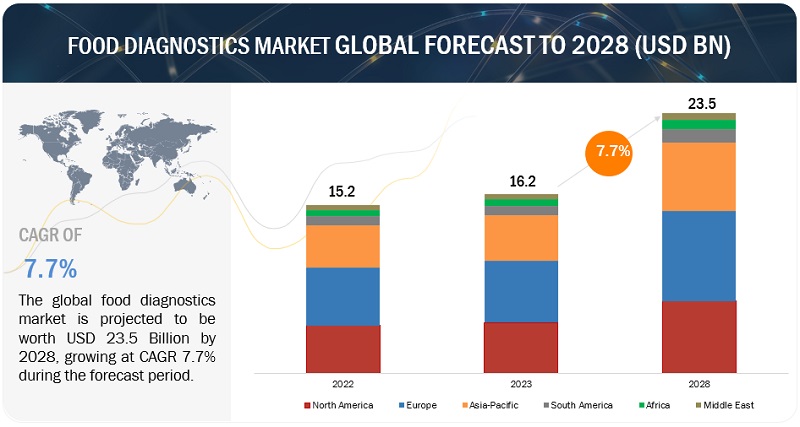

The food diagnostics market size is estimated at USD 16.2 billion in 2023 and is projected to reach USD 23.5 billion by 2028, at a CAGR of 7.7% from 2023 to 2028. Food diagnostics is the collection of processes and methodologies employed to evaluate and verify food products, guaranteeing their adherence to safety, quality, genuineness, and compliance with regulatory standards. These procedures encompass diverse testing methods and analytical approaches applied across different stages of the food supply chain, encompassing production, processing, distribution, and consumption. It is essential for the evaluation and preservation of the desired quality attributes of food items, which involve assessing characteristics such as flavor, texture, color, fragrance, and overall sensory qualities.

Food Diagnostics Market Trends

Advanced Technologies: The market is witnessing a surge in the adoption of technologies such as PCR (polymerase chain reaction), ELISA (enzyme-linked immunosorbent assay), and next-generation sequencing. These technologies are revolutionizing how foodborne pathogens are detected and analyzed, making testing more efficient and accurate.

Rise of Portable Testing Solutions: As consumer demands for quick results grow, portable diagnostic devices are on the rise. These solutions enable rapid testing at the point of need, empowering manufacturers, retailers, and consumers to identify potential safety issues without delays.

AI and Machine Learning: Leveraging artificial intelligence and machine learning is enhancing data analysis in food diagnostics. These technologies can predict potential contamination risks, optimize testing protocols, and improve decision-making processes.

Increased Regulations and Standards: Governments and global organizations are tightening food safety standards, leading to increased demand for reliable diagnostic tools. Regulatory compliance is driving investments in the market as companies strive to meet these new requirements.

Food Diagnostics Market Opportunities

Emerging Markets: Developing economies are investing more in food safety, leading to increased demand for diagnostic solutions. This represents a growing opportunity for companies that can tailor solutions for these regions. Collaboration and Partnerships: Strategic partnerships between diagnostic companies, food manufacturers, and regulatory bodies can lead to more comprehensive testing and monitoring systems.

Sustainability Focus: The market is shifting towards environmentally friendly diagnostic products, appealing to consumers and organizations committed to sustainable practices.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=225194671

The meat, poultry, and seafood segment is projected to hold the largest market share in the food diagnostics market, based on tested foods.

Foodborne illnesses and contamination outbreaks are a persistent global issue, frequently originating from protein-rich food categories like meat, poultry, and seafood. Ensuring the safety and quality of these products is essential to prevent public health crises and preserve consumer trust. Meat, poultry, and seafood are fundamental to the food industry, contributing significantly to market revenues. As essential components of diets around the world, they account for a significant portion of consumer spending, emphasizing the critical need for their safety and quality. Therefore, it is vital to monitor these products for pathogens, allergens, chemical residues, and other contaminants to safeguard consumer health and maintain the economic stability of the industry. Globalization of the food supply chain has made it necessary to address international regulations and standards. Compliance with stringent regulations, such as Hazard Analysis and Critical Control Points (HACCP), ISO standards, and national food safety guidelines, is mandatory for manufacturers and exporters. This has driven the need for advanced food diagnostics techniques in meat, poultry, and seafood.

The safety segment is expected to lead and achieve the highest CAGR in the food diagnostics market, driven by testing type.

The safety sub-segment is set to lead and experience the highest growth within the testing type segment of the food diagnostics market. Food safety testing plays a crucial role in the global food industry, ensuring the safety of products intended for human consumption. Recently, food safety testing has gained more emphasis than food quality testing, driven by growing concerns over foodborne illnesses and outbreaks. This testing encompasses a range of methods designed to identify contaminants, pathogens, and chemical residues in food products, safeguarding consumers from potential health risks. Contaminants like Salmonella, E. coli, allergens, and chemical residues can present significant health dangers. As a result, strict regulatory standards and heightened awareness have increased the demand for advanced testing techniques. Furthermore, with the complexities of global supply chains, food safety testing has become even more essential in preventing outbreaks, protecting public health, and preserving the reputation of food manufacturers.

Asia Pacific is projected to experience the highest CAGR in the global food diagnostics market.

The Asia Pacific region is experiencing rapid population growth, urbanization, and rising disposable incomes. Countries like China and India are seeing significant population increases, leading to higher food consumption. This surge in demand has heightened the need for effective food safety and quality testing. As urban migration accelerates, the demand for processed and packaged foods is also on the rise, further driving the need for stringent safety and quality control measures, which is fueling the growth of the food diagnostics market. Additionally, the food supply chain in Asia Pacific is becoming more intricate due to globalization and the expansion of international trade. This growing complexity requires thorough testing and monitoring across the entire supply chain, from farm to fork. As a result, food diagnostics solutions are playing a critical role in ensuring the safety and quality of food products.

Leading Food Diagnostics Companies:

Major key players operating in the food diagnostics market include Bio-Rad Laboratories Inc. (US), Thermo Fisher Scientific Inc. (US), Neogen Corporation (US), BioMerieux (France), Agilent Technologies Inc. (US), Merck KGaA (Germany), QIAGEN (Germany), Bruker (US), and Danaher (US).