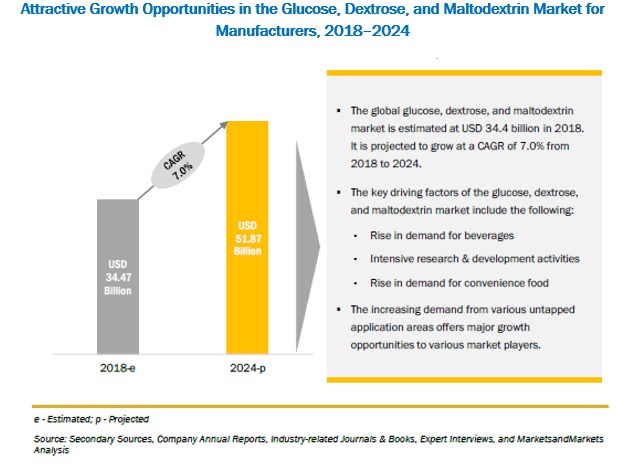

The glucose, dextrose, and maltodextrin market is projected to reach USD 51.87 billion by 2024, at a CAGR of 7.0% from 2018, in terms of value. The market for glucose, dextrose, and maltodextrin is driven by the increase in demand from the beverage industry, intense research & development activities, and an increase in demand for convenience foods. The demand for glucose, dextrose, and maltodextrin in the food & beverages segment, is expected to witness significant growth in the near future, as major food & beverage companies are expected to increase the application of glucose, dextrose, and maltodextrin due to their multiple benefits, including their role as sweeteners, binders, emulsifiers, and thickening agents. However, growth in demand for gums as an alternative to glucose, dextrose, and maltodextrin restrains the market growth.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=217379551

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=217379551

Starch derivatives are produced by enzymatically, physically, and organically altering the characteristics of native starch. Glucose, dextrose, and maltodextrin are among the major starch derivatives used. Glucose is a sweetener used in a range of food products. It is produced from the hydrolysis of starch. Dextrose is a dextrorotatory form of glucose. It is used in baking products such as cake blends and toppings, snack food items such as cookies, and desserts such as custards and sherbets. Maltodextrin is a moderately sweet or flavorless sugar, which is easily digestible, and is absorbed as rapidly as glucose.

They perform numerous functions and hence find application in various industries. They act as thickening agents and stabilizers in the food & beverage industry. They act as key ingredients in the pharmaceutical industry by performing the function of a binder in the production of tablets. These are also used as emulsifiers in the personal care & cosmetics industry.

The glucose, dextrose, and maltodextrin market include players such as ADM (US), Ingredion (US), AGRANA (Austria), Tate & Lyle (UK), Cargill (US), ROQUETTE (France), Grain Processing Corporation (US), Avebe Group (Netherlands), Tereos (France), Global Sweeteners Holdings (Hong Kong), Gulshan Polyols (India), and Fooding Group Limited (China).

The market is concentrated with key players adopting expansions & investments, new product launches, acquisitions, and joint ventures, partnerships, and agreements with other players to strengthen their business, explore new & untapped markets, expand in local areas of emerging markets, and develop a new customer base for long-term client relationships.

Cargill manufactures and markets food, agricultural, financial, and industrial products & services. The company’s key business segments include animal nutrition & protein, food ingredients & applications, origination & processing, and industrial & financial services. It offers nutrition expertise and feeding solutions to help optimize animal production operations. It also offers numerous functional food ingredients and starch derivatives majorly to the food & beverages and personal care industries. Its core competencies lie in supply chain management, risk management, and research & development.

The company has subsidiaries in 70 countries. It has R&D centers in Europe and North America, and provides services in Africa, Europe, Asia, South America, North America, and the Middle East; this enables it to have a significant global market presence.

Cargill’s strategy is directed toward becoming a key supplier in the global starch market through expansions. In line with this strategy, the company focuses on bringing new innovations to its starch product portfolio as well as the expansion of its production scale and geographic operations in high-growth markets through acquisitions. In October 2017, launched functional native starches under its new SimPure brand to meet the demand of its customers for label-friendly products of favorable taste and texture.

Archer Daniels Midland Company (ADM) is primarily engaged in the production of food ingredients, animal feed & feed ingredients, biofuels, and naturally derived alternatives to industrial chemicals. The company functions through four segments, namely, oilseed processing, corn processing, WILD Flavors & Specialty Ingredients, and agricultural services. It is a leading manufacturer of protein meal, vegetable oil, corn sweeteners, flour, biodiesel, ethanol, and other value-added food & feed ingredients. The corn processing segment is engaged in corn wet milling and dry milling activities, converting corn into sweeteners, starches, and bio-products. The sweeteners and starch category comprise corn syrups, dextrose, and maltodextrin required in food. ADM has its presence in North America, Europe, the Middle East, Africa, and Asia Pacific, which contributes to its core competency of having a global infrastructure.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=217379551

The key strategy adopted by ADM is innovation, through which merges its business with other food processing companies and expands its business geographically in the starch industry. For instance, in March 2018, the company entered into an agreement to acquire a 50% equity stake in the sweeteners and starches business of Aston Foods (Russia), to expand its food & beverage segment in Russia.

No comments:

Post a Comment