Friday, September 17, 2021

Agricultural Pheromones Market Growth by Emerging Trends, Analysis, & Forecast to 2026

Wednesday, September 8, 2021

Agricultural Pheromones Market to Showcase Continued Growth in the Coming Years

The

report "Agricultural Pheromones Market by Crop

Type (Fruits & Nuts, Field Crops, & Vegetable Crops), Function (Mating

Disruption, Mass Trapping, Detection & Monitoring), Mode of Application

(Dispensers, Traps, & Sprays), Type, and Region - Global Forecast to

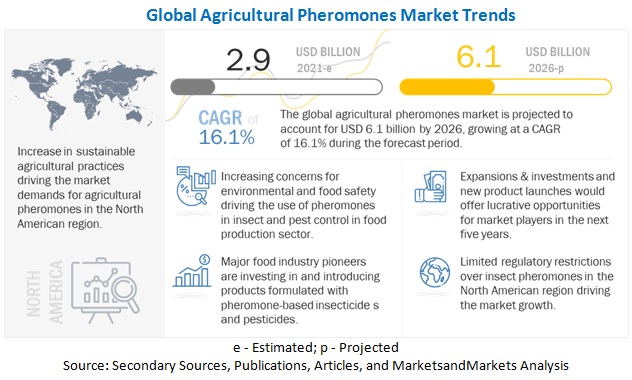

2026", The global agricultural pheromones market is

estimated to be valued at USD 2.9 billion in 2021. It is projected to reach USD

6.1 billion by 2026, recording a CAGR of 16.1% during the forecast period.

Semiochemicals such as pheromones and allelochemicals are those biological

pesticides that are organic in nature and are environmentally safe. Companies

nowadays are increasing their research & development investments to

diversify the application area for these pesticides and thus, propelling the

growth of the overall market. Many horticulture and agriculture farmers are

employing sex pheromones and attractants to decrease the number of

crop-damaging insects and pests effectively.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=11243275

Convenient and ready-to-use traps are projected to witness the

highest growth during the forecast period.

Pheromone traps are

usually used to capture certain species of insects in stored products. A

pheromone attractant is used inside the trap to lure the insects. Traps are

used for monitoring and mass trapping as well. However, in the case of mass

trapping, the number of traps per unit area is increasing effectively to trap

more insects. Some of the most commonly used traps include delta traps, sticky

traps, winged traps, and funnel traps.

By crop type, the fruit & nuts segment dominated the

agricultural pheromones market in 2020.

Fruits & nuts include

crops, such as apple, peach, pear, grapes, citrus, mango, and coconut. Some of

the major insects that infest crops include oriental fruit borer, codling

moths, fruit fly, Indian meal moths, and leafroller. Companies such as Suterra

(US), Koppert Biologicals (Netherlands), and Russell IPM (UK) focus on

providing solutions for insect pheromones in fruits. Research is also conducted

for the efficient management of fruit pests by making use of pheromone

nanogels. This technology is currently being tested for guavas. The methodology

is still under trial and would be a simple and cost-effective technique if it

clears the clinical trials and could significantly reduce fruit fly infestation

on guavas. In most cases, dispensers are utilized for delivering pheromones

used in mating disruption in fruit crops.

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=11243275

US dominated the North America market for agricultural

pheromones market in 2020.

In the US, common pests

found on fruit crops are grapevine moth, banana weevil, oriental fruit moth,

and codling moth. These insects are mainly used for monitoring, mass trapping,

and attract-and-kill purposes in the US. The insect pests found on field crops

in the US are cotton boll weevil, pink bollworm, and southwestern corn borer.

In the US, mating disruption is usually practiced in apple, peach, pear, and

cotton farms to control populations of insect species, such as codling moths,

oriental fruit moths, and pink bollworms. Some of the major pheromone

manufacturing companies, such as Suterra (US) and Provivi, Inc. (US), have also

made the US a favorable market for the utilization of pheromones.

The key players in this

market include Shin-Etsu Chemical Co., Ltd. (Japan), Koppert Biological Systems

(Netherlands), Isagro Group (Italy), Biobest Group NV (Belgium), Suterra LLC

(US), Russell IPM (UK), ISCA Technologies (US), Trécé Incorporated (US),

Bedoukian Research, Inc. (US), Pherobank B.V. (Netherlands), BASF SE (Germany),

Certis Europe BV (Netherlands), Bioline AgroSciences Ltd. (US), Bio Controle (Brazil),

and ATGC Biotech Pvt Ltd. (India).

Tuesday, August 31, 2021

Agricultural Pheromones Market: Growth Opportunities and Recent Developments

The report "Agricultural Pheromones Market by Crop Type (Fruits & Nuts, Field Crops, & Vegetable Crops), Function (Mating Disruption, Mass Trapping, Detection & Monitoring), Mode of Application (Dispensers, Traps, & Sprays), Type, and Region - Global Forecast to 2026", The global agricultural pheromones market is estimated to be valued at USD 2.9 billion in 2021. It is projected to reach USD 6.1 billion by 2026, recording a CAGR of 16.1% during the forecast period. Semiochemicals such as pheromones and allelochemicals are those biological pesticides that are organic in nature and are environmentally safe. Companies nowadays are increasing their research & development investments to diversify the application area for these pesticides and thus, propelling the growth of the overall market. Many horticulture and agriculture farmers are employing sex pheromones and attractants to decrease the number of crop-damaging insects and pests effectively.

Download

PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=11243275

Impact of Covid-19

on the global agricultural pheromones market

Since the onset of

the COVID-19 pandemic, consumer preferences have shifted toward consuming

healthy and organic food products to maintain health and improve immunity.

Other emerging industry trends, including consumption of safe, natural,

clean-label, and pesticide-free products, have also changed the scenario of

agriculture across the globe. COVID-19 is projected to have a considerable

impact on the growth of the agricultural pheromones market. In the optimistic

scenario, it is assumed that the impact would be positive, and crop protection

manufacturers are willing to buy agricultural pheromones, considering the rise

in demand for clean organic products and insect & pest-free environments.

In addition, as the trade barriers would be relaxed to rebuild economies,

trading will be easier.

Challenges: Need for

development of multi-target insect pheromone dispensers

Pheromones are target-specific, and hence, target one

species during its period of application. In an apple farm, when codling moths

are targeted through monitoring and trapping; other secondary pests such as

stink bugs can remain unnoticed, which can lead to higher pest outbreaks and

increased pesticide application. This subsequently increases the production

costs of the growers. To solve the problem of secondary pest management, it is

necessary to develop a product that would target more than one species at the

same time. The development of multi-target pest pheromone dispensers is a

challenge for many integrated pest management companies.

By mode of application,

the dispensers segment dominated the market in 2020, due to the ease of

handling and low cost

Dispensers are utilized for the application of insect

pheromones in specified amounts to different types of crops. The dispensers

should be placed at a particular height to be an effective source. Dispensers

are most commonly utilized to monitor insect populations in arable crops,

stored products, and forest ecosystems. An ideal dispenser should be renewable

and should be made of cheap organic materials alongside being economically

inexpensive and toxicologically inert. Pheromone-based devices are able to

ensure the successful control of pests, such as codling moths, tomato pinworm,

pink bollworm, and oriental fruit moth. Pheromone dispensers are of different

types, such as passive pheromone dispensers, retrievable polymeric pheromone

dispensers, hollow fibers, and high emission dispensers.

Request for

Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=11243275

The North America region

dominated the agricultural pheromones market and is projected to grow at the

highest CAGR of 16.9% from 2021 to 2026.

The market for pheromones is growing in North America

owing to the widening scope of applications in not only agriculture but also in

forestry and for industrial purposes, such as in the food and pharmaceutical

industries. ISCA produces a formulation to control noctuid moths on row crops

that acts as a mating-disruption for the gypsy moth that is used by the US

Forest Service. Some of the majorly grown agricultural crops in the region

include cotton, tomatoes, grapes, corn, pome fruits, and stone fruits. These

are some of the crops that are prone to attacks from various insect species,

such as the pink bollworm, leaf miner, codling moth, and berry moths. In North

America, pheromones are used for mating disruption purposes.

Key Market

Players:

The key players in this market include Shin-Etsu Chemical

Co., Ltd (Japan), Koppert Biological Systems (Netherlands), Isagro Group

(Italy), Biobest Group NV (Belgium), Suterra LLC (US), Russell IPM (UK), ISCA

Technologies (US), Trécé Incorporated (US), Bedoukian Research, Inc. (US),

Pherobank B.V. (Netherlands), BASF (Germany), Certis Europe BV (Netherlands),

Bioline AgroSciences Ltd. (US), Bio Controle (Brazil), and ATGC Biotech Pvt

Ltd. (India).