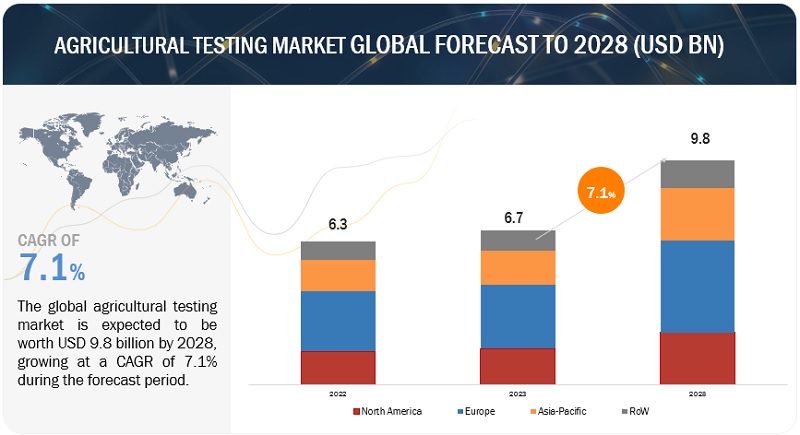

The agricultural testing market is projected to reach USD 9.8 billion by 2028 from USD 6.7 billion by 2023, at a CAGR of 7.1% during the forecast period in terms of value. The demand for agricultural testing is increasing due to several factors. Concerns about food safety and public health drive the need for testing to identify contaminants and ensure the safety of agricultural products. Quality assurance is another driver, as testing helps determine nutrient content, maturity, and genetic modifications to meet market requirements. Environmental concerns prompt testing to assess soil health and detect contamination. Testing also aids in optimizing crop yields by identifying nutrient deficiencies and managing pests. International trade requires testing to comply with regulations, while advancements in technology make testing more efficient and accessible. These factors collectively contribute to the rising demand for agricultural testing.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=203945812

By application, safety testing is projected to have fastest growing rate during the forecast period.

products are subject to various national and international regulations, standards, and guidelines. Safety testing is necessary to comply with these regulations and ensure that products meet the specified safety criteria. Non-compliance can result in product recalls, legal consequences, damage to reputation, and loss of market access. By conducting safety testing, agricultural businesses can demonstrate their commitment to meeting regulatory requirements and providing safe products to consumers. Also, agricultural products are often traded internationally, and different countries have specific safety standards and import regulations. Exporting agricultural products requires compliance with the safety requirements of the destination market. Safety testing is necessary to ensure that products meet these standards and avoid potential trade barriers or rejections. Exporters must provide evidence of safety testing to demonstrate the suitability of their products for international markets.

Asia Pacific is expected to have the fastest growing rate during the forecast period.

The Asia-Pacific region is home to a significant portion of the global population, including countries like China and India, which have the world's largest populations. This densely populated region requires extensive agricultural production to meet the growing food demand. As a result, there is a greater need for agricultural testing to ensure the safety, quality, and productivity of agricultural products. The Asia-Pacific region has experienced rapid industrialization and urbanization, leading to increased pollution and pressure on agricultural lands. This has raised concerns about the impact of industrial activities and urban expansion on agricultural productivity and safety. Agricultural testing helps identify and mitigate potential contamination risks, ensuring the safety and sustainability of agricultural practices in the face of urban development.

Request Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=203945812

The key players in this market include SGS (Switzerland), Eurofins (Luxembourg), Intertek (UK), Bureau Veritas (France), ALS Limited (Australia), TUV Nord Group (Germany), Merieux (US), AsureQuality (New Zealand), RJ Hill Laboratories Limited (New Zealand), SCS Global (US), Agrifood Technology (Australia), APAL Agricultural Laboratory (Australia), Agvise Laboratories (US), LGC Limited (UK), and Water Agricultural Laboratories (US). These players have adopted various growth strategies such as collaborations and acquisitions to increase their global market presence.