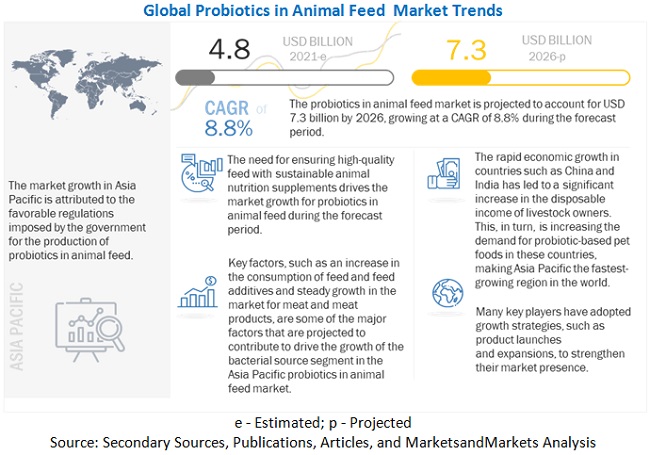

The global probiotics in animal feed market was valued at USD 4.4 billion in 2020. It is estimated to reach about USD 4.8 billion in 2021 and is projected to grow at a CAGR of 8.8%, to reach USD 7.3 billion by 2026. The demand for probiotics in animal feed in fortified foods is projected to remain high due to the increasing awareness about their benefits, and willingness of consumers to purchase premium products incorporated with probiotics in animal feed. The use of probiotics in animal feed has shown positive effects on overall animal health. The market for poultry has been increasing gradually over the past decade with the growing demand for egg and poultry meat across the globe.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=85832335

Drivers: Increase

in the production of compound feed

With the rise in

demand for meat and meat products and the increase in the importance of

protein-rich diets among consumers across the globe, the demand for compound

feed s is growing in the Asia Pacific, North American, and European countries.

The Food and Agriculture Organization (FAO) estimates that by 2050, the demand

for food products would grow by 60%, and that of animal protein would grow by

1.7% per year. The major feed producing countries in the world include China,

the US, Brazil, Mexico, Spain, India, and Russia. The demand for chicken and

red meat has been growing in these countries, which has also contributed to the

growth of the market.

Restraints:

International quality standards and regulations for probiotics in animal feed

products

International

bodies such as the US Food and Drug Administration (FDA), US Center of

Veterinary Medicine (CVM), World Health Organization (WHO), European Commission

(EC), European Food Safety Authority (EFSA), Australian Pesticides and

Veterinary Medicines Authority (APVMA), Natural Health Product Directorate

(NHPD), and the National Health Surveillance Agency (ANVISA) regulate the usage

of various additives in feed products and issue stringent regulations for probiotic

manufacturers. These organizations control the usage of different chemicals and

ingredients used in feed processing.

Poultry segment is

projected to be the largest segment in the probiotics in animal feed market

during the forecast period.

Due to its low-fat content as compared to beef and veal,

the consumption of poultry meat has increased over the years. The US Food and

Drug Administration (USFDA) banned the usage of antibiotics as feed supplements

to help livestock and poultry grow faster. Therefore, prominent players are

more focused on providing high-quality probiotics in animal feed for livestock

such as poultry.

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=85832335

Asia Pacific region is

projected to account for the largest market size during the forecast period

Developing countries, particularly in the Asia Pacific

region, offer high-growth opportunities in the probiotics in animal feed market

due to the rise in awareness among consumers to supplement consumption and a

high occurrence of various diseases. Related companies are projected to engage

in forwarding or backward integration to tap the market opportunities. The

production of poultry and cattle meat products is projected to be the highest

in countries such as China, and India, which is driving the market for

probiotics in animal feed in this region.

This report includes a

study of marketing and development strategies along with the product portfolios

of leading companies in the probiotics in animal feed market. It includes

profiles of leading companies such as Chr. Hansen (Denmark), Koninklijke DSM

N.V. (Netherlands), DuPont (US), Evonik Industries (Germany), Land OLakes (US),

Mitsui & Co., Ltd. (Japan), Ohly (Denmark), Lesaffre (France), Alltech

(US), Novozymes (Denmark), Calpis Co., Ltd. (Japan), Unique Biotech (India),

and Pure Cultures (US).

No comments:

Post a Comment