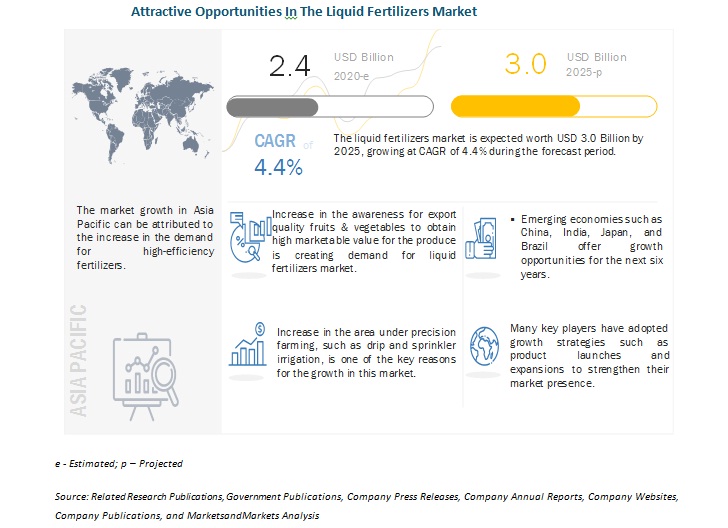

The global liquid fertilizers market size is estimated to be valued at USD 2.4 billion in 2020 and is projected to reach USD 3.0 billion by 2025, recording a CAGR of 4.4%. The growth of the liquid fertilizers industry is driven by various factors due to its ease of use and rapid absorption by the soil and plants, which in turn, ensures that nutrients reach crops faster than other forms of fertilizers.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=225530281

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=225530281

Key players in the liquid fertilizers market include Nutrien, Ltd. (Canada), Yara International ASA (Norway), Israel Chemical Ltd. (Israel), K+S Aktiengesellschaft (Germany), Sociedad Química Y Minera De Chile (SQM) (Chile), The Mosaic Company (US), and EuroChem Group (Switzerland). Product innovation, expansions, mergers & acquisitions, agreements, collaborations, and partnerships were some of the core strengths of the leading players in the liquid fertilizers market. These strategies were adopted by the key players to increase their market presence. It also helped them diversify their businesses geographically, strengthen their distribution networks, and enhance their product portfolios. Some of the other leading players in the liquid fertilizers market include CF Industries Holdings, Inc.(US), OCP Group (Morocco), OCI Nitrogen (Netherlands), Wilbur-Ellis (US), Compass Minerals (US), Kugler (US), Haifa Group (Israel), COMPO Expert GmbH (Germany), AgroLiquid (US), Plant Food Company, Inc. (US), Foxfarm Soil and Fertilizer Company (California), Agro Bio Chemicals (India), and Agzon Agro (India).

Nutrien Ltd. (Canada) Nutrien has the largest crop nutrient product portfolio, which is combined with a global retail distribution network that includes more than 1,500 farm retail centers. The company is a leading manufacturer and distributes over 27 million tonnes (29.76 million tons) of nitrogen, potassium, and phosphate products for industrial, agricultural, and feed customers worldwide. The company has a wide-ranging agricultural retail network that provides services to over 500,000 grower accounts. The company has a network of nearly 1,700 retail locations in seven countries, along with operations and investments in 14 countries, globally. The company has its presence in regions such as North America, South America, Europe, Asia, Africa, and Australia.

Yara International ASA (Norway) is one of the largest fertilizer manufacturing companies in the world. The company is primarily engaged in producing and distributing mineral fertilizers and environmental solutions. It manages its business primarily through three business segments, namely, downstream, industrial, and upstream. The company offers its liquid fertilizer products through its product portfolio and is available in potassium, phosphorus, and sulfate forms. The company offers fertilizer brands, such as YaraBela, YaraLiva, YaraMila, YaraTera, YaraVera, and YaraVita. The company offers a complete fertilizer portfolio to growers, globally, under its downstream segment, and also offers ammonia, urea, nitrates, and other nitrogen-based fertilizer products under its upstream business segment. The company offers fertilizers of various nutrients, such as nitrogen, phosphorus, potassium, calcium, and magnesium.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=225530281

The market for liquid fertilizers in the South America region is projected to grow at the highest CAGR from 2020 to 2025. According to FAOSTAT, Brazil is the largest producer of agricultural products due to the availability of abundant land and rural labor force, followed by Argentina. The growth in South America is majorly attributed to by the increase in the adoption of agrochemicals and advancements in farming techniques in Brazil and Argentina with distribution channels established by global agrochemical players. Due to these factors, the market in the South America region is projected to record the highest growth from 2020 to 2025.