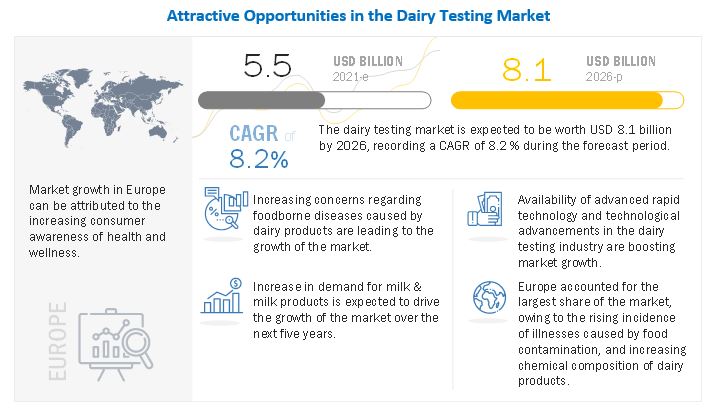

The report "Dairy Testing Market by Type (Safety (Pathogens, Adulterants, Pesticides), Quality), Technology (Traditional, Rapid), Product (Milk & Milk Powder, Cheese, Butter & Spreads, Infant Foods, ICE Cream & Desserts, Yogurt), and by Region - Global Forecast to 2026", The global dairy testing market is estimated to be valued at USD 5.5 billion in 2021 and is projected to reach a value of USD 8.1 billion by 2026, growing at a CAGR of 8.2% during the forecast period. Increase in consumer awareness regarding the safety and quality of food products, stringent regulations imposed by the regulatory bodies, and increase in the global dairy trade, have been driving the global dairy testing market.

Challenge: Lack of harmonization of food safety standards

The increasing number of national standards for food safety management has led to ambiguity and created the need for their harmonization. The leading industries in the food sector have recognized the higher cost and inefficiencies created by the development of multiple food safety standards. Audits are conducted to ensure compliance with government regulatory legislations. Neither ingredient suppliers nor retailers or foodservice companies are well served when duplicative standards and audits raise the total costs for food certification without enhancing or ensuring the overall safety of food. Industrial experts have often suggested uniform and harmonized food safety standards to reduce the multiplicity of food laws for better efficiency. In order to eliminate duplication and overlapping of multiple standards, the government and private-sector stakeholders should work together to create transparent and uniform food certification standards.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=240885146

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=240885146

By type, safety testing is projected to dominate the dairy testing market during the forecast period.

The safety testing segment is expected to dominate in 2021 and is projected to record the highest growth during the forecast period. This is due to the increased emphasis on safety testing of food output by regulatory authorities who are focusing on improving the safety and quality of dairy. Testing also helps address regulatory loopholes, prevent adulteration and malpractices, and meet labeling mandates.

By technology, the rapid technology segment is projected to dominate the dairy testing market during the forecast period.

The rapid technology segment is estimated to dominate the dairy testing market in 2021 and is projected to record higher growth during the forecast period. Rapid technology offers low turnaround time, higher accuracy and sensitivity, and the capacity to test a wide range of contaminants as compared to traditional technology; this is driving the dairy testing market for rapid technology.

The increasing demand for dairy testing in Europe is driving the growth of the dairy testing market.

Europe has the world’s most stringent regulations for dairy testing, which undergo frequent updates and revisions. The world’s highest number of sample tests for both safety as well as quality are conducted in Europe. Strict compliance with MRLs and measures to prevent microbial contamination are preconditions for entering the European market. Exporters aiming to export milk and dairy products to the EU are required to follow a strict set of guidelines. They need to be export registered and listed with the EU (they require an AA or approved arrangement, which is a food safety document that describes how an organization manages its food safety and quality). The increasing dairy trade between Europe and other regions is also driving the dairy testing market in this region as more dairy samples are being tested, both for import as well as export. Europe has one of the highest food safety standards in the world, due to which cases of milk fraud are rare. The Rapid Alert System for Food and Feed Safety provides information when risks to public health are detected in the food chain.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=240885146

This report includes a study on the marketing and development strategies, along with the product portfolios of the leading companies operating in the dairy testing market. It includes the profiles of leading companies such as SGS SA (Switzerland), Bureau Veritas (France), Eurofins (Luxembourg), Intertek (UK), TÜV SÜD (Germany), TÜV NORD GROUP (Germany), ALS Limited (Australia), Mérieux NutriSciences (US), Neogen Corporation (US), Romer Labs (Austria), Microbac Laboratories (US), AsureQuality (New Zealand).

No comments:

Post a Comment