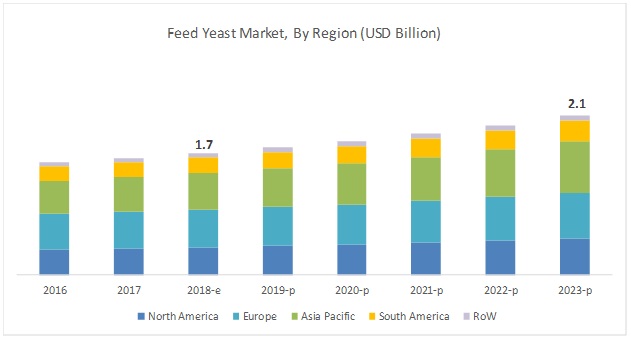

The feed yeast market is estimated to account for USD 1.7 billion in 2018 and is projected to reach USD 2.1 billion by 2023, at a CAGR of 5.27% during the forecast period. The market is primarily driven by the increasing awareness on health concerns related to the use of antibiotics in feed and preference for yeast-based feed products due to its high nutritional value. In addition, with the ban on the use of antibiotics in feed in most of the regions has led to high demand for feed yeast products.

On the basis of genus, the Saccharomyces Spp. segment is projected to be the fastest-growing segment during the forecast period.

Saccharomyces cerevisiae has been the most widely adopted yeast for various applications, including feed. Majority of the key players such as Associated British Foods plc. (UK), Cargill (US), and Lesaffre (France) have been providing feed yeast with Saccharomyces formulation. According to the FAO, besides Saccharomyces spp., Candida spp. (a part of which was formerly known as Torula) has been gaining traction as a probiotic yeast in feed application in North America. Of the various probiotic strains registered with the FAO in 2017 for animal nutrition, only Saccharomyces and Candida are approved for probiotic application in the feed industry.

Download PDF Brochure:

The increasing awareness of health benefits associated with probiotic yeast has widened the scope of growth for the feed yeast market.

The use of probiotic yeast in ruminant feed resulted in improved health and higher milk production. Similarly, in pigs, yeast triggers an immune response to reduce the entry of pathogens in the body and also reduces the occurrence of post-weaning diarrhea. With the increasing use of probiotics for animal nutrition, growth promotion, and gut health development, the probiotic yeast segment is projected to record the fastest growth, on the basis of type, during the forecast period.

With the introduction of stringent regulations, Europe is estimated to dominate the feed yeast market in 2018.

The feed yeast market in Europe is driven by the introduction of stringent regulations pertaining to the use of antibiotics in feed. Increasing awareness about the benefits of feed yeast is projected to contribute to the market growth. The high demand for quality and nutrient-rich feed in the European countries has led to the high demand for feed yeast among farmers. Moreover, the European legislators are also concerned about food and animal safety and thus have implemented many safety laws for the same. With high concerns related to animal health, the EU government has put a ban on the use of antibiotic growth promoters in feed due to its negative impact on animal health as well as on the health of human consumers. For the replacement of those antibiotics,

Speak to Analyst:

This report includes a study of the development strategies of leading companies. The scope of this report includes a detailed study of feed yeast manufacturers such as Associated British Foods PLC. (UK), Archer Daniels Midland Company (US), Alltech Inc. (US), Cargill (US), Lesaffre (France), Angel Yeast Co. Ltd. (China), and Lallemand Inc. (Canada).

Key questions addressed by the report:

- How would the feed yeast market be dependent on the distilleries and livestock industry, and which livestock would adopt maximum usage of feed yeast?

- Which region will account for the highest share in the feed yeast market?

- Which type of feed yeast holds high potential for growth in each key country?

- What are the trends and factors responsible for influencing the adoption rate of feed yeast in key emerging countries? What is the level of support offered by the government across countries towards the manufacturers to adopt these natural growth promoters in feed?

- Which are the key players in the market and how intense is the competition?