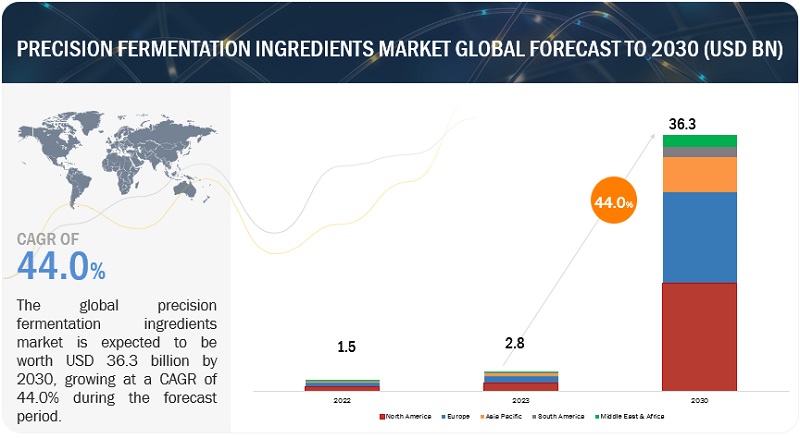

The precision fermentation ingredients market size is estimated to be valued at USD 2.8 billion in 2023 and is projected to reach USD 36.3 billion by 2030, recording a CAGR of 44.0% in terms of value The demand for precision fermentation ingredients is increasing due to the increasing demand for plant-based alternative products worldwide.

The expanding business has offered lucrative business opportunities to the players who are operating in the market segments. For instance, in May 2023, Geltor introduces CAVIANCE™, a vegan type of Il collagen polypeptide offering remarkable skin rejuvenating benefits. This innovative product stimulates six different types of collagens, exhibits potent antioxidant properties, and aids in wound healing. Other key players, like MycoTechnology, established a “groundbreaking” collaborative venture with Oman Investment Authority (OIA) to produce mushroom-based protein using locally cultivated dates. This joint venture will be named Vital Foods Technologies LLC. The overall precision fermentation ingredients market is classified as a competitive market, with the top five key players, namely Geltor (US), Perfect Day, Inc. (US), The Every Co. (US), Impossible Foods Inc. (US), Motif FoodWorks, and Inc. . (US), occupying 25–50% of the market share.

Precision Fermentation Ingredients Market Drivers: Growing adoption of vegan as well as meat-free lifestyles

According to research conducted by The Hartman Group, the landscape of the North American precision fermentation ingredients market is poised for a transformative shift Around 40% of U.S. adults, over 90 million individuals, are ready to embrace precision fermentation products, projected to reach 132 million consumers by 2027. Younger generations are receptive due to environmental concerns and sustainability, with the second most influential factor being the positive impact on the environment. This aligns with their preference for sustainable consumption. The link between precision fermentation and sustainability, including reduced greenhouse gas emissions, natural farming, and sustainable packaging, offers innovation potential. Millennials and Gen Z are willing to pay up to 10% more for such products. This technology serves as a catalyst for a more sustainable and technologically advanced market landscape shaped by evolving consumer preferences and environmental consciousness. This trend invariably is supporting the precision fermentation ingredients market growth.

Restraints: Higher manufacturing costs associated with the production of ingredients utilizing precision fermentation ingredients

Demand for microbe-based precision fermented proteins or fats has gained momentum lately due to the increasing demand for animal-free products by the rising vegan population. In addition, precision fermentation provides several benefits: it reduces land and water usage, greenhouse gas emissions, and health problems associated with animal-based products. However, higher manufacturing costs have acted as a major restraint for the industry to scale up. Specific growth media for microorganisms, large-scale fermenters, and specialized purification processes combine to increase the production cost exponentially. Also, the risk of yield failure or contamination is high, as microorganisms need a stable and sterile environment for growth.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=30824914

By food & beverage application, the egg alternatives segment is projected to grow with the second-highest CAGR in the precision fermentation ingredients market during the forecast period.

The rising inclination toward vegan food has led manufacturers to introduce a variety of egg alternatives. Precision fermentation derived egg alternatives find use in baking, cooking, and food formulation. Every Company introduced an egg protein called ClearEgg via precision fermentation in collaboration with Pressed Juicery in November 2021. In April 2021, the company increased its production capacity of egg alternatives further. In 2022, Shiru streamlined animal-free egg prototype creation using AI and machine learning. This innovative method accelerated the replication of egg properties within a plant-based framework.

North America holds the highest market share during the forecast period.

North America remained the largest market for precision fermentation ingredients due to increasing consumer awareness, consumption of healthy food ingredients, the veganism trend, etc. The landscape of North American precision fermentation ingredients market is poised for a transformative shift; around 40% of U.S. adults, over 90 million individuals, are ready to embrace precision fermentation products, projected to reach 132 million consumers by 2027 (The Hartman Group). Younger generations are receptive due to environmental concerns and sustainability, with the second most influential factor being the positive impact on the environment. This aligns with their preference for sustainable consumption. The link between precision fermentation ingredients and sustainability, including reduced greenhouse gas emissions, natural farming, and sustainable packaging, offers innovation potential. Millennials and Gen Z are willing to pay up to 10% more for such products. This technology serves as a catalyst for a more sustainable and technologically advanced market landscape shaped by evolving consumer preferences and environmental consciousness.

Top Companies in the Precision Fermentation Ingredients Market

Key players in this market include Geltor (US), Perfect Day, Inc. (US), The Every Co. (US), Impossible Foods Inc. (US), Motif FoodWorks, Inc. . (US), Formo (Germany), Eden Brew (Australia), Mycorena (Sweden), Change Foods (US), and MycoTechnology (US).