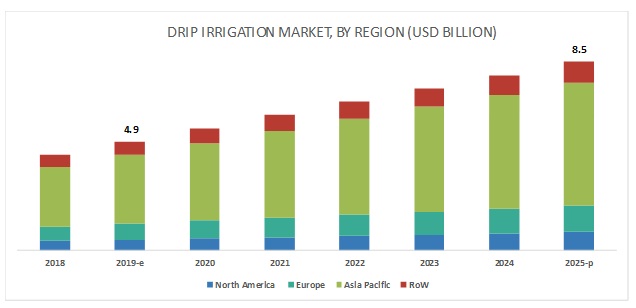

The global drip irrigation market is projected to grow from USD 4.9 billion in 2019 to USD 8.5 billion by 2025, at a CAGR of 9.6%. The rise in the popularity of drip irrigation solutions can be attributed to government initiatives, water conservation activities, enhancement of production, and decrease in production cost. Markets such as China and India are among the key markets targeted by drip irrigation manufacturers and distributors due to the large agriculture sector driven by regional demand and exports that are adopting drip irrigation services in the region.

Increasing concerns over water withdrawal and government initiatives are the key factor driving the growth in the drip irrigation market during the forecast period

Drip irrigation helps minimize water loss due to evaporation by distributing water through a network of valves, pipes, tubing, and emitters. Drip irrigation methods are known to offer a significant advantage in efficiency against other conventional irrigation methods, including sprinkler and flooding. The adoption of micro irrigation technology has helped achieve higher cropping and irrigation intensity, which has made a significant impact on resource saving, cultivation cost, crop yield, and farm productivity. This technology has received considerable attention from policymakers and government for its perceived ability to contribute significantly toward agricultural productivity and economic growth.

Download PDF Brochure:

By emitter type, inline emitters dominated the drip irrigation market

Emitters are the most crucial components of a drip irrigation system as they discharge water flowing through the lateral over the crop root area. The role of emitters is to discharge water at a predetermined rate and help prevent clogging. Inline emitters are usually present within the laterals with equal spacing. They may be flat boat-shaped, cylindrical, or may be attached to the inner wall of the lateral. Inline emitters are usually used for row crops or field crops. They help provide maximum resistance against clogging and are suitable for surface irrigation and subsurface irrigation. The end users of inline emitters have substantial labor savings, as emitters are preinstalled.The inline emitters are molded into the dripline, which helps negate the costs for additional emitters.

Asia Pacific is projected to dominate the drip irrigation market by 2025

The Asia Pacific drip irrigation market is anticipated to witness significant growth during the forecast period due to the high agricultural production, government initiatives incentivizing the adoption of drip irrigation systems, and increase in irrigable areas in the region which has resulted in water scarcity across multiple countries in the region. Asia Pacific was the largest consumer of drip irrigation and is a key exporter of agricultural products. The region is mainly dominated by large-scale operations, primarily exports, with an organized distribution chain.

Request for Customization:

This report includes a study of the development strategies, along with the product portfolios of leading companies. It also includes the profiles of leading companies such as Jain Irrigation Systems Ltd. (India), Lindsay Corporation (US), The Toro Company (US), Netafim Limited (Israel), Rain Bird Corporation (US), Chinadrip Irrigation Equipment Co. Ltd. (China), Elgo Irrigation Ltd. (Israel), Shanghai Huawei Water Saving Irrigation Corp. (China), Antelco Pty Ltd. (Australia), EPC Industries (India), Microjet Irrigation (South Africa), TL Irrigation (US ), Azud System (Italy), Metzer Group (Israel), Grupo Chamartin Chamsa (Italy), and Dripworks Inc. (US).

Recent Developments:

- In May 2019, The Metzer Group launched new ring connectors for its line of drip tapes. The new ring connectors are available in four different variants and are ideal for use in thin-walled pipes.

- In February 2019, Rivulis expanded its operations in Mexico with the opening of a new factory in Leon. The factory is expected to become the largest drip irrigation factory in the Americas and started manufacturing operations in early February.