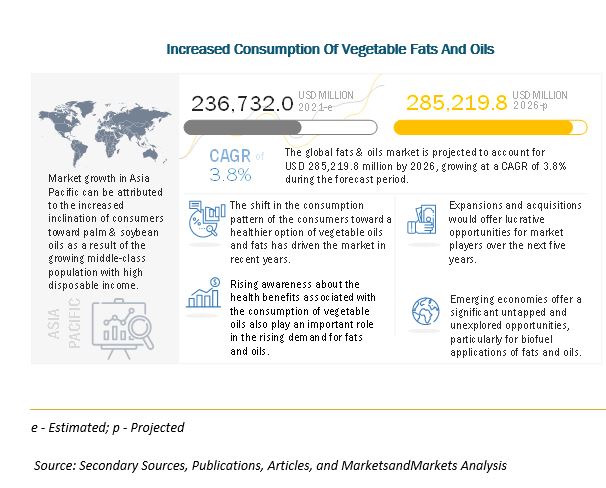

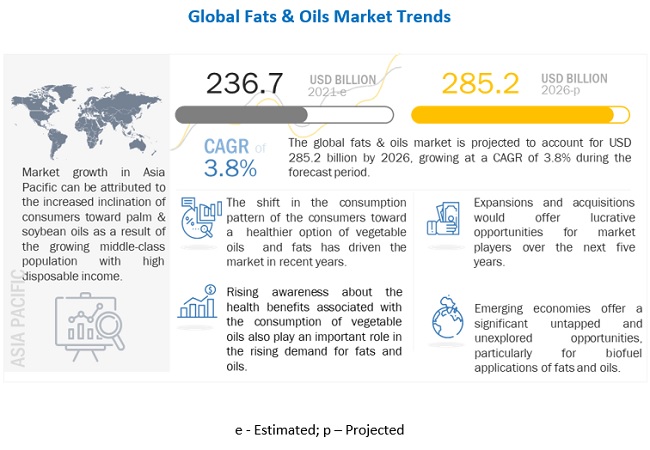

The report "Fats & Oils Market by Type (Vegetable Oils (Palm, Soybean, Rapeseed, Sunflower, and Olive), Fats (Butter, Tallow, and Lard)), Application (Food and Industrial), Source (Vegetables and Animals), Form, and Region - Global Forecast to 2026" The global fats & oils market is estimated to be valued at USD 236.7 billion in 2021. It is projected to reach USD 285.22 billion by 2026, recording a CAGR of 3.8% during the forecast period. The global fats & oils market has been influenced by some of the macroeconomic and microeconomic factors witnessed in some key countries. This would prove strong enough to drive the market significantly in terms of value sales during the forecast period. The growth of this market is attributed to the increased awareness about healthier substitutes to trans-fat, demand for a more nutritious and balanced diet among consumers, and sustainable food and energy systems. Companies manufacturing edible oil or cooking oil are positioning their products as healthy oils to gain market share as the customers are focusing on consuming healthy food.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=6198812

Palm oil continued to be the most popular vegetable oil globally, given its varied applications

Among vegetable oils, palm oil remained the most popular with around 30% of the market share. Grown only in tropical countries, oil palm trees produce high-quality oil that is used for cooking in developing countries. It is also used in food products, detergents, cosmetics, and to a small extent, biofuels. Being a very productive crop, it is used across applications and across the globe. It offers a far greater yield at a lower cost of production than other vegetable oils. The soybean oil market is projected to be the fastest-growing market by 2026. Animal fats find major applications in pet food, animal feed, and other industrial purposes such as biodiesel and oleochemicals.

Vegetable oils garnered popularity as a replacement to traditional oils and trans-fats

The fats & oils market, by application, is estimated to be dominated by the food applications segment in 2021. It is also projected to be the fastest-growing segment during the forecast period. Oils of plant origin have been predominantly used for food-based applications. Plant oils not only represent a non-polluting renewable resource, but also provide a wide diversity in fatty acids composition with diverse applications.

The rising health awareness among the people of every generation has led to a rise in the adoption of vegetable oils and fats to replace traditional oils and trans-fats, which contain a high level of saturated fatty acids and are known to cause various ailments.

Asia Pacific remained the largest and fastest growing regional market, owing to high consumption in China and India

Asia Pacific, followed by Europe, accounted for the largest share both in value and volume in the global fats & oils market in 2021. The large consumption base in Asia Pacific, i.e., robust processed foods and industrial applications for fats and oils, makes it the fastest-growing region during the forecast period. Asia pacific fats & oils market is majorly driven by China and India, owing to the shift in consumption patterns and the high imports of vegetable oils and fats. As per a report by Jiangnan University, China, the consumption of vegetable oils in China has been increasing year by year. The top vegetable oils consumed in China included soybean oil, rapeseed oils, palm oil, and peanut oil. India is the world’s second-largest consumer and the largest importer of vegetable oils. The country is expected to maintain a high per capita consumption level, reaching 14 kg/capita by 2030.

Make an Inquiry @

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=6198812

The Key players in this market include Associated British Foods PLC (UK), Archer Daniels Midland Company (US), Bunge Limited (US), Wilmar International Limited (Singapore), United Plantations Berhad (Malaysia), Unilever PLC (UK), Ajinomoto Co., Inc. (Japan), Mewah International Inc. (Singapore), Cargill, Incorporated (US), Richardson International Limited (Canada), International Foodstuff Company (UAE), Goodhope Asia Holdings Ltd. (Singapore), Vega Foods (Singapore), Welch, Holme & Clark Co., Inc. (US), Oleo Fats (Philippines), CSM Ingredients (US), AAK International (UK), Fuji Oil Co., Ltd. (Japan), Gemini Edible & Fats India Pvt Ltd. (India), and K S Oils (Singapore).

About MarketsandMarkets™

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies’ revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model – GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets’s flagship competitive intelligence and market research platform, "Knowledgestore" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.