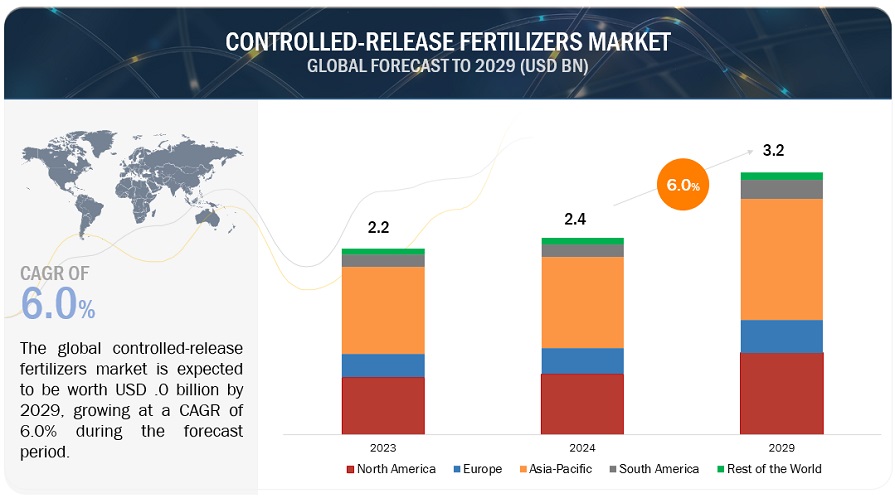

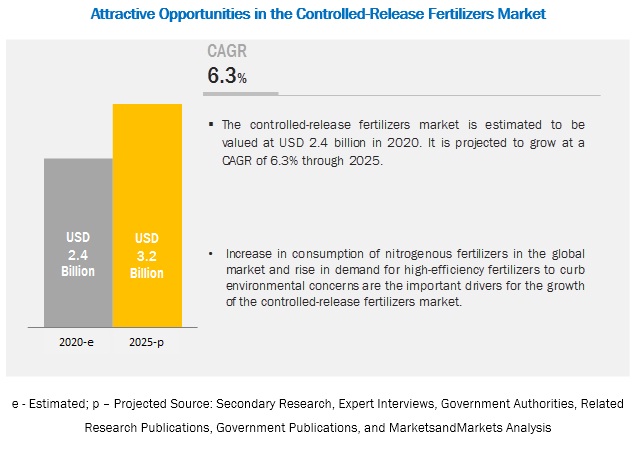

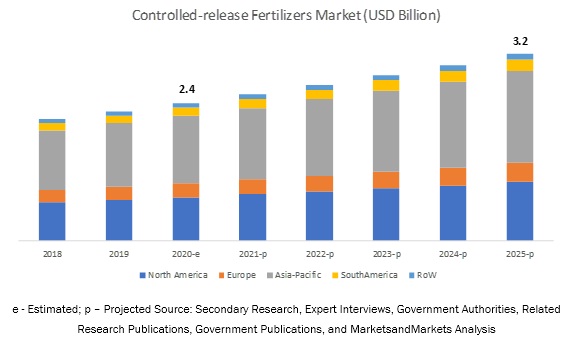

The controlled-release fertilizers market is on a strong growth trajectory, projected to reach USD 3.41 billion by 2030 from USD 2.54 billion in 2025, registering a CAGR of 6.1% during the forecast period (2025–2030).

As global agriculture shifts toward sustainability and efficiency, the demand for CRFs is increasing rapidly. These fertilizers are engineered to release nutrients gradually, ensuring optimal plant uptake while minimizing environmental losses. The market growth is largely fueled by the rising need for higher crop yields, improved nutrient use efficiency, and reduced environmental impact.

Driving Forces Behind Market Growth

Farmers worldwide are adopting controlled-release fertilizers to achieve consistent nutrient availability, reduce application frequency, and enhance soil health. Environmental concerns—such as soil degradation, water pollution, and greenhouse gas emissions from conventional fertilizers—are prompting a transition to CRFs that promote sustainable nutrient management.

Technological advancements, including polymer-coated and biodegradable formulations, have improved the efficiency and adaptability of CRFs across different crops and climatic conditions. Moreover, supportive government policies, precision agriculture adoption, and long-term cost benefits are encouraging broader implementation among modern farmers.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136099624

By Type: Nitrogen Stabilizers Lead the Market

The nitrogen stabilizers segment commands a significant share of the global CRF market due to its essential role in improving nitrogen utilization and minimizing environmental losses. These stabilizers—comprising urease and nitrification inhibitors—slow down nitrogen conversion in the soil, enabling crops to absorb nutrients efficiently over an extended period.

By reducing volatilization and leaching, nitrogen stabilizers help maintain soil fertility, boost yields, and lower fertilizer application frequency—especially valuable for large-scale and high-value crops. With mounting regulatory pressure to curb nitrogen runoff and growing awareness of sustainable farming, nitrogen-stabilized CRFs have become a cornerstone of eco-friendly agriculture.

Leading companies such as ICL, Nutrien, SQM, and Yara are integrating nitrogen stabilizers into their product portfolios to meet the dual goals of productivity and environmental stewardship.

By Function: Time-Release Systems Dominate

Time-release systems represent the largest segment of the controlled-release fertilizers market, credited for their ability to deliver nutrients in sync with crop growth cycles. Utilizing polymer-coated or matrix-based formulations, these fertilizers ensure steady nutrient availability, reducing losses caused by leaching or volatilization.

Their adaptability across a wide range of crops—including cereals, fruits, vegetables, and plantations—has driven widespread adoption. Farmers appreciate the convenience, reduced labor needs, and cost savings these systems offer, particularly in large-scale farming operations.

In addition, the ongoing development of biodegradable coatings and multi-nutrient formulations further enhances their appeal, reinforcing their pivotal role in sustainable and precision agriculture.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=136099624

By Region: North America Leads the Global Market

North America holds the largest share of the global CRFs market, supported by its advanced agricultural infrastructure, technological adoption, and commitment to sustainable practices. Farmers across the U.S. and Canada increasingly prioritize nutrient management strategies that maximize yields while minimizing ecological footprints.

The strong presence of key industry players—such as Yara, Nutrien, ICL, SQM, and Mosaic—combined with robust manufacturing and distribution networks, continues to strengthen regional market growth.

Government initiatives promoting precision farming and environmentally responsible fertilizer use have accelerated CRF adoption. Furthermore, R&D investments and innovations in coating technologies have expanded product versatility for diverse crops and soil types.

North America’s leadership in data-driven nutrient management and large-scale mechanized farming ensures efficient CRF use, delivering both agronomic and economic advantages.

Leading Controlled-release Fertilizers Companies:

Prominent companies driving innovation and competition in the controlled-release fertilizers market include:

Yara (Norway), Nutrien Ltd. (Canada), Mosaic (US), ICL (Israel), Nufarm (Australia), Kingenta (China), ScottsMiracle-Gro (US), Koch Industries (US), Helena Chemicals (US), SQM (Chile), Haifa Negev Technologies Ltd. (Israel), JCAM AGRI Co., Ltd. (Japan), COMPO EXPERT (Germany), The Andersons Inc. (US), and Van Iperen International (Netherlands).