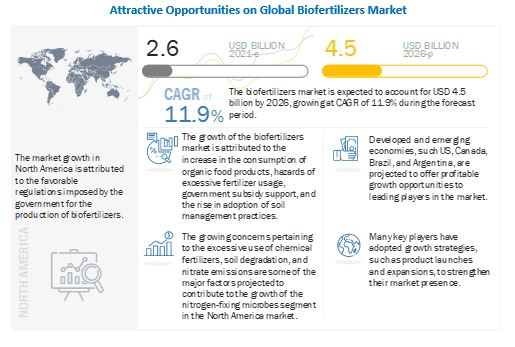

The report "Biofertilizers Market by Form (Liquid, Carrier-Based), Mode of Application (Soil Treatment, Seed Treatment), Type (Nitrogen-fixing, Phosphate solubilizing & Mobilizing, Potash Solubilizing & Mobilizing), Crop Type, and Region - Global Forecast to 2026", The global biofertilizers market size is estimated to be valued at USD 2.6 billion in 2021 and is expected to reach a value of USD 4.5 billion by 2026, growing at a CAGR of 11.9% in terms of value during the forecast period. Factors such as growth in consumer preference for organic food products, adoption of soil fertility management practices, serious concerns regarding the control of nitrate emissions and eutrophication in the aquatic environment, and government promotions for the use of organic fertilizers are some of the factors driving the growth of the biofertilizers market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=856

Liquid, by form, is estimated to hold the largest market share during the forecast period

The market for biofertilizers, by form, has been segmented into liquid biofertilizers and carrier-based biofertilizers. Liquid biofertilizers account for the largest market during the forecast period owing to the large pool of products available in the market. Liquid biofertilizer technology is considered an alternative solution to the conventional form of carrier-based biofertilizers. Liquid biofertilizers are specially formulated and contain not only the desired microorganisms and their nutrients, but also substances that can support the stability of the storage conditions of resting spores and cysts for longer shelf-life. Liquid fertilizers have better tolerance limits for adverse conditions. The quality control protocols for liquid biofertilizers are easy and expeditious compared to carrier-based biofertilizers.

Pulses & oilseeds, by crop type, is projected to grow at the second-highest CAGR in the biofertilizers market during the forecast period

The pulses & oilseeds segment is projected to grow at the second-fastest rate during the forecast period. Oilseeds such as soybean are also used as animal feed in the form of cakes as well as in the production of biodiesel and other renewable chemicals. Inoculation with Rhizobium is often recommended to augment nitrogen supply from the soil, particularly where the crop has been introduced recently or has not been grown for several years, or where the native Rhizobium population is inadequate and/or ineffective. Pigeon pea is another important perennial legume crop, which often requires a significant amount of soil nutrients for proper growth. These requirements are easily fulfilled with the assistance of biofertilizers at an affordable price, thus increasing the demand for biofertilizers.

Nitrogen-fixing microbes, by type, is estimated to account for the largest market share during the forecast period

Nitrogen-fixing microbes account for the largest market size during the forecast period. Biological nitrogen fixation provides sustainable and environment-friendly agricultural production. The value of nitrogen-fixing biofertilizers in improving and enabling a higher yield of legumes and other crops can be realized through the application of biofertilizers. They are mainly used in legumes, pulses, black grams, groundnuts, and soybeans. Among all the microorganisms, rhizobium is majorly used due to its efficiency in nitrogen fixation as well as popularity. Rhizobium is a symbiotic, nitrogen-fixing bacterium, which integrates atmospheric nitrogen and fixes it in the root nodules of crops.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=856

North America is estimated to hold the largest market share during the forecast period

The imposition of bans on the usage of harmful chemicals and fertilizers in the agricultural industry by governments in North American countries has created a high growth potential for biofertilizers. In addition, the increasing acceptance of organic foods among consumers is projected to widen the scope of growth for leading players. The US dominated the biofertilizers market in North America in 2020. The FDA introduced stringent regulations pertaining to the quality standards of agricultural products, which is projected to encourage the use of biofertilizers in the US.

This report includes a study on the marketing strategies and the product portfolios of the major companies that operate in the biofertilizers market. The report has leading company profiles such as Novozymes A/S (Denmark), Vegalab SA (Switzerland), UPL Limited (India), Chr. Hansen Holding A/S (Denmark), Kiwa Bio-Tech (China), Lallemand Inc. (US), Rizobacter Argentina S.A. (Argentina), T. Stanes & Company Limited (India), IPL Biologicals Limited (India), Nutramax Laboratories Inc. (US), Symborg (Spain), Kan Biosys (India), Mapleton Agri Biotech Pty Ltd (Australia), Seipasa (Spain), AgriLife (India), Manidharma Biotech Pvt Ltd (India), Biomax Naturals (India), Jaipur Bio Fertilizers (India), Valent BioSciences (US), Aumgene Biosciences (India), Agrinos (US), Criyagen (India), LKB BioFertilizer (Malaysia), Varsha Bioscience and Technology India Pvt Ltd. (India), and Valagro (Italy).

No comments:

Post a Comment