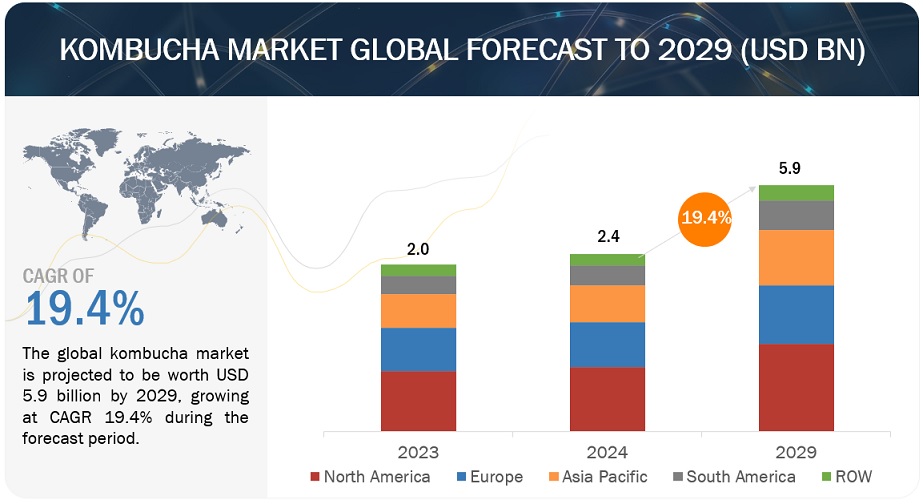

The global kombucha market is estimated at USD 2.4 billion in 2024 and is projected to reach USD 5.9 billion by 2029, at a CAGR of 19.4% during the forecast period. The global kombucha market has witnessed remarkable growth in recent years, driven by factors Such as increasing consumer awareness regarding the health benefits associated with kombucha consumption, such as improved digestion, boosted immune system, and detoxification properties, which are driving demand. Additionally, the rising trend of healthier beverage options and the shift towards natural and organic products are further fueling market growth. Furthermore, the availability of a wide range of flavors and variants catering to diverse consumer preferences is expanding the consumer base. Moreover, the growing emphasis on sustainability and eco-friendly production methods in the beverage industry encourages the adoption of kombucha, as it is often perceived as a more environmentally friendly option than traditional carbonated soft drinks.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=211406364

By product type, the conventional type to hold the largest share in the kombucha market.

The burgeoning market for conventional kombucha drinks stems from the widely recognized health benefits of fermentation. Through this process, kombucha generates a rich array of polyphenols, organic acids, amino acids, vitamins, antibiotics, and diverse micronutrients, contributing to its perceived wellness properties. As consumers increasingly prioritize health-conscious choices, the allure of kombucha's natural, nutrient-rich composition becomes more compelling. This trend is further buoyed by a growing interest in functional beverages, where kombucha's unique blend of ingredients positions it as a sought-after option for those seeking both refreshments and health benefits.

By type, the flavored type segment will grow at the highest rate in the kombucha market.

Flavored kombucha caters to diverse consumer preferences as it presents an exciting array of taste profiles, ranging from fruity and floral to spicy and tangy, appealing to a wide spectrum of palates. This variety not only enhances consumer choice but also serves as a gateway for those new to kombucha, easing them into the unique taste of this fermented beverage. Furthermore, flavored kombucha addresses evolving consumer demands for novel and experiential beverages, as it provides an innovative twist on traditional kombucha offerings. The addition of flavors to kombucha enhances its nutritional value by incorporating the specific qualities of each flavor into the beverage. For example, in hibiscus and ginger kombucha, hibiscus contributes to blood pressure reduction and is rich in vitamin C, while ginger aids digestion and facilitates the carbonation process. Similarly, nearly every flavor infused into the drink offers both nutritional benefits and a delightful taste.

By distribution channel type, the online retailer segment is estimated to grow at the highest rate in the kombucha market.

The segment of online retailers within the kombucha market has experienced notable growth, primarily propelled by the surge in e-commerce platforms. Consumers increasingly favor the ease of purchasing kombucha products online, allowing them to explore a diverse array of brands and flavors from the convenience of their homes. Online retailers offer a wide selection of kombucha products, accommodating various dietary preferences and health requirements. Moreover, these platforms often furnish comprehensive product descriptions, customer reviews, and recommendations, aiding consumers in making well-informed purchasing decisions. Delivery options to one's doorstep further augment convenience, particularly for individuals with hectic schedules or limited access to physical stores. The online retailers segment stimulates competition among kombucha brands, spurring innovation and enhancements in quality to attract and retain customers. In essence, the online retailers segment plays a pivotal role in broadening the accessibility of kombucha products to a wider consumer audience, thereby significantly contributing to the expansion and sustainability of the kombucha market.

Make an Inquiry:

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=211406364

The North American region constitutes the largest share of the kombucha market in terms of value.

Increasing health consciousness among consumers is a significant driver for the growth of the North American kombucha market. As people become more aware of the importance of gut health and overall well-being, they are seeking out functional beverages like kombucha that offer probiotic benefits and promote digestive health. Another driving factor is the growing trend towards natural and organic products. Consumers are increasingly looking for beverages made with clean, organic ingredients, free from artificial additives and preservatives. Organic kombucha fits well within this trend, offering a healthier alternative to sugary sodas and artificially flavored drinks.

In summary, the growth of the Kombucha market in North America is propelled by increasing consumer preferences towards organic drinks, a shift towards healthy food preference, and increasing consumer awareness regarding the health benefits associated with kombucha.

Key players in this market include GT's Living Foods (US), Brew Dr. (US), SYSTM Foods Inc. (US), Health-Ade LLC (US), Tropicana Brands Group (US), MOMO Kombucha (UK), GO Kombucha (UK), Harris Freeman (US), Kosmic Kombucha (US), Equinox Kombucha (UK), Remedy Drinks (Australia), Soulfresh Global Pty Ltd (Australia), Cruz Group Sp. z o. o. (Poland), NessAlla Kombucha (US), and FedUp Foods (US).