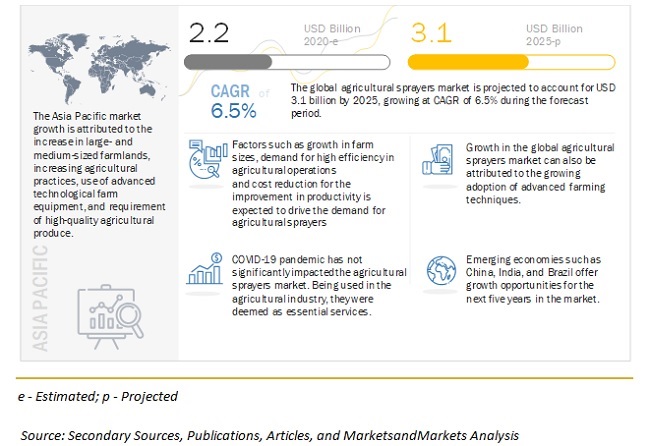

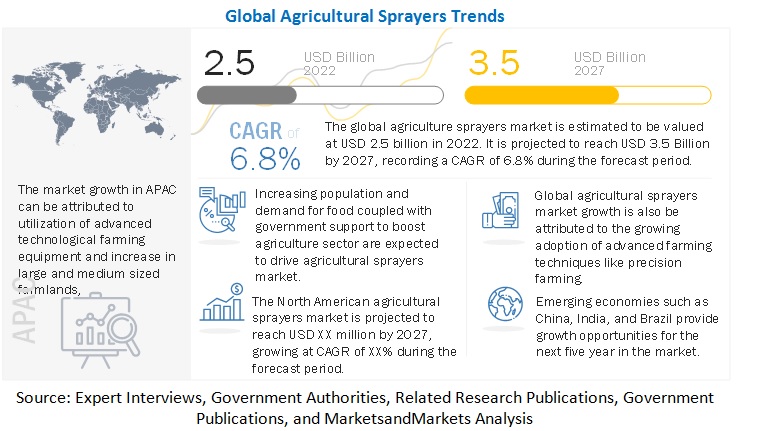

The Agricultural Sprayers Market is projected to reach USD 3.5 billion by 2027, recording a CAGR of 6.8% during the forecast period. It is estimated to be valued at USD 2.5 billion in 2022. Farming equipment are essential to enhance crop yield and cut down the labor cost. Over the past few years, agricultural sprayers have become important for farmers for spraying fertilizers, as well as other chemicals such as herbicides and pesticides during the harvest time as per the need. Technological developments permit farmers to apply chemicals in an effective manner. Therefore, the market for agricultural sprayers has gained a momentum because change in farming techniques and technological adoption. The global market can be classified based on type, farm size, nozzle type, power source, capacity, crop type, usage, and region.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=46851524

Driver: Growing focus on farm efficacy to increase yield

Farmers or growers are not only faced with different challenges associated to farm functions but also various market challenges. Some of the market challenges include fluctuating prices, uncontrollable weather conditions, finding buyers for their product, and lack of natural resources. The newer technology versions of agricultural sprayers have provided various benefits to the farmers, such as low cost, increased spray efficiency, safety, and less damage to the crops and environment. This is substantially increasing the demand for agricultural sprayers in the global market.

Restraint: High capital investment is needed for technologically-advanced farm equipment

New farming technologies such as GPS, drones, and GIS to collect input data, variable rate technology, and satellite devices are expensive as compared to other non-tech devices and need huge capital investment. The majority of the farmers are marginal farmers or small landholding farmers who find it difficult to invest in expensive equipment. This restraint is particularly high in developing countries such as India, China, and Brazil. Currently, most developing countries are importing farming equipment from other countries, which increases the product cost, which in turn expected to lower the market growth of agricultural sprayers in near future.

The cereals segment holds the largest market share in the global agricultural sprayers market

The cereals segment comprises corn, rice, wheat, barley, and other cereals & grains. The use of agricultural sprayers helps farmers cover larger farm sizes and protect crops, resulting in higher crop yield. Agricultural sprayers involve high demand from cereal producers to increase crop yield. The market for agricultural sprayers is expanding as a result of the growing demand for grains and cereals in consumers' diets.

Request Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=46851524

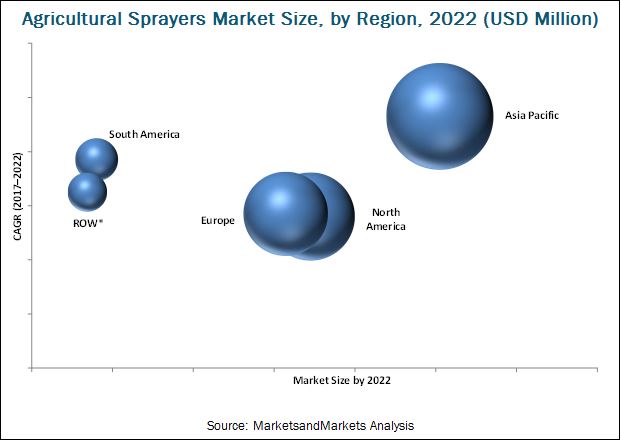

Asia Pacific dominated the agricultural sprayers market, with a value of USD 932.2 million in 2021; it is projected to reach USD 1430.4 million by 2027, at a CAGR of 7.5% during the forecast period.

In developing countries, the markets for agri-food products are changing rapidly, becoming increasingly open and homogenized toward international standards. Acquiring technical know-how and financial resources to incorporate standards such as quality assurance, safety, and traceability is difficult to do as it marginalizes many small and medium farms and agro-enterprises. Adoption of Unmanned aerial vehicles (UAVs) in Australia, high dependency on agriculture in India, and increasing export of agricultural machineries in China are some of the important factors fueling the Asia-Pacific agricultural sprayers market growth in the near future.