The global

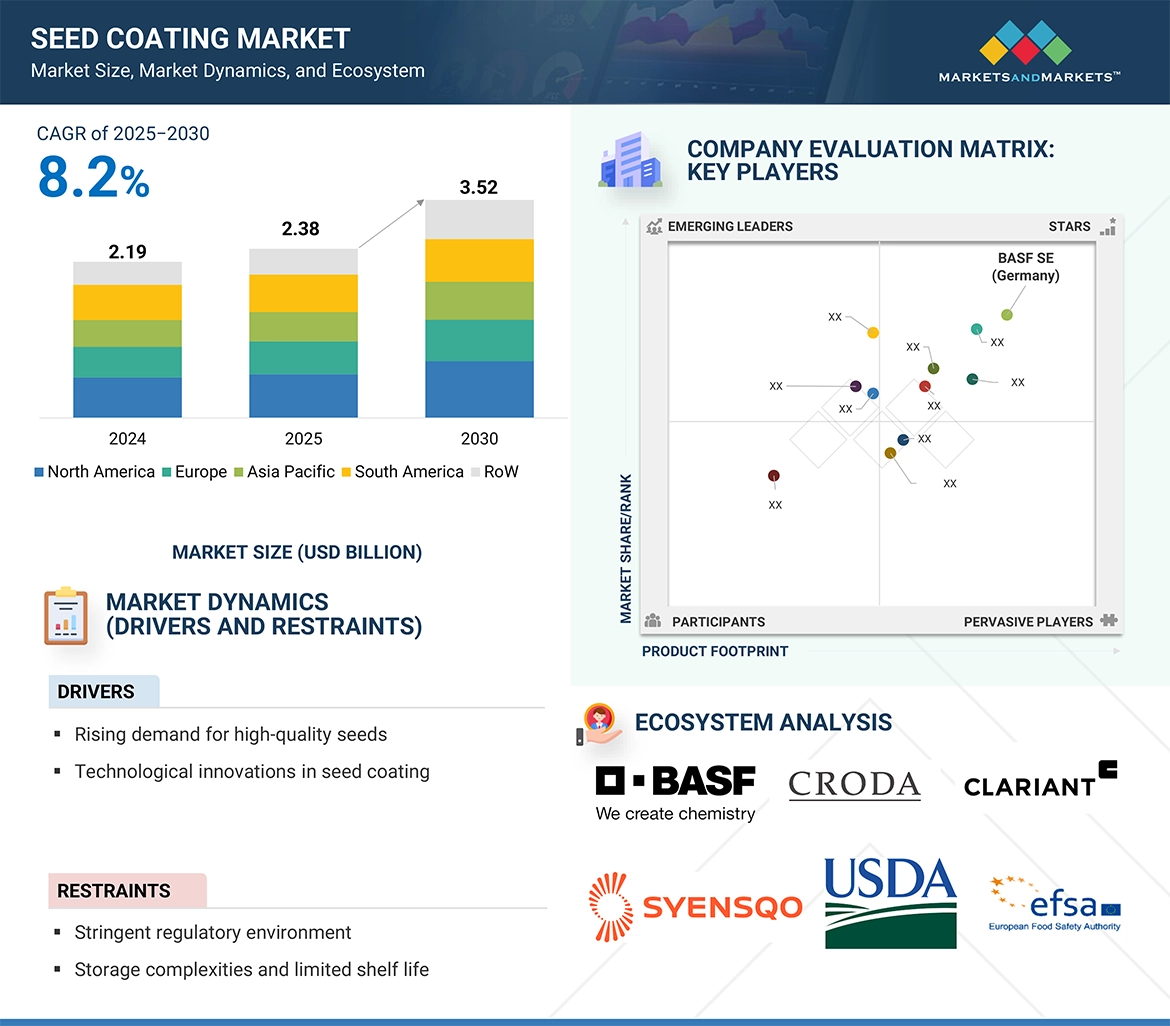

seed coating market is projected to grow from USD 2.38 billion in 2025

to USD 3.52 billion by 2030, registering a compound annual growth rate (CAGR)

of 8.2% during the forecast period. This growth is primarily driven by the

rising demand for high-quality seeds that enhance germination, ensure uniform

crop emergence, and boost resistance to early-stage pests and diseases.

Advancements in coating technologies—particularly polymer and bio-based formulations—have enabled the integration of micronutrients, plant protectants, and microbial agents directly into the seed coating. These innovations significantly improve seed performance. Additionally, the expansion of precision agriculture and the emphasis on sustainable farming practices further support the adoption of seed coating technologies. Favorable government policies and the increasing need to maximize yields on limited arable land also contribute to the market's momentum.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=149045530

By Additive Type: Colorants

Lead the Segment

Colorants represent a major

share of the seed coating additives market. They play a critical role in seed

identification, brand differentiation, and regulatory compliance. By allowing

easy visual distinction based on seed type and treatment level, colorants

enhance both safety and traceability in seed handling. They also improve the

visual appeal of seeds and strengthen brand recognition for seed producers.

A leading player in this

segment is Sensient Technologies Corporation, offering the SensiCoat

product line—customizable, vibrant, and compliant with 40 CFR Part 180

regulations. These pigment dispersions are specifically formulated for seed

treatments, helping companies create distinctive, consistent seed coatings.

By Coating Type: Synthetic

Coatings Dominate

Synthetic coatings account

for the largest market share among coating types. Typically polymer-based,

these coatings are favored for their durability, consistent performance, and

ability to carry a wide range of active ingredients. They offer strong adhesion,

low dust-off, and extended shelf life, making them ideal for commercial-scale

agriculture.

Furthermore, synthetic

coatings are highly compatible with various additives such as fertilizers,

pesticides, and biological inoculants, contributing to enhanced seed protection

and better crop establishment. Their cost-efficiency and proven effectiveness

have solidified their dominance in the global market.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=149045530

By Region: North America

Holds a Leading Position

North America commands a

significant share of the global seed coating market. This leadership is

supported by the region’s advanced agricultural infrastructure, widespread use

of precision farming techniques, and the strong presence of major seed and agrochemical

companies.

Large-scale production of

crops like corn, soybean, and wheat drives demand for high-performance seed

coatings that enhance germination and protect against pests. Moreover,

government initiatives promoting sustainable agriculture and increased

investment in agricultural R&D reinforce the adoption of advanced seed

coating technologies across the region.

Leading Seed

Coating Companies

The report profiles key players such as BASF SE

(Germany), Syensqo (Belgium), Clariant (Switzerland), Croda International plc

(UK), Sensient Technologies Corporation (US), Germains Seed Technology (UK),

Milliken (US), Covestro AG (Germany), BrettYoung (Canada), Chromatech

Incorporated (US), Centor Group (Netherlands), Michelman, Inc. (US), Precision

Labs (US), CR Minerals, LLC (US), and Universal Coating Systems (US).

No comments:

Post a Comment