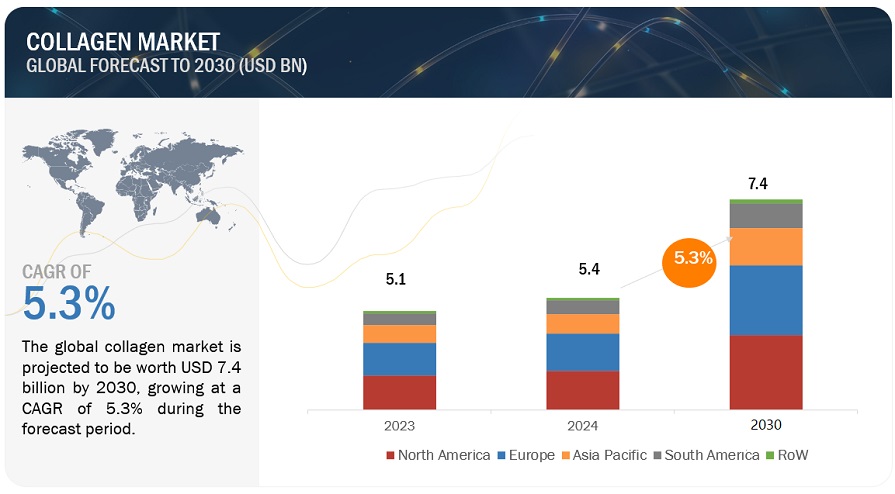

The collagen industry, valued at approximately $5.1 billion in 2023, is projected to grow at a 5.3% CAGR, reaching $7.3 billion by 2030. This sector is undergoing significant transformations and innovations, particularly in nutrition and cosmetics, where collagen has become a key focus. As awareness of collagen increases, so does the demand for this essential protein, which can be obtained through collagen supplements or by boosting the body’s natural collagen production. This shift has resulted in a rising demand for collagen in various forms.

Collagen Market Drivers: Rise in consumption of collagen-based food and beverages

Collagen is gaining significant traction as consumers increasingly seek health and wellness products. The demand for collagen peptides is fueled by a rising interest in functional foods, dietary supplements, and sports nutrition among health-conscious individuals aiming to enhance skin, joint, and bone health. Additionally, the expanding use of collagen in the food and beverage industry—including applications in confectionery, dairy, meat processing, and beverages—further enhances market potential. Demand for collagen, particularly in emerging economies, is expected to grow as more people adopt healthy lifestyles and focus on preventing chronic diseases. Collagen is available in supplement form, but many of these products may contain fillers and artificial additives that could cause allergic reactions. Some individuals may experience side effects such as bloating, an unpleasant taste, diarrhea, and skin rashes. Reactions can vary from person to person, and certain collagen supplements might also contain heavy metals and animal-derived ingredients. These components can trigger allergic responses, leading to skin issues, as noted by Hasina Khatib in a 2020 Vogue article.

The marine segment in the collagen market is poised for remarkable growth with the highest CAGR in the upcoming forecast period.

The marine source of collagen has rapidly become the leader in the collagen market, experiencing remarkable growth for several key reasons. Its sustainability, stemming from fish by-products that reduce waste, resonates with the increasing environmental awareness among consumers. Known for its high bioavailability, marine collagen is easily absorbed by the body, making it an effective option for supplementation. Its versatility supports a wide range of applications in dietary supplements, cosmetics, and medical products, meeting diverse consumer needs.

Rich in type I collagen, which is essential for skin, hair, and joint health, marine collagen offers significant nutritional benefits. It is also allergen-free and suitable for various dietary preferences, enhancing its popularity. Ongoing research and development within the marine collagen sector foster continuous innovation, strengthening its market presence. As global demand for collagen-based products rises, fueled by health-conscious consumers seeking natural options, marine collagen remains a key player in this thriving market.

Asia Pacific: The Fastest-Growing Region for the Collagen Market

The Asian collagen market is experiencing the highest CAGR, driven by rising health awareness, a growing demand for beauty and wellness products, and a cultural tradition of incorporating collagen into diets. Key factors boosting collagen sales include the nutraceutical and cosmetics industries, supported by increasing disposable incomes and heightened interest in collagen supplements and skincare items. Additionally, the aging population in countries like Japan and China, seeking solutions for joint and bone health, significantly contributes to market growth in this region.

The key players in the collagen market include Darling Ingredients (US), Ashland (US), Tessenderlo Group (Belgium), GELITA AG (Germany), Nitta Gelatin NA Inc (Japan), Nippi Collagen NA Inc (Japan), Collagen Solution (UK), Titan Biotech (India), Weishardt Holding SA (France), DSM (Netherlands), and Amicogen (South Korea). These market participants are emphasizing the expansion of their footprint via agreements and partnerships. They maintain a robust presence in North America, Asia Pacific, South America, RoW, and Europe, and they are supported by manufacturing facilities and well-established distribution networks spanning these regions.