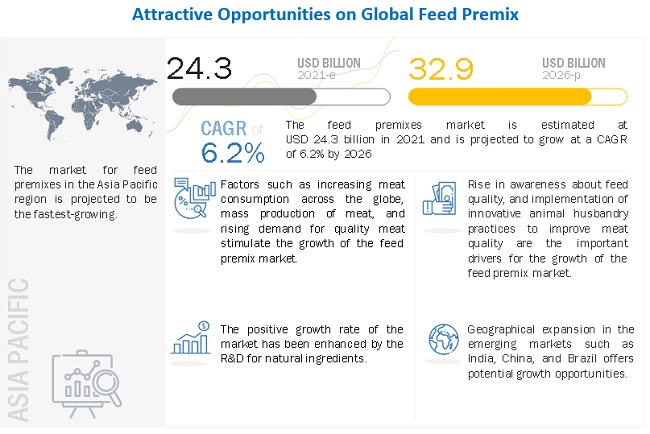

The report "Feed Premix Market by Ingredient Type (Vitamins, Minerals, Amino Acids, Antibiotics, Antioxidants), Livestock (Poultry, Ruminants, Swine, Aquatic Animals, Equine, and Pets), Form (Dry and Liquid), and Region - Global Forecast to 2026 ",size is estimated to be valued at USD 24.3 billion in 2021 and is projected to reach a value of USD 32.9 billion by 2026, growing at a CAGR of 6.2% during the forecast period. The growth of this market is attributed to increasing awareness about feed quality, and the implementation of innovative animal husbandry practices to improve meat quality are the important drivers for the growth of the feed premix market.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=170749996

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=170749996

Amino acids, by batter type, is estimated to hold the largest market share during the forecast period

The consumption of amino acid feed premixes remains high globally. Asia Pacific continues to be the high-growth market for these premixes. Key markets such as China and India also benefit from the increase in domestic production of amino acids, particularly lysine, as they are available at lower costs.

The dry segment, by form, is estimated to hold the largest share in the feed premix during the forecast period

The dry form in the feed premix market is preferred by manufacturers due to its enhanced stability, ease of handling and storage, and convenience of usage in a wide range of products.

In 2020, the Asia Pacific region held the largest share in the dry segment in the market due to the increase in demand for feed premixes in the feed industry and the growing trend of food fortification in countries such as India and China.

Poultry, by livestock, is estimated to account for the largest market share during the forecast period

On the global level, the total poultry production has been increasing, and with the growth in poultry production and consumption, it has become important for meat producers to focus more on the quality of meat. These factors are projected to drive the growth of the feed premix industry to provide a complete nutritional feed for poultry. Feed premixes, such as vitamins, minerals, and amino acids, are some of the major premixes used in poultry feed products for improved quality and production

Request for Sample Pages of the Report @

https://www.marketsandmarkets.com/requestsampleNew.asp?id=170749996

https://www.marketsandmarkets.com/requestsampleNew.asp?id=170749996

Asia pacific is estimated to hold the largest market share during the forecast period

Asia Pacific is projected to be the largest and fastest-growing segment. Increased awareness among consumers about quality meat and increased meat consumption across the region is expected to provide more scope for market expansion. Livestock is an important constituent of agriculture in the Asia Pacific region. The region widely rears and consumes pork and poultry. With the rising demand for animal products, increased livestock productivity is necessary. Quality feed is the primary determinant of the performance and productivity of livestock.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies operating in the Feed premix. It consists of the profiles of leading companies such Koninklijke DSM N.V. (Netherlands), Nutreco N.V. (Netherlands), Cargill (US), Archer Daniels Midland Company (ADM) (US), BEC Feed Solutions (Australia), DLG Group (Denmark), Charoen Pokphand Foods PCL (Thailand), Land O’Lakes (US), AB Agri Ltd. (UK).