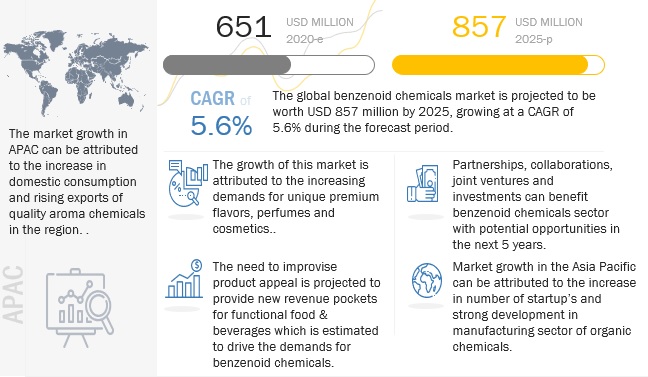

The benzenoids market is projected to grow at a CAGR of 5.6% to reach USD 857 million by 2025. The global industry was estimated to be valued at USD 651 million in 2020. The steady onset of factors such as rise in consumption of processed food products, shifting flavor & fragrance trends and steady growth in the personal care products in the global benzenoids markets, particularly in emerging and developing markets have triggered demand for quality benzenoid chemicals.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=18857610

Driver: Shifting flavor & fragrance trends and preferences amongst populations globally

The global choices and preferences related to taste and aromas are changing rapidly with changing marketing trends, mindsets and increasing expenditure on lifestyle. As per the 2018 report of “Innova Market Insights” 64% of US consumers state that they “love to discover flavors from other cultures,” Dull flavors are being reinvented and more retail products and restaurants are highlighting ethnic flavors or street flavors. Unique scents and attractive designs have pushed the home fragrance market to its strongest position yet. While over the years traditionally rooted fragrances like jasmine and sandalwood have had a distinct contribution, especially for soaps, a combination of fruity-floral fragrances are now gaining traction with marketers wooing younger consumers.

Restraint: Potential health risks of synthetic chemicals affecting production growth

The genotoxicity and carcinogenicity are the key factors that are taken into consideration to determine the safety of the chemical use. Companies that manufacture perfume or cologne purchase fragrance mixtures from fragrance houses to develop their own proprietary blends. Benzenoids as food additives and fragrance ingredients are regulated as some of them pose potential risks to human health at defined concentrations. Organization such as US FDA (US Food & Drug Administration), EU Commission, IFRA (International Fragrance Association) set standards and guideline for manufacturers in order to control the possible health risks due to overuse of aroma chemicals in food and fragrance products.

By Application , the soaps & detergents sub-segment is estimated to observe the fastest growth in Benzenoid Chemicals market.

The aroma in soaps and detergent products is bought about by the use many natural and synthetic compounds. The generally used natural compounds include oregano oil, lemon oil, coconut oil, camellia oil, and coffee essential oil amongst others. During the spread of coronavirus pandemic, the significance of soaps and detergents for hygiene purposes grew tremendously giving a boost to the sales of the industry. With organizations such as American Centers for Disease Control and Prevention, promoting hand hygiene through use of soaps and clean running water the benzenoids market grew faster in the pandemic time.

Request Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=18857610

The increasing exports of the region of benzenoid chemicals to the North American and European regions, accounts for the high market share of the region.

China ranks first in terms of imports and exports of organic chemicals globally. The global chemical industry has seen a 7% annual growth rate. countries such as China, Japan, South Korea, Indonesia are doing exceedingly well in the cosmetics, beauty and personal care products market. According to Istrata reports, Southeast Asia revenue in the Beauty and Cosmetics segment amounts to USD25.449 billion in 2020 where 74% of sales contribute to mass-marketed cosmetics and 26% on luxury items. Thus the region accounts for the largest market shares in the global benzenoid market.