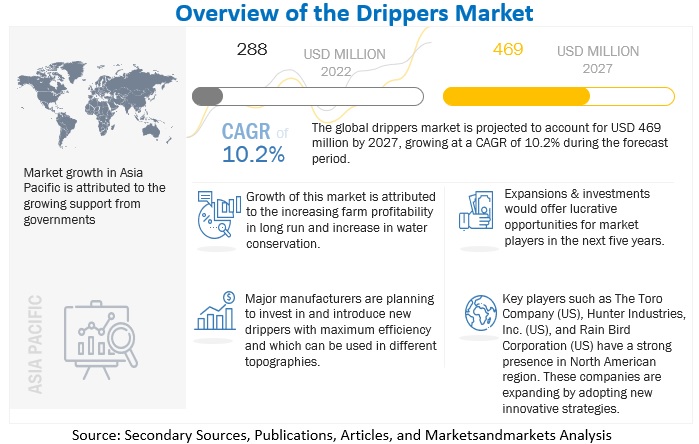

According to a research report "Drippers Market by Type (Inline and Online), Crop Type (Field Crops (Corn, Cotton, Sugarcane, Rice), Fruits & Nuts, Vegetable Crops), and Region (North America, Europe, Asia Pacific, South America, and Rest of the world) - Global Forecast to 2027" published by MarketsandMarkets, the global drippers market size is estimated to be valued at USD 288 million in 2022. It is anticipated to reach USD 469 million by 2027, recording a CAGR of 10.2% in value. The efficient working of drippers is dependent on the quality of the water. Except for some coastal areas, many current and potential water sources for irrigation systems come from surface water, which is often lower in salt content. As a result, systems using surface water sources are typically less likely to develop precipitates in drippers. Surface water is typically of lower quality than groundwater. However, iron and manganese levels should be checked because high levels could cause drippers to clog and necessitate treatment. Many firms are introducing anti-clogging, pressure compensating, no-drain, and anti-siphon drippers in the market.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=134897872

The Inline drippers type is forecasted to account for the largest market share in the drippers market.

Inline drippers are usually present within the laterals with equal spacing. Inline emitters may be flat boat-shaped, cylindrical, or attached to the lateral inner wall. Inline emitters are mostly used for row crops or field crops such as onion, chili, potato, turmeric, vegetables, sugarcane, and cotton. They can be used with uneven lands and steep hills requiring longer lateral running lengths. The main objective of drippers is to achieve minimum discharge of water. The discharge range of an emitter is usually between 1–15 liters per hour.

The field crops segment is anticipated to gain the largest market share in the drippers market.

Appropriate drippers help provide crops with water at the required flow rate. The increasing prices of field crops have fueled the market for drippers. Corn is a widely grown field crop using drip irrigation systems. Growing corn on a large scale while facing unpredictable weather conditions or water scarcity is challenging. Water stress in corn crops can lead to about 8% permanent yield loss daily. Corn is the third-largest plant-based food source for the world. Compared to flood and sprinklers, corn irrigated by drip demonstrated a higher yield, required significantly less fertilizer, and resulted in reduced carbon emissions.

Make an Inquiry @

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=134897872

The Asia Pacific region is projected to account for a major share of the drippers market during the forecast period.

Accounting for more than 60% of the global population, the increase in technological advancement in irrigation facilities, decreasing water wastage, and government subsidies in various countries helped in exponential growth for this region. In some countries in the Asia Pacific region, the retreat of the government from irrigation is largely based on political-economic considerations. The government’s support of the irrigation sector in countries like India has been a broader pro-rural policy package that aims to support agriculture. The region has been shifting from installing basic irrigation facilities to adopting precision irrigation systems through technological upgrading. Some of the players operating in the region are Chinadrip Irrigation Equipment Co., Ltd. (China), Jain Irrigation Systems Ltd. (India), Antelco Pty Ltd. (Australia), Metro Irrigation (India), KSNM Drip (India), and Mahindra EPC (India).

Some of the major players operating in the global agricultural drippers market are Netafim Limited (Israel), Rain Bird Corporation (US), Chinadrip Irrigation Equipment Co., Ltd. (China), Elgo Irrigation Ltd. (Israel), Metzer (Israel), Azud (Spain), Jain Irrigation Systems Ltd. (India), The Toro Company (US), Rivulis Irrigation Ltd. (Israel), and Hunter Industries, Inc. (US).