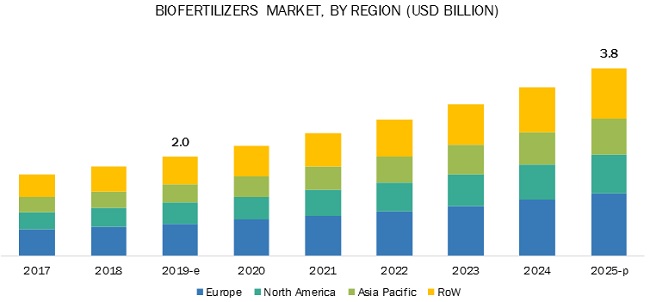

The biofertilizers market is estimated to be valued at USD 2.0 billion in 2019 and is projected to reach USD 3.8 billion by 2025, recording a CAGR of 11.2% during the forecast period. The market is driven primarily by the increasing organic farmland as well as the rising acceptance of biofertilizers among farmers.

Based on form, liquid biofertilizers is estimated to account for a major value share in 2019

Of both the forms, the usage of liquid biofertilizers remains substantially high, globally. This is due to its higher shelf life as compared to carrier-based biofertilizers. Liquid biofertilizers have a life expectancy of 2 to 3 years, making it more convenient and affordable for farmers in developing countries. Moreover, liquid fertilizers have better tolerance limits for adverse conditions. The quality control protocols for liquid biofertilizers are also easy and expeditious compared to carrier-based biofertilizers. Thus, in terms of value, the liquid biofertilizers segment is estimated to dominate the global market in 2019.

Download PDF Brochure:

Higher consumption of biofertilizers for organic fruits & vegetables contributes to the growth of the biofertilizers market in this segment

Biofertilizers have proved to be useful in numerous ways, including improving the quality, shelf-life, and yield of fruits & vegetables. The increasing trend of consumer preferences for organic fruits & vegetables due to changing lifestyle and rising per capita income is the primary factor driving market growth. A rising trend in the cultivation of organic fruits & vegetables and those under IPM practices have also created a positive impact on the growth of the biofertilizers market.

Based on the mode of application, the soil treatment segment is projected to witness higher growth in the biofertilizers market

Soil treatment methods increase the crop yield and help in fetching better results. When applied to the soil, it increases the availability of nutrients and improves the yield by 10 to 25% without adversely affecting the soil as well as the environment. Soil treatment is used mainly in the Asian region due to rampant use of traditional agriculture methods in the current farming system. Thus, the market for biofertilizers with soil treatment mode of application is estimated to propel during the forecast period.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=856

With the increasing demand for organic food products, North America is estimated to dominate the biofertilizers market in 2019

Changing lifestyle and increasing buying power among consumers has increased the demand for biofertilizers. High adoption of advanced irrigation systems such as drip & sprinkler irrigation and widespread acceptance of biofertilizers among the farmers is further propelling the market growth. The farmers in this region are highly skilled in terms of knowledge and machinery. Due to the rampant use of chemical fertilizers, the fertility of the soil is declining. To maintain soil fertility as well as the yield of crops, farmers are sustainably opting for biofertilizers.

This report includes a study of the development strategies of leading companies. The scope of this report consists of a detailed study of biofertilizer manufacturers such as Novozymes (Denmark), Kiwa-Biotech (China), Rizobacter Argentina S.A (Argentina), Lallemand Inc. (Canada) and Symborg (Spain).

Recent Developments:

- In June 2019, Novozymes (Denmark) announced plans to continue its research and distribution partnership with Bayer (Germany), where Novozymes could form multi-partnership with UPL (India) and Univar Solutions (US) to distribute its biological products. In July 2018, Rizobacter Argentina (Argentina) registered an inoculant for chickpea. This product would help to increase the potential pulses market of Europe and India.

- In July 2018, Rizobacter Argentina (Argentina) registered an inoculant for chickpea. This product would help to increase the potential pulses market of Europe and India.

- In May 2016, Lallemand Inc. (Canada) acquired Lage y Cia (Uruguay), a prominent seed inoculant company in South America. This acquisition would help Lallemand in the product development of yeast, fungi, and bacteria as a biostimulant, biocontrol, and biofertilizer agent in the agriculture industry.

No comments:

Post a Comment