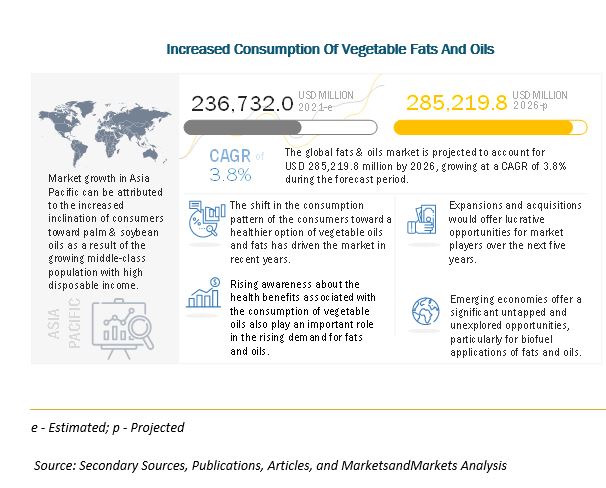

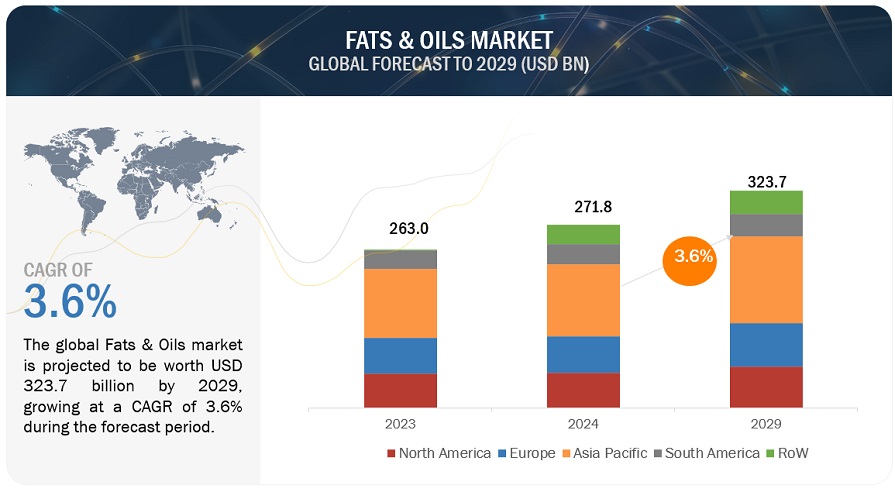

The global fats and oils market is projected to be valued at USD 271.8 billion in 2024, with a compound annual growth rate (CAGR) of 3.6%, expected to reach USD 323.7 billion by 2029. This market is undergoing significant transformations and innovations. The demand for fats and oils goes beyond culinary uses, impacting various sectors, including animal feed, oleochemicals, and biofuels.

Vegetable oils and animal fats are essential components in the food industry, contributing to the texture, flavor, and shelf life of processed foods. Palm, rapeseed, sunflower, and soybean oils are the most widely used oils worldwide, thanks to their versatile applications in both food and non-food products. Animal fats, such as butter and lard, are particularly important in baking, where they are prized for their rich, distinctive flavors.

Here are some key trends in the Fats and Oils Market:

Health Consciousness: As consumers become more health-conscious, there’s a growing demand for healthier fats, such as olive oil, avocado oil, and coconut oil. This shift is leading to the popularity of oils with favorable fatty acid profiles and beneficial nutrients.

Plant-Based Oils: The trend toward plant-based diets is driving the demand for oils derived from plants. Oils like sunflower, canola, and palm oil are gaining traction due to their versatility and health benefits.

Sustainable Sourcing: Environmental sustainability is becoming increasingly important for consumers and manufacturers. Brands are seeking sustainably sourced oils and fats, leading to a rise in certifications like RSPO (Roundtable on Sustainable Palm Oil).

Functional Fats: There is a growing interest in functional fats that offer additional health benefits, such as omega-3 and omega-6 fatty acids. These are often marketed for their heart health benefits and ability to support cognitive function.

Food Innovation: The food and beverage industry is continually innovating with new formulations that incorporate unique fats and oils to enhance flavor, texture, and nutritional value. This includes the use of fats for plant-based and alternative protein products.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=6198812

Vegetable Sources of Fats and Oils Expected to Lead Market Share During the Forecast Period.

Vegetable-based oils are expected to maintain the largest share of the fats and oils market throughout the forecast period. This dominance can be attributed to their versatility, health benefits, and wide availability. Oils from sources like soybean, palm, and sunflower are commonly used in cooking and food processing due to their broad range of applications and consumer preference for healthier alternatives to animal fats. These oils offer essential fatty acids and are considered more beneficial for health. Moreover, innovations in agricultural practices and biotechnology have boosted vegetable oil production, ensuring a consistent and cost-effective supply. Their adaptability in both food and industrial uses reinforces their leading role in the market.

The Food Application Segment is Projected to Dominate the Fats and Oils Market Share Throughout the Forecast Period.

In the application segment, the food industry is projected to hold the largest share of the fats and oils market throughout the forecast period. Fats and oils play a vital role in enhancing flavor, texture, and preservation across various food products. They are essential in cooking and baking, providing desirable characteristics like crispiness and richness. Additionally, fats and oils act as carriers for fat-soluble vitamins and flavors, boosting consumer appeal. The growing demand for processed and convenient foods, coupled with an increasing interest in diverse culinary experiences, further drives the dominance of food applications in this market segment.

The key players in the market are ADM (US), Wilmar International Ltd (Singapore), Cargill, Incorporated (US), Bunge (US), Kaula Lumpur Kepong Berhad (Malaysia), Olam Agri Holdings Pte Ltd (India), Manildra Group (Australia), Mewah Group (Singapore), Associated British Foods plc (UK), United Plantations Berhad (Malaysia), Ajinomoto Co., Inc. (Japan), Fuji Oil Co., Ltd. (Japan), Oleo-Fats (Philippines), Borges Agricultural and Industrial Edible Oils, S.A.U. (Spain), K S Oils Limited (India), CSM Ingredients (US), SD Guthrie International Zwijndrecht Refinery B.V. (Netherlands), Musim Mas Group (Singapore), Richardson International Limited (Canada), and AAK AB (Sweden).