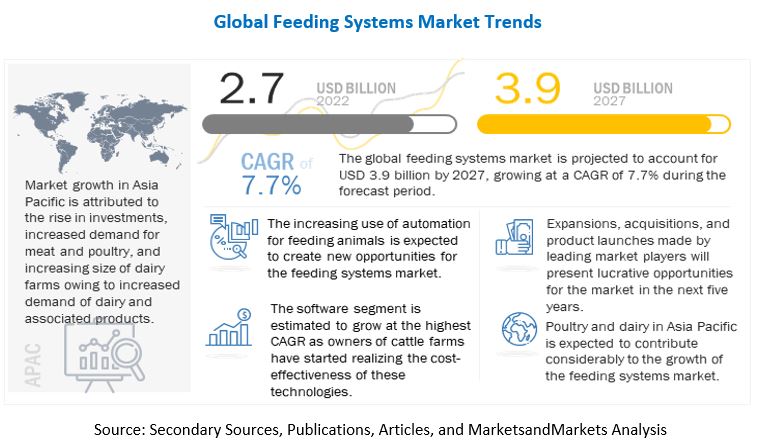

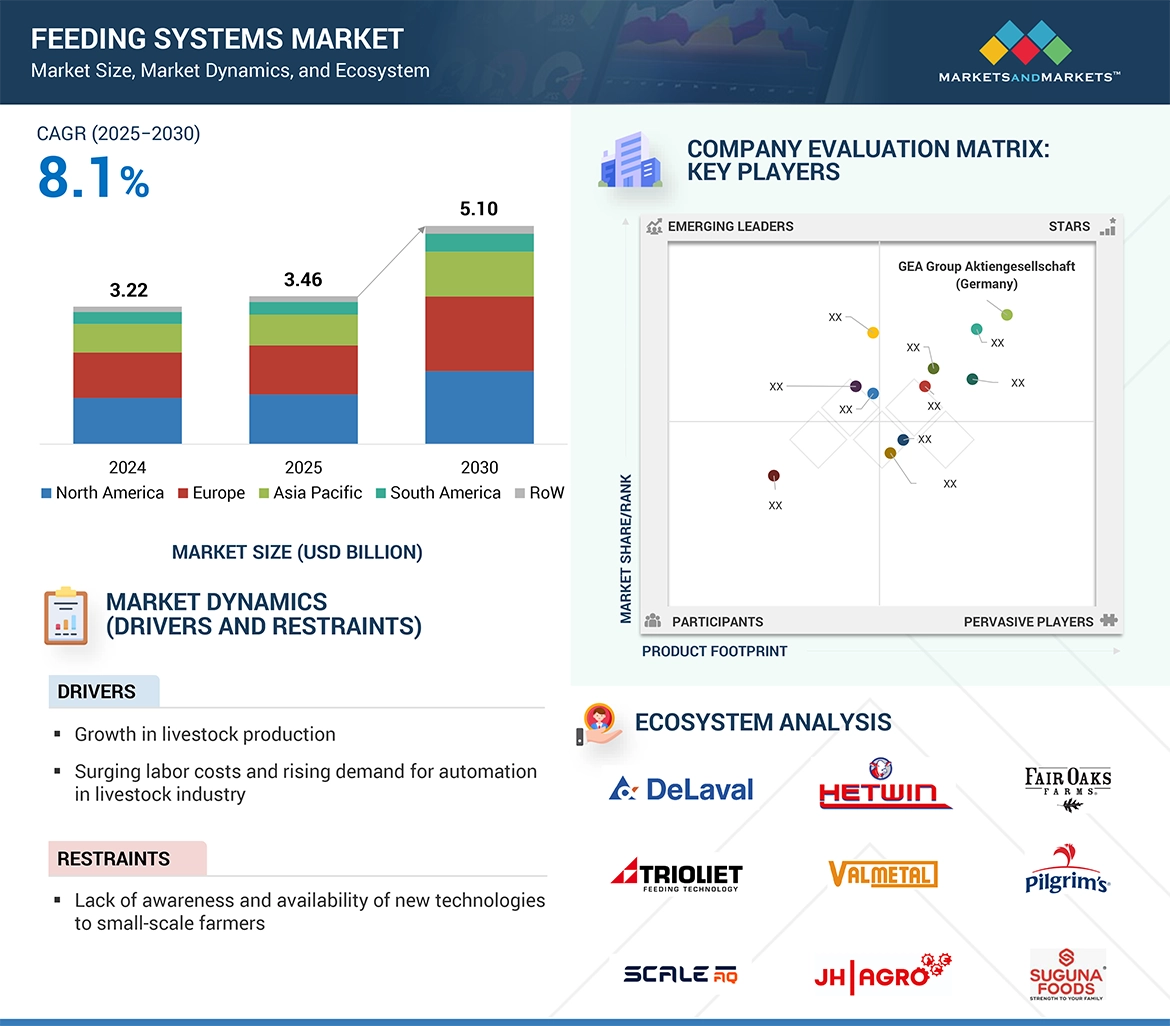

The global feeding systems market is expected to grow from USD 3.46 billion in 2025 to USD 5.10 billion by 2030, registering a compound annual growth rate (CAGR) of 8.1% during the forecast period. The increasing adoption of sustainable agricultural practices is a key driver of this growth. As the agriculture sector faces mounting pressure to minimize its environmental impact, feeding systems are emerging as a crucial solution for improving efficiency and reducing ecological footprints.

Feeding systems play a vital role in sustainability by minimizing feed waste, enhancing digestion to reduce methane emissions, and lowering the carbon footprint of animal production. Precision feeding—enabled by advanced feed formulation software—helps farmers provide balanced nutrition, avoiding overfeeding or nutrient runoff that can pollute soil and waterways.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=102235948

Mixing Segment to Dominate by Function

Among various functions, the mixing segment is projected to hold a significant share of the market. Proper mixing ensures that essential nutrients like proteins, vitamins, and minerals are evenly distributed in the feed, aligning with the nutritional requirements of different livestock.

Mixing systems help maintain feed consistency and quality—particularly important for sensitive animals like goats. Automated mixing technologies such as self-propelled mixers, self-loading mixers, and stationary mixers with conveyor belt systems are gaining popularity. These systems not only automate loading, mixing, and dispensing processes but also incorporate weighing mechanisms to ensure precision feeding. As a result, farmers can prepare feed efficiently and save considerable time and labor.

Poultry Segment to Witness Highest Growth Among Livestock

The poultry segment is anticipated to register the highest CAGR during the forecast period. According to a 2021 FAO report, poultry meat is expected to account for 41% of global meat protein consumption by 2030. This surge in demand is fueling the need for efficient feeding systems in poultry farming.

Poultry production heavily relies on nutrient-rich feed for optimal growth, prompting manufacturers to invest in innovative feeding technologies. Common systems used in poultry farms now include automatic pan feeders, chain feeders, and round & hanging tube feeders, all designed to deliver feed uniformly and efficiently.

Request Sample pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=102235948

North America to Lead the Global Market by 2030

North America—comprising the U.S., Canada, and Mexico—is set to lead the feeding systems market by 2030. The region’s growth is fueled by increasing demand for high-quality dairy and meat products, along with a strong focus on animal welfare and performance-enhancing nutrition.

Over the last three decades, North American farms have steadily transitioned from manual feeding to automated systems, thanks to rapid technological progress and greater accessibility. The shift has encouraged the development of advanced solutions like individual and group feeders tailored to improve productivity and reduce labor dependency.

Leading Feeding Systems Companies:

The report profiles key players such as Tetra Laval (Sweden), GEA Group Aktiengesellschaft (Germany), Lely (Netherlands), Trioliet B.V. (Netherlands), VDL Agrotech (Netherlands), ScaleAQ (Norway), AGCO Corporation (US), BouMatic (US), Pellon Group Oy (Finland), Rovibec Agrisolutions (Canada), CTB, Inc. (US), AKVA Group (Norway), Dairymaster (US), Maskinfabrikken Cormall A/S (Denmark), and Schauer Agrotronic GmbH (Austria).