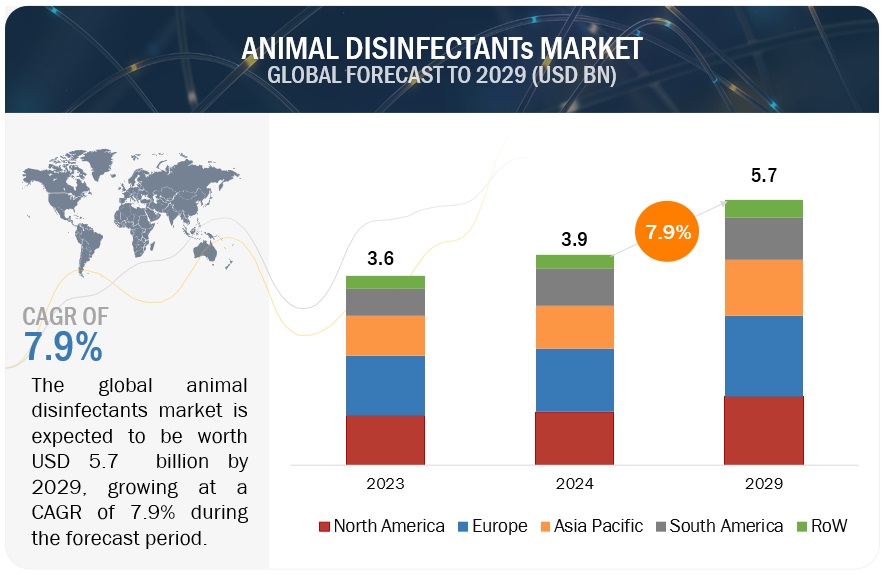

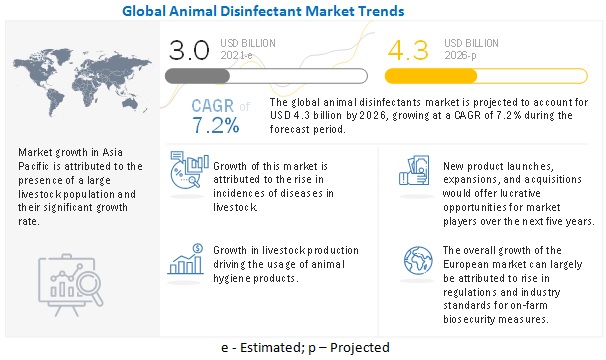

The global animal disinfectants market is projected to grow from USD 3.9 billion in 2024 to USD 5.7 billion by 2029, registering a CAGR of 7.9% during the forecast period. The versatility and wide-ranging applications of animal disinfectants make them an essential component in maintaining livestock health and welfare. These products are particularly effective in eliminating harmful microorganisms such as bacteria, viruses, fungi, and parasites, which can thrive in animal housing, equipment, and surrounding areas.

Regular use of animal disinfectants significantly reduces the risk of disease outbreaks, ensuring a safe and healthy environment for livestock. They are frequently utilized in settings where cleanliness is paramount, such as farms, veterinary clinics, and animal shelters. When choosing a disinfectant, factors such as the type of pathogen, the surface to be sanitized, and potential impacts on humans or animals must be carefully considered. Effective disinfection, combined with stringent hygiene and biosecurity protocols, is critical for preventing and managing biohazards.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=38718363

Dairy Cleaning: A Leading Application Segment

Dairy cleaning is expected to dominate the animal disinfectants market between 2024 and 2029. Disinfectants play a vital role in eliminating pathogens from dairy equipment, surfaces, and facilities. According to the United States Department of Agriculture, the global cattle population exceeded 1 billion in 2022, driving demand for animal disinfectant products. Proper cleaning of milking machines, teat dips, and milk tongs minimizes pathogen transmission and helps ensure the production of safe, high-quality milk.

Cleaning protocols often involve the use of acid or alkaline solutions for equipment, while hydrogen peroxide combined with peracetic acid is commonly employed for sanitizing pipelines and storage tanks. Regular application of disinfectants in areas like milking parlors, holding pens, and feeding zones not only fosters a healthier environment for animals and workers but also enhances the overall efficiency of dairy operations.

Iodine: A Dominant Disinfectant Type

Iodine-based disinfectants are expected to hold the largest share within the type segment of the animal disinfectants market. Renowned for their broad-spectrum efficacy against bacteria, viruses, and fungi, iodine products are a preferred choice in animal healthcare and biosecurity. Additionally, iodine-based solutions are regarded as relatively safe and less toxic, driving their popularity in the market.

In 2021, Zagro launched IOGUARD 300, a powerful iodophor-based disinfectant containing 3.4% iodine. This product is highly effective against bacteria, viruses, and fungi and is designed for use in livestock housing, equipment, and hatcheries. The combination of iodine’s benefits and continuous innovation by key companies is expected to solidify its dominance in the market.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=38718363

North America: A Key Regional Market

North America is projected to hold a substantial share of the animal disinfectants market, with key contributors being the US, Canada, and Mexico. The USDA reported significant growth in poultry production in the region between 2020 and 2022, with Mexico's production increasing from 983.43 million to 1.25 billion and Canada’s rising from 350.26 million to 563.94 million. This surge highlights the growing need for effective animal disinfectant products to maintain biosecurity and livestock health in intensively populated farming operations.

Leading Animal Disinfectants Manufacturers:

Key Market Players in this include Neogen Corporation (US), GEA Group Aktiengesellschaftv (Germany), Lanxess (Germany), Zoetis (US), Solvay (Belgium), Stockmeier Group (Germany), Kersia Group (France), Ecolab (US), Albert Kerbl GmbH (Germany), PCC Group (Germany), DeLaval Inc. (Sweden), Diversey Holdings Ltd. (US), Virbac (France), Kemin Industries Inc. (US) and Fink Tec GmbH (Germany).