The overall pest control market is projected to grow from USD 22.7 billion in 2021 to USD 29.1 billion by 2026, at a CAGR of 5.1%. The rise in the popularity of pest control solutions can be attributed to the increasing scope of urbanization in developing markets and the emergence of megacities, which host over 15-20 million residents. Markets such as China and India are among the key markets targeted by pest control service providers and pesticide suppliers due to their high population density and a large middle-class population that is adopting pest control services in the region.

Drivers: Rising adoption of digital applications and technology

One of the most important aspects of food safety in the global food supply chains is pest control. The changes in the way food are produced, sourced, and distributed, along with climate changes, have led to an increase in risks of food safety from pests. In addition, more stringent regulations for food safety and changes in consumer demands are the key factors that are projected to encourage food producers/manufacturers to find more efficient and sustainable ways to ensure food quality and safety. Changes in consumer habits, such as online shopping, have led to an increase in the use of automation in the supply chain, which allows pests to thrive where there are few or no humans around to notice pest infestations or deter pests, such as rats and mice. Thus, pest control manufacturers are adopting greener and smarter pest control solutions.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=144665518

Opportunities: Adoption of Artificial Intelligence (AI) in pest control

The adoption of various trending technologies, such as AI, has been on the rise due to the low service cost and its operation in remote and difficult-to-access locations continuously without interrupting the operation of the facility. Hence, the demand for digital pest control solutions is projected to grow considerably in the coming years. Pest control service companies, such as Rentokil, are using AI-based image-recognition technology to identify and treat various types of bugs and vermin. Some of the company's pest control technicians are using an Android mobile app developed by Accenture to identify bugs. When its technician witnesses an increase in a type of bug or rodent, he/she can take a picture of the pest and use the app, PestID. The picture is then sent to Google’s image classification and machine learning software to run through several pest images and identify the intruder. When a positive identification is made, the app immediately provides remediation solutions to help the technicians decide the treatment plans, including proper chemicals and recommendations for homeowners. Since AI has helped in reducing the frequency of technician visits, thus resulting in low service cost and ultimately higher adoption in the future.

By control method, software & services segment is the fastest growing segment in the market during the forecast period

The software & services segment plays an integral part in digital pest control solutions while implementing platforms and executing activities related to them. These services include consulting, integration, and support and maintenance, which are required to deploy, execute, and maintain pest control. AI and IoT are trending technologies that help improve smart pest monitoring and control. One of the key software & service providers is Rentokil, which offers PestConnect that includes a range of IoT-enabled pest-control devices that allows the monitoring of food processing facilities with maximum efficiency and minimum effort. According to one of the primaries conducted in Bayer CropScience, India, “The use of advanced information technologies and connected traps are among the new solutions offered by companies such as the Bayer Rodent Monitoring System.

Request for Customization:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=144665518

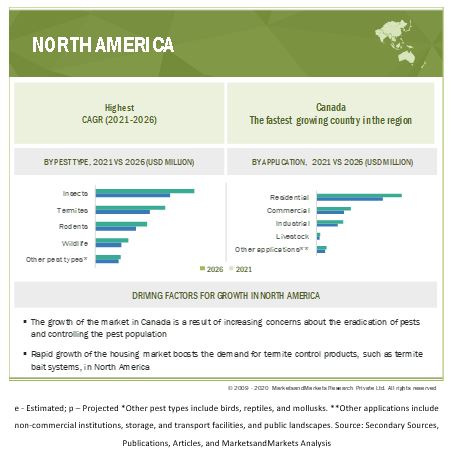

North America is projected to account for the largest market size during the forecast period

The North American pest control market is projected to be the largest between 2021 and 2026, while the Asia Pacific market is projected to grow at the highest CAGR. North America was the largest consumer of pest control in 2020. It is still the largest market for pest control, with 50.6% of the market share. There are over 20,000 pest control companies in North America, with an average of six technicians in each company. The strengthening of the housing market and a steadily improving economy have led to increased investments in both residential and commercial properties.

Key Market Players:

The key service providers in this market include Terminix (US), Ecolab (US), Anticimex (Sweden), Rollins Inc. (US), Rentokil Initial Plc (UK), and RATSENSE (Singapore). The pesticide suppliers in the pest control market include Bayer CropScience (Germany), BASF (Germany), Syngenta AG (Switzerland), Sumitomo Chemicals Co. Ltd. (Japan), Adama (Israel), FMC Corporation (US), Corteva Agriscience (US), PelGar International (UK), and Bell Laboratories (US). These players are undertaking strategies such as new product developments and launches and divestments to improve their market positions and extend their competitive advantage.