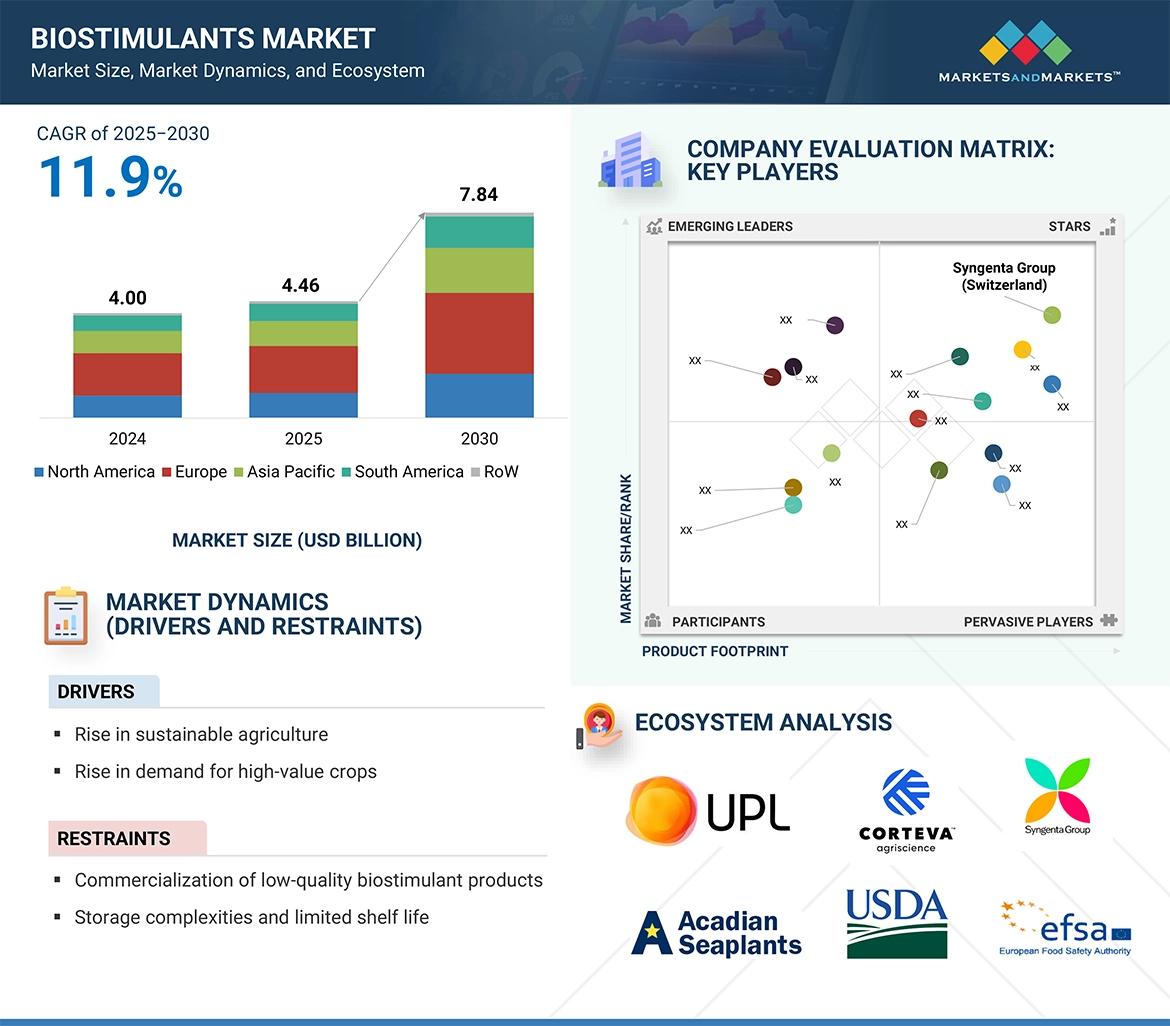

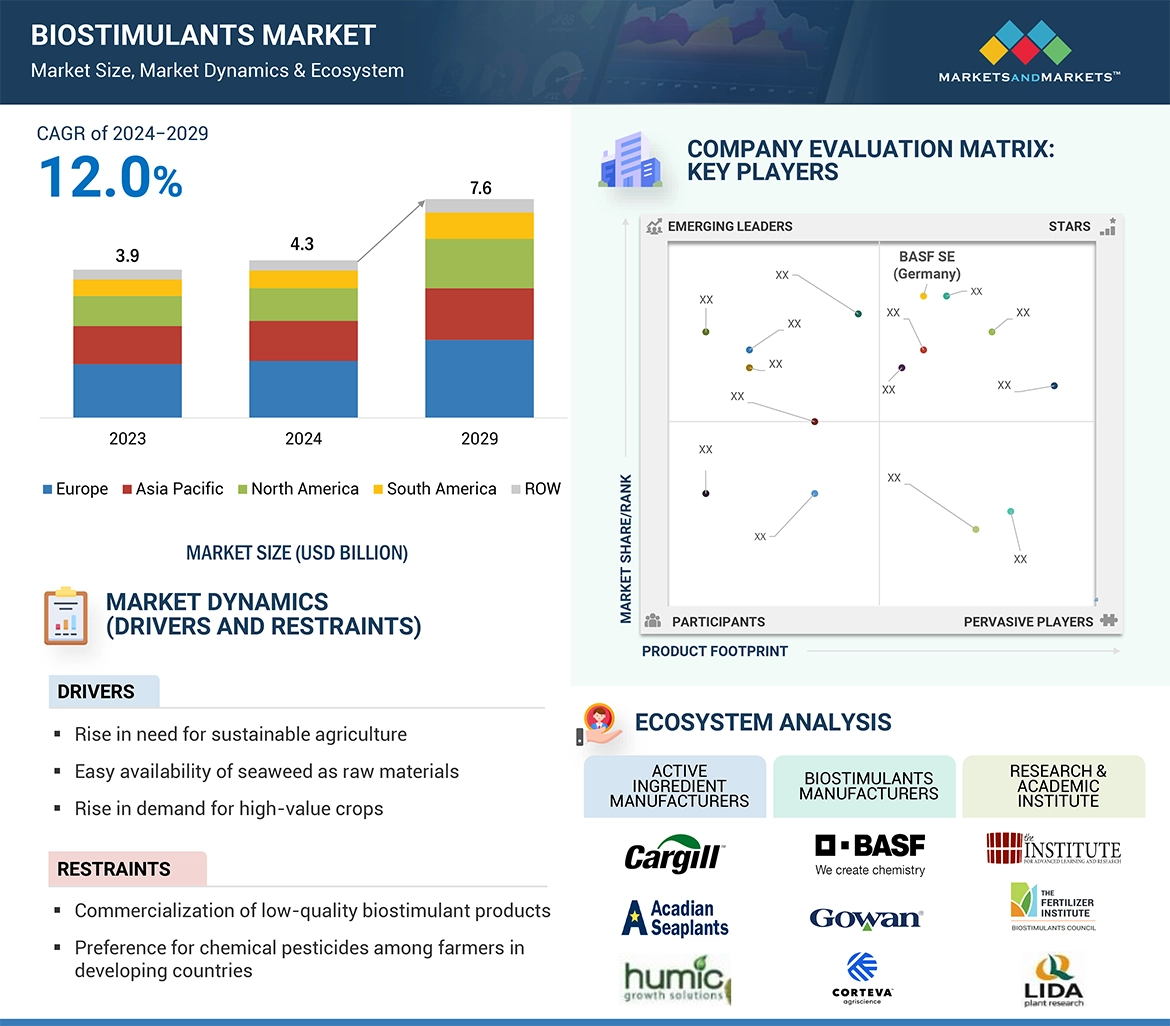

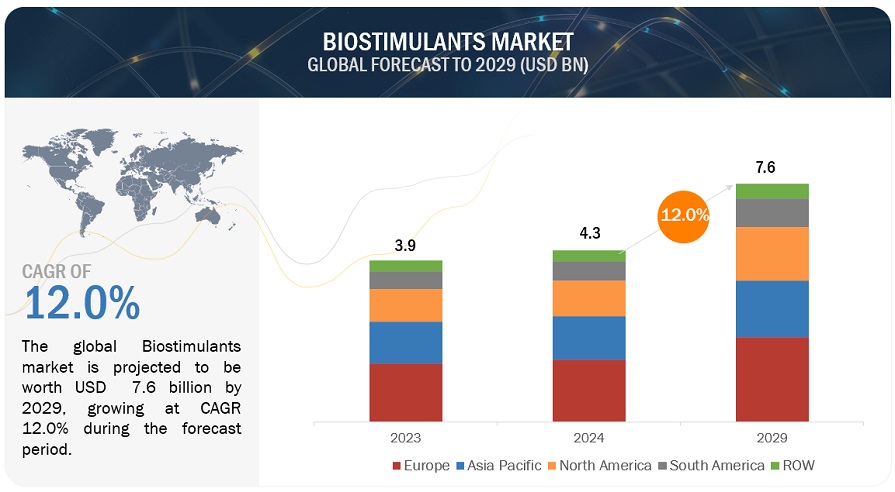

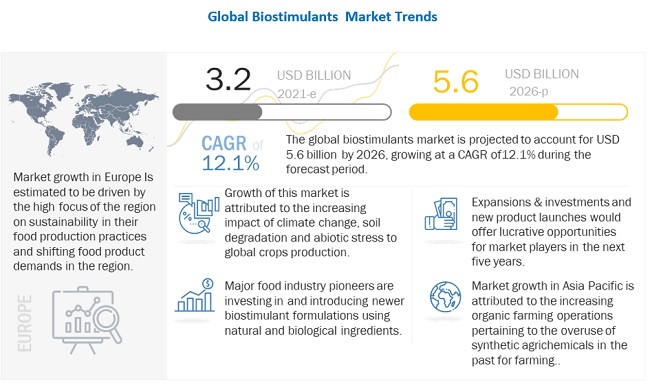

The global biostimulants market is projected to grow from USD 4.46 billion in 2025 to USD 7.84 billion by 2030, reflecting a CAGR of 11.9% during the forecast period. This robust growth is primarily fueled by the rising adoption of sustainable agricultural practices, the expanding use of organic farming, and heightened awareness about the benefits of biostimulants in enhancing crop yield, quality, and resilience to abiotic stress.

Supportive government

initiatives—such as the European Union’s Farm to Fork strategy—are further

accelerating market growth by promoting eco-friendly farming techniques. In

parallel, advancements in biostimulant formulation and extraction technologies

are improving product effectiveness and expanding their applicability across

diverse crop types. Farmers are increasingly turning to biostimulants to boost

nutrient efficiency, enhance soil health, and reduce dependency on chemical

fertilizers. In addition, rising consumer demand for high-quality, residue-free

produce is encouraging growers to incorporate biostimulants

as part of their organic and sustainable farming toolkit.

By Active Ingredient: Amino

Acids Lead the Market

The amino acids segment

dominates the active ingredient category, owing to its critical role in

supporting plant growth, enhancing nutrient uptake, and improving stress

tolerance. Amino acids act as precursors to essential plant hormones, enzymes,

and proteins that drive key physiological functions such as photosynthesis,

nutrient assimilation, and root development. Their proven effectiveness in

aiding plant recovery from abiotic stresses like drought, temperature

fluctuations, and salinity makes them a preferred choice for farmers aiming to

boost productivity and resilience.

One key player in this space

is Aminocore (Germany), known for its natural amino acid-based fertilizers and

biostimulants. Developed through mild enzymatic hydrolysis—a

pharmaceutical-grade process—Aminocore’s products offer a superior free amino

acid profile that is twice as effective as conventional solutions, without

relying on synthetic components or toxic additives.

By Form: Liquid

Biostimulants Dominate

In terms of form, the liquid

biostimulants segment holds the largest market share, largely due to its ease

of application, rapid absorption, and high efficacy in promoting plant growth

and resistance to environmental stressors. Farmers widely favor liquid

formulations as they are compatible with various application methods—including

foliar sprays, fertigation, and soil drenching—ensuring uniform distribution

and quick uptake by plants. Additionally, liquid biostimulants demonstrate

strong compatibility with other agrochemicals and fertilizers, further

enhancing nutrient absorption and crop response.

North America dominates the Biostimulants

Market Share.

North America represents a

substantial share of the global biostimulants market, underpinned by

large-scale commercial farming, advanced agricultural technologies, and a

strong focus on soil health and crop productivity. The United States and Canada

lead the region with high-volume production of staple crops such as wheat,

corn, and soybeans, which require consistent and efficient nutrient input.

Government support for

organic and sustainable farming methods, coupled with growing awareness about

the soil-enhancing and yield-boosting benefits of biostimulants, is further

strengthening the market. Additionally, regional players are heavily investing

in R&D to create next-generation biostimulant products with enhanced

performance and wider crop applicability.

Leading Biostimulants

Companies:

The report profiles key players

such as UPL (India), FMC Corporation (US), Corteva (US), Syngenta Group

(Switzerland), Sumitomo Chemical Co., Ltd. (Japan), Nufarm (Australia),

Novonesis Group (Denmark), BASF SE (Germany), Bayer AG (Germany), PI Industries

(India), T. Stanes and Company Limited (India), Gowan Company (US), J.M. Huber

Corporation (US), Haifa Negev Technologies LTD (Israel), and Koppert

(Netherlands).