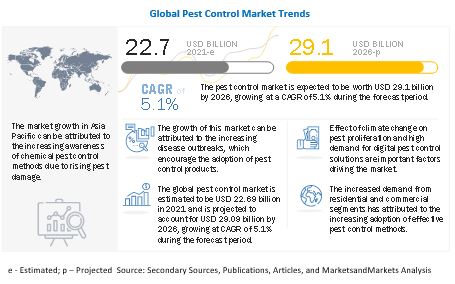

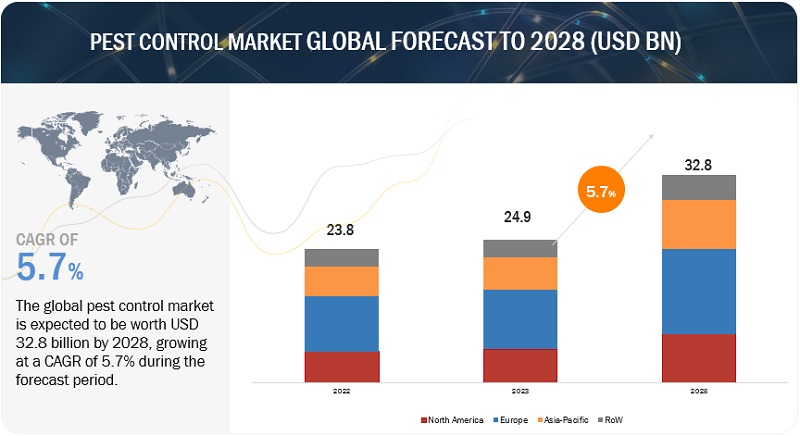

The global pest control market is expected to grow from an estimated $24.9 billion in 2023 to $32.8 billion by 2028, with a compound annual growth rate (CAGR) of 5.7% during this period. The global demand for pest control products and services is being driven by several key factors. There is growing awareness about the health risks and diseases associated with pests, prompting individuals and businesses to prioritize pest prevention and control measures. This increased focus on health and hygiene is significantly boosting the demand for pest control services. Additionally, advancements in pest control technologies and methods have enhanced the effectiveness, accuracy, and sustainability of treatments, making them more attractive to consumers.

- Increasing instances of vector-borne disease outbreaks to encourage public health initiatives

- Impact of climate change on pest proliferation

- Rising adoption of digital applications and technology

Within the mode of application segment, sprays are predicted to have the largest market value during the forecast period.

Sprays are utilized for the application of pest control in specified amounts to different surfaces and areas. Spraying allows for a widespread and even distribution of pest control products, reaching areas that might be difficult to access through other methods. This method is particularly useful for both indoor and outdoor applications, making it suitable for a wide range of pest control scenarios. Additionally, advancements in spray technology have led to the development of more targeted and eco-friendly formulations that minimize the impact on non-target species and the environment.

North America is expected to have the largest market share during the forecast period.

The market for pest control is growing in North America owing to the widening scope of applications in not only residential or commercial but also in livestock and for industrial purposes, such as in the food and pharmaceutical industries. The pest control market in North America is experiencing notable growth owing to a convergence of factors. Moreover, there are numerous companies in North America providing pest control products and services. Apart from major players, there are many local players in the market. The presence of numerous pest control companies in the region also indicates that there is high demand for the pest control management. Stringent regulations in industries such as food safety and hospitality further bolster the market's expansion. Innovations in pest control technologies, including eco-friendly solutions and integrated approaches, enhance efficacy and appeal to environmentally conscious consumers.

The key players in this include Bayer AG (Germany), Corteva Agriscience (US), BASF SE (Germany), Sumitomo Chemical Co. Ltd. (Japan), Syngenta AG (Switzerland), Rentokil Initial plc (UK), Anticimex (Sweden), Rollins, Inc. (US), ATGC Biotech Pvt Ltd. (India), Ecolab Inc. (US), FMC Corporation (US), De Sangosse (France), Bell Laboratories (US), PelGar International (UK), and Fort Products Limited (UK). Companies are emphasizing on expanding their production facilities by entering into partnerships and agreements as well as by launching new products to grow their businesses and their market shares. New product launches because of extensive research & development (R&D) initiatives, geographical expansion to tap the potential of emerging economies, and strategic acquisitions to gain a foothold over the large extent of the supply chain are the key strategies adopted by companies in the pest control market.

- In June 2023, Bayer AG’s agricultural division, Bayer CropScience, partnered with Crystal Crop Protection Ltd. to develop and launch groundbreaking solutions for pest control that are aimed at benefiting paddy growers across India. This partnership indicates a critical turning point in the quest to improve rice farmer yields and crop protection techniques in India.

- In June 2023, Corteva Agriscience opened a combined crop protection and seed research laboratory in Eschbach, Germany. This research centre would help the company drive innovation and deliver sustainable solutions for farmers. The expansion would also enable the company to conduct state-of-the-art crop protection studies to help develop solutions which protect crops from pests and diseases, thus boosting the pest control market.

- In April 2023, Rollins, Inc. acquired Fox Pest Control through its own brand, HomeTeam Pest Defense. The acquisition is expected to augment Rollins long-term growth strategy in new geographies across the US market.