy), Metzer Group (Israel), Grupo Chamartin Chamsa (Italy), and Dripworks Inc. (US). These players are undertaking a strategy involving new product launches, acquisitions, and collaborations & agreements to improve their market position and extend their competitive advantage.

Recent Developments:

- In June 2020, Lindsay Corporation announced the acquisition of Net Irrigate, LLC (US), an agriculture Internet of Things technology company that provides remote monitoring solutions for irrigation customers. The acquisition would help the company to enhance its irrigation technology offering.

- In May 2020, The Toro Company launched clog-resistant drip tape, Toro Aqua-Traxx Azul drip tape. The drip tape offers a filter inlet design and optimized flow passages that pass through debris to maximize clog resistance and product performance.