The global precision fermentation ingredients market size is estimated to be valued at USD 2.8 billion in 2023 and is projected to reach USD 36.3 billion by 2030, recording a CAGR of 44.0% by value. Changing consumer preferences towards veganism, increasing protein consumption, and rising investments in innovations are the major factors for market growth. Substantial breakthroughs in the genetic engineering space have enabled the cost-effective and sustainable reprogramming of microorganisms (synthetic biology) through precision fermentation to create a wide range of specialized food protein constituents.

The expanding business has offered lucrative business opportunities to the players who are operating in the market segments. For instance, in May 2023, Geltor introduced CAVIANCE™, a vegan type of Il collagen polypeptide offering remarkable skin rejuvenating benefits. This innovative product stimulates six different types of collagen, exhibits potent antioxidant properties, and aids in wound healing. Other key players, like MycoTechnology, established a “groundbreaking” collaborative venture with the Oman Investment Authority (OIA) to produce mushroom-based protein using locally cultivated dates. This joint venture will be named Vital Foods Technologies LLC. The overall Precision fermentation ingredients market is classified as a competitive market, with the top five key players, namely Geltor (US), Perfect Day, Inc. (US), The Every Co. (US), Impossible Foods Inc. (US), Motif FoodWorks, and INC. (US) occupying 25-50% of the market share.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=30824914

Precision Fermentation Ingredients Industry Oveview

The precision fermentation ingredient industry is an emerging sector that harnesses cutting-edge biotechnology and fermentation processes to produce a wide range of ingredients for various applications. This industry leverages advanced techniques to precisely engineer microorganisms such as bacteria, yeast, and fungi to produce specific compounds of interest.

Key features of the Precision Fermentation Ingredients industry include:

- Advanced Biotechnology: The industry relies on advanced biotechnological methods to engineer microorganisms at the genetic level. This allows for precise control over the fermentation process and the production of desired ingredients.

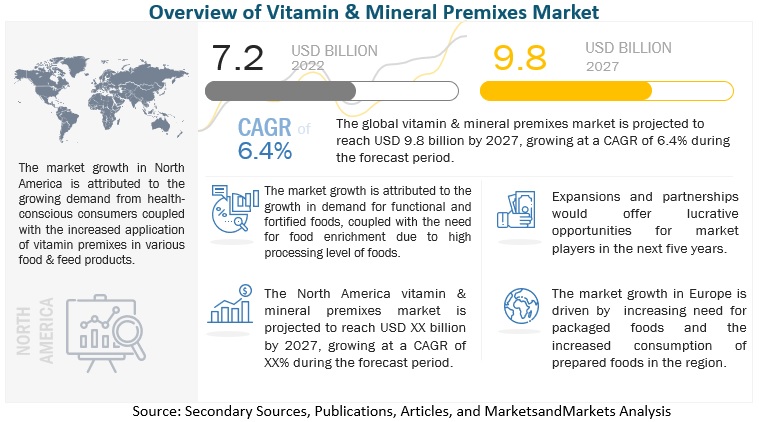

- Customized Ingredient Production: Precision fermentation enables the production of a diverse array of ingredients, including proteins, enzymes, vitamins, flavors, fragrances, and other specialty compounds. These ingredients can be customized to meet specific requirements for various industries, including food and beverage, pharmaceuticals, cosmetics, and agriculture.

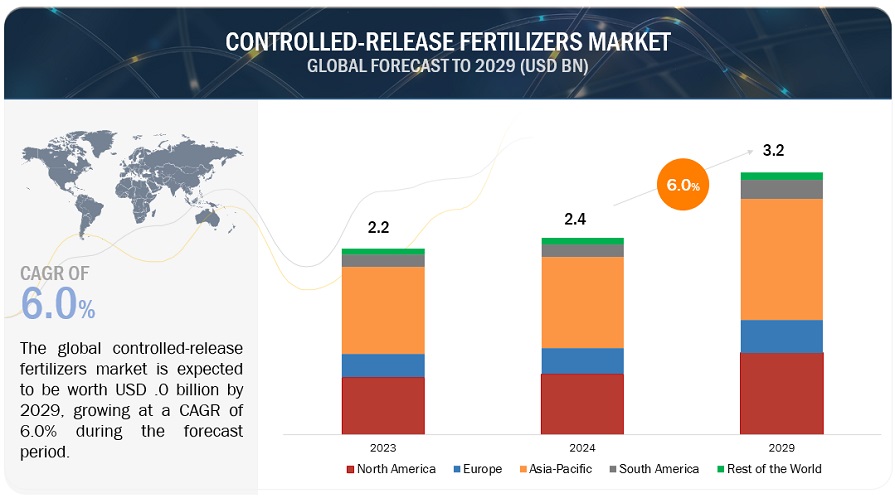

- Sustainability: Precision fermentation offers significant environmental benefits compared to traditional ingredient production methods. It often requires fewer resources, generates less waste, and can be carried out using renewable feedstocks. As a result, it aligns well with sustainability goals and attracts interest from environmentally conscious consumers and businesses.

- Novel Applications: The versatility of precision fermentation enables the development of novel ingredients with unique functionalities and applications. These ingredients can be used to enhance the nutritional profile of food products, improve product stability and shelf-life, and even address specific health or dietary needs.

- Market Growth: The Precision Fermentation Ingredients market is experiencing rapid growth, driven by increasing demand for sustainable and alternative ingredients across various industries. As consumers become more aware of environmental issues and seek healthier, ethically sourced products, the demand for precision fermentation ingredients is expected to continue growing.

- Regulatory Landscape: While the regulatory landscape for precision fermentation ingredients is still evolving, regulatory bodies are increasingly recognizing the safety and efficacy of these ingredients. However, companies operating in this space must navigate regulatory requirements to ensure compliance with food safety standards and labeling regulations.

Make an Inquiry:

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=30824914

Challenges: Customer acceptance of precision fermented based products

Though exhibiting huge scope to scale-up, precision fermentation-based outputs still have knowledge gaps. Bioavailability, allergenicity, digestibility, and bioequivalence of products are all factors that must be considered when evaluating products and ingredients. This is an essential factor if customers are switching from nutritional wholesome food products to modified food products that have some specific added proteins. Therefore, accepting precision-fermented food products is projected to be one of the challenging factors for the market. This challenge can be overcome by bringing consumer awareness regarding precision-fermented food products, which will drive the precision fermentation ingredients market growth in the coming years.

By food & beverage application, the egg alternatives segment is projected to grow with the second-highest CAGR in the precision fermentation ingredients market during the forecast period.

The rising inclination toward vegan food has led manufacturers to introduce a variety of egg alternatives. Precision fermentation derived egg alternatives find use in baking, cooking, and food formulation. The Every Company introduced an egg protein called ClearEgg via precision fermentation in collaboration with Pressed Juicery in November 2021. In April 2021, the company increased its production capacity of egg alternatives further. In 2022, Shiru streamlined animal-free egg prototype creation using AI and machine learning. This innovative method accelerated the replication of egg properties within a plant-based framework.

Request Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=30824914

North America holds the highest market share during the forecast period.

North America remained the largest market for precision fermentation ingredients due to the increasing consumer awareness, consumption of healthy food ingredients, and veganism trend etc. The landscape of North American precision fermentation ingredients market is poised for a transformative shift; around 40% of U.S. adults, over 90 million individuals, are ready to embrace precision fermentation products, projected to reach 132 million consumers by 2027 (The Hartman Group). Younger generations are receptive due to environmental concerns and sustainability, with the second most influential factor being the positive impact on the environment. This aligns with their preference for sustainable consumption. The link between precision fermentation ingredients and sustainability, including reduced greenhouse gas emissions, natural farming, and sustainable packaging, offers innovation potential. Millennials and Gen Z are willing to pay up to 10% more for such products. This technology serves as a catalyst for a more sustainable and technologically advanced market landscape shaped by evolving consumer preferences and environmental consciousness.