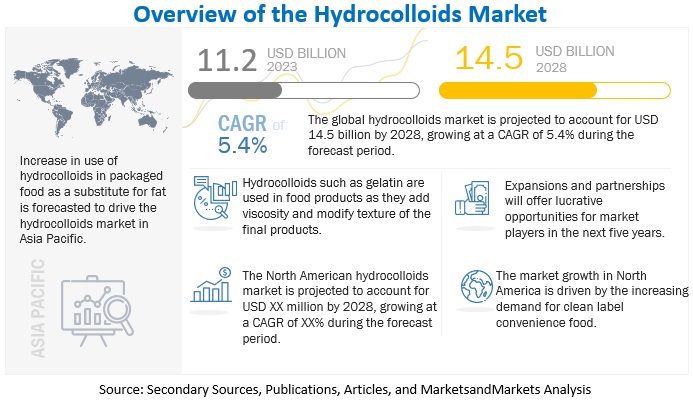

The global hydrocolloids market is projected to be valued at USD 11.2 billion in 2023 and is expected to grow to USD 14.5 billion by 2028, reflecting a compound annual growth rate (CAGR) of 5.4% during this period. Hydrocolloids are a category of biopolymers commonly utilized in food technology to enhance quality attributes and extend shelf life. They play a vital role in various food formulations, serving as thickeners in soups, gravies, salad dressings, sauces, and toppings, as well as water retention agents, stabilizers, emulsifiers, and gel-forming agents in products like jams, jellies, marmalades, restructured foods, and low-sugar gels. The increasing demand for clean-label products driven by health and wellness trends, along with the growth of the ready meal and convenience food sectors, is expected to propel market expansion.

Hydrocolloids Market Drivers: Multifunctionality of hydrocolloids to lead to wide range of applications

Among the various biopolymers, hydrocolloids are extensively used in food technology to enhance quality and extend shelf life. They are commonly incorporated into food formulations across a range of products, such as soups, salad dressings, gravies, sauces, jellies, jams, restructured foods, marmalades, and low-calorie gels. Hydrocolloids also play a crucial role in preventing the formation of sugar and ice crystals in ice cream and in managing flavor release. In the baking industry, they improve food texture and moisture retention, which helps delay starch retrogradation and enhances overall product quality during storage. Recently, certain hydrocolloids have gained attention for their ability to act as fat replacers, enabling the creation of low-calorie products. Their addition has been shown to improve the texture, thickening, and water retention of gluten-free bakery items. For instance, using xanthan gum in gluten-free bread made from a starch blend of rice flour, corn starch, and sodium caseinate yields favorable results in rheological testing. Consequently, the growing demand for gluten-free bakery products is expected to further boost the need for hydrocolloids in the food industry.

Hydrocolloids Market Opportunities: Emerging markets in Asia Pacific and Africa

The growing global population is intensifying the demand for the production, management, and conservation of precious resources. High energy costs and rising raw material prices are significantly affecting low-income consumers by driving up food prices. Additionally, water shortages are placing further strain on food supplies, particularly in Africa and Northern Asia. However, the large-scale production of hydrocolloids in these regions, combined with advancements in science and technology, offers small and medium-sized food and beverage manufacturers an opportunity to incorporate clean label ingredients into their products. This trend is expected to contribute positively to the growth of the hydrocolloids market.

Gelatin is Expected to Capture the Largest Share of the Hydrocolloids Market Throughout the Study Period.

The gelatin segment is expected to lead the market; however, as awareness of health and environmental issues increases, consumers are increasingly gravitating toward plant-based hydrocolloids. A significant factor anticipated to substantially impact the size of the hydrocolloids in food market during the forecast period is the rapid rise in the global population of overweight and obese individuals. There is a growing demand for food products that maintain desirable texture, flavor, and aroma while containing lower levels of fat, sugar, and salt.

Food and beverages are projected to hold the largest market share during the research period based on application.

Hydrocolloids play a crucial role in enhancing the cooking yield, texture, and slicing characteristics of beef and poultry products. Carrageenan is commonly used to retain moisture and preserve the natural texture of meat, while also increasing viscosity. On the other hand, agar helps reduce the fat content in meat products. Xanthan gum serves as a thickening and stabilizing agent, while gelatin improves the appearance of meat and helps gel the liquids in processed hams. The inclusion of alginate enhances the texture and overall quality of meat products. Additionally, pectin and locust bean gum act as fat replacers, and guar gum functions as a binder and lubricant in various meat products.

North America is Dominates the Hydrocolloids Market Share.

North America is expected to capture the largest share of the global hydrocolloids market. This demand is largely driven by the region's dietary preferences, particularly for ingredients that help reduce oil and fat content in food. Hydrocolloids act as a barrier against the oils and fats prevalent in popular breaded and fried dishes. By utilizing hydrocolloids, calorie-rich fats can be replaced with what is essentially structured water. As consumers increasingly seek out low-oil and low-fat options, the effective use of hydrocolloids meets this demand. Consequently, the hydrocolloids sector in the U.S. is projected to experience significant growth, fueled by the rising number of health-conscious individuals.

Key players in this market include International Flavors & Fragrances Inc. (US), Ingredion (US), Cargill, Incorporated (US), Kerry Group plc (Ireland), Associated Archer Daniels Midland Company (US), Palsgaard A/S (Denmark), Darling Ingredients Inc. (US), DSM (Netherlands), Ashland (US), Tate & Lyle (UK), CP Kelco U.S., Inc. (US), Nexira (France), Fufeng Group (China), and BASF SE (Germany).