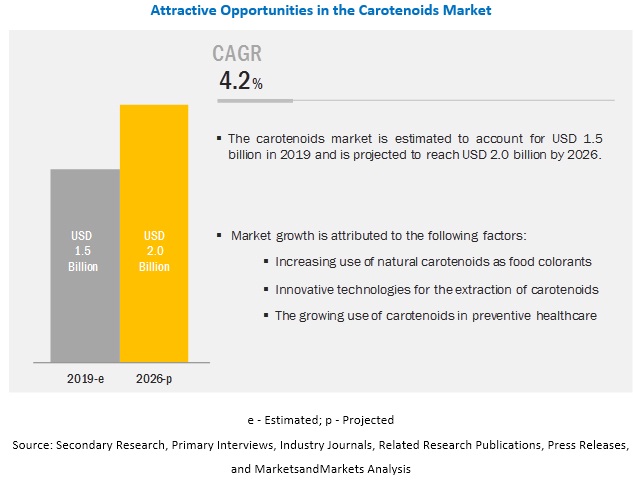

The carotenoids market size is projected to grow from USD 1.5 billion in 2019 to USD 2.0 billion by 2026, recording a compound annual growth rate (CAGR) of 4.2%, in terms of value, during the forecast period. Carotenoids are a group of yellow to red pigments, including the carotenes and the xanthophylls, found particularly in plants, algae, and photosynthetic bacteria and certain animal tissues. The increase in the usage of carotenoids as food colorants and the advancements end-user technologies are the major factors that are projected to drive the growth of the carotenoids market.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=158421566

Increasing application for astaxanthin as food color has led the segment to account for the highest market share in the carotenoids market

Astaxanthin accounts for the largest share in the market, during the forecast period. Astaxanthin is found in certain algae and has a red pigment. Due to its red pigment, it is now being widely used in meat products to impart color. It is used in food products such as salmon, lobster, trout, shrimp, and other seafood products. Moreover, it is also now being used as it helps in fighting diseases such as Parkinson’s disease, the prevention of macular degeneration, and the Alzheimer’s disease.

Natural segment is projected to grow at faster CAGR in the carotenoids market during the forecast period as consumers are demanding natural food products

The natural segment is forecasted to grow at higher CAGR in the market during the study period. This can be attributed to increase in biological activities and high antioxidant properties offered by natural carotenoids. During last few decades there has been increasing concern over the chemical ingredients used in various food products. Consumers across the globe are now demanding for food products with natural ingredients as they are perceived as safer fand healthier for consumption. This has driven the demand for natural carotenoids in food industry.

Make an Inquiry @

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=158421566

The Europe region is projected to account for largest market share in the carotenoids market during the forecast period due to increase demand for clean-label products

The Europe region is forecasted to dominate the carotenoids market in terms of market share during the forecast period. This is due to the presence of consumers who are demanding natural and clean-label food products. The players in food and feed industry in Europe are widely using natural ingredients as a colorant in their products and easy availability of carotenoids makes it a preferrable option for these manufacturers. Furthermore, growing ageing population has led to increase in demand for carotenoids as it may benefit in curing cataract and other eye disorders.

The prominent vendors in the carotenoids market include Koninklijke DSM (Netherlands), BASF (Germany), Chr. Hansen (Denmark), Kemin Industries (US), Lycored Limited (Israel), Cyanotech Corporation (US), Fuji Chemical Industry Co Ltd. (Japan), Novus International (US), DDW The Color House (US), and Dohler Group (Germany).