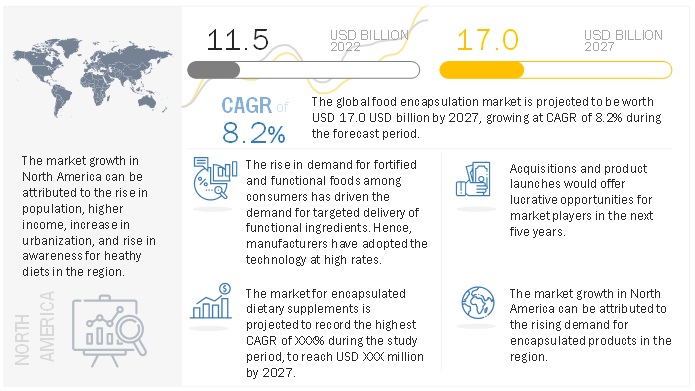

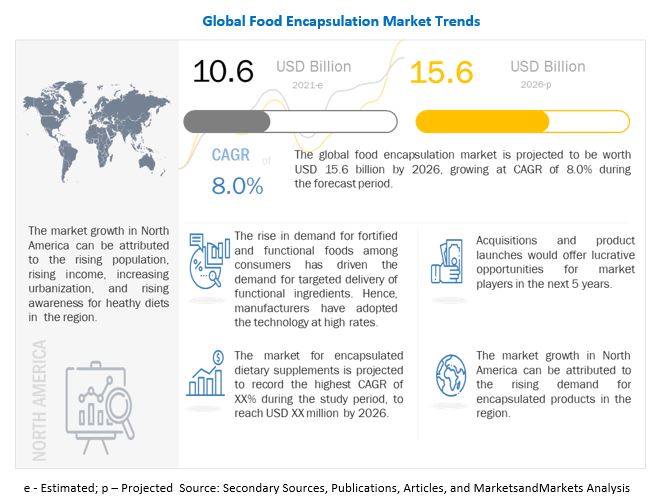

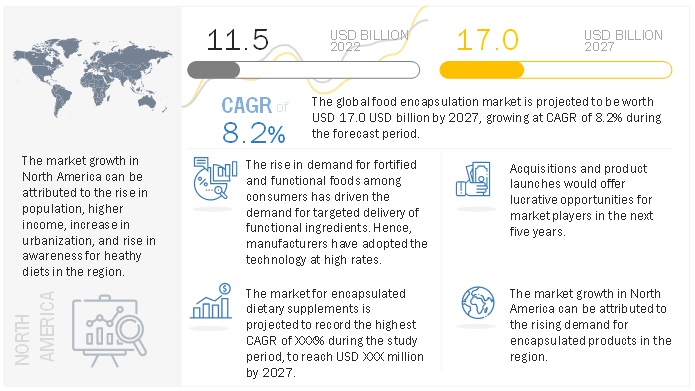

The global food encapsulation market was valued at USD 11.5 billion in 2022 and is projected to grow at a CAGR of 8.2%, reaching USD 17.0 billion by 2027. This growth is driven by the widespread use of encapsulation technology and its numerous advantages over alternative methods. Encapsulation enhances the stability and bioavailability of bioactive ingredients, extends the shelf life of food products, and helps preserve taste and flavor for longer periods. The technology is particularly popular in the nutraceutical and food & beverage industries.

Emerging markets are witnessing rapid growth due to innovations by key industry players, technological advancements, and expanding economies. The global food encapsulation market is highly competitive, with both global and regional players adopting strategies such as partnerships, product launches, mergers & acquisitions, and investments to expand their market presence and share.

Government policies supporting international trade of confectionery products—particularly those using artificial ingredients like flavors, sweeteners, and colors—are expected to boost the demand for encapsulated artificial food colors. As consumer preferences evolve and there is an increasing desire for novel, flavorful products, the demand for diverse artificial colors sourced from various origins will further fuel the market for food encapsulation.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=68

Vitamins and mineral are projected to grow in the food encapsulation market because of usage in superfoods for boosting brain and bone health

Consumers’ increasing attention to health and prevention, greater customized nutrition needs for different segments of the population, rising healthcare costs, search for alternatives to cure specific problems, and rising consumer awareness regarding the severity of chronic diseases drive the need for vitamins and minerals.

Vitamins are functional ingredients used in food products due to their specific nutritional properties. They are classified as fat-soluble and water-soluble vitamins. Fat-soluble vitamins contain Vitamins A, D, E and K. Vitamins B and C form a part of water-soluble vitamins. When added as a food ingredient, it is vital to target and control the release of these vitamins. This drives the need for their encapsulation. According to an article by Nutraingredients in 2019, over 40% of the vitamins consumed in the food industry are encapsulated. The encapsulation of vitamins is necessary to enclose vitamin molecules in a stable shell to prevent oxidation, preserve the nutrients, and avoid the products from deteriorating for a longer period.

On the other hand, minerals are formulated in the form of salts for food application. According to industry experts, encapsulation of these salts not only increases the cost but also becomes redundant. Thus, the adoption of this technology for minerals is minimal, estimated to be less than 5%.

Robotic Technology in Food Encapsulation is One of the Major Trends

Robots enhance the process of packaging nutraceutical supplements by being time-efficient and accurate. They increase the shelf life of nutraceutical ingredient products and help them to comply with regulatory guidelines by reducing the risk of contamination. Furthermore, the recent increase in the demand for nutritional supplements requires large-scale production, increasing the demand for robots to optimize production facilities.

Analyzing machine performance, gathering data, and troubleshooting in advance are the key robotics trends in the nutraceutical ingredients market projected to increase technology adoption in the industry. COBOTs are primarily used in the nutraceutical industry for such applications. According to TransAutomation Technologies, the labor expenditures of three people each day can be offset by a single robot that can perform one function for 24 hours per day. This helped several pharmaceutical and nutritional supplement manufacturers increase productivity, reducing their need for human labor and the challenges and costs that go along with it. Collaborative robots enable humans and robots to work together effectively in open or uncaged environments. Through collaborative robots, a human operator and robot can be engaged together in the same process, or the operator can simultaneously manage other tasks that a person might better solve.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=68

North America dominated the food encapsulation market; it is projected to grow at a CAGR of 7.8% during the forecast period.

The food encapsulation market in North America is influenced by factors like health awareness, promotion of nutraceuticals and functional foods and growing expenditure on prevention of chronic non communicable diseases. Food encapsulation adds value to foods and effectively delivers potent bioactives in isolation as supplements or as value addition in functional foods. The US dominated the market in 2021 and is projected to be the fastest-growing market for food encapsulation in North America. The market in this region is driven by technological advancements in food encapsulation techniques such as liposome compression, inclusion complex and centrifugal extrusion and the growing demand for functional and fortified foods that use encapsulated nutrients and the growing consumption of convenience foods that use encapsulated flavors and colors. Most of the key market players have a presence in the region. These include International Flavors and Fragrances Inc (US), Sensient Technologies Corporation (US), Balchem Corporation (US), Encapsys LLC (US), Ingredion Incorporated (US), Cargill (US), DuPont (US), Aveka Group (US), and Advanced BioNutrition Corp. (US).

Leading Food Encapsulation Manufacturers

The global food encapsulation market is dominated by top players such as Cargill, Incorporated (US), BASF SE (Germany), Kerry (Ireland), DSM (Netherlands), Ingredion (US), Symrise (Germany), Sensient (Germany), Balchem (US), International Flavors & Fragrances Inc. (US), Firmenich SA (Switzerland), FrieslandCampina (Netherlands), TasteTech (UK), LycoRed Corp (Israel), Ronald T Dodge Company (US), Innov’io (France), Givaudan (Australia), AnaBio Technologies (Ireland), Sphera Encapsulation (Italy), Reed Pacific (Australia), Aveka (US), Advanced Bionutrition Corp (US), Clextral France (US), Vitablend (Netherlands), and Encapsys LLC (US).