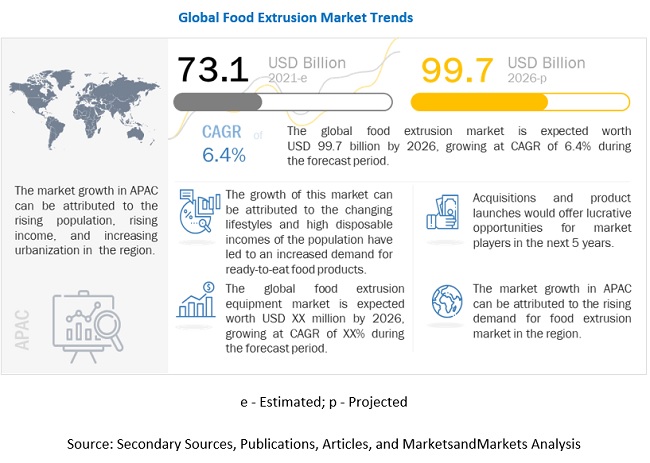

The global food extrusion market is estimated to be valued at USD 73.1 billion in 2021. It is projected to reach USD 99.7 billion by 2026, recording a CAGR of 6.4% during the forecast period. The demand for ready-to-Eat (RTE) snack foods is growing due to their convenience, nutrition value, attractive appearance, taste, and texture. Cereal-based extruded snacks are the most commonly consumed snacks. Extruders blend diverse ingredients to develop novel snack foods. The quality of the final product depends on the processing conditions used during extrusion, which include the composition of the raw materials, feed moisture, barrel temperature, screw speed, and screw configuration.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=221423108

Drivers: Increase in demand for processed product types

The food extrusion market is primarily driven by the growth of the processed food industry. The changing lifestyles and high disposable incomes of the population have led to an increased demand for ready-to-eat product types as they help save time and effort. Additionally, the demand for processed product types from the urban population of developing economies is expected to subsequently drive the demand for food extrusion equipment. The rising per capita income and the increasing trend of snacking between meals are also fueling the demand for extruded product types. Consumer preferences in emerging economies such as China, India, Brazil, and the Middle East have gradually transitioned from traditional homemade breakfasts and snacking meals to ready-to-eat products over the last couple of decades.

Restraints: Volatility of raw material prices

Changes in climatic conditions across the globe have reduced the production of raw materials, such as potatoes, corn, and tapioca. Snack pellet manufacturers suffer a shortage of raw material supply and are unable to meet the rising demand. Due to the volatility factor, the prices of other raw materials, such as wheat and vegetable oil, vary by more than 40%, along with the fluctuation of natural gas by more than 25%. In addition to this, the high price of snack pellet ingredients, such as binding agents and savory flavors, also act as a restraint. Due to a hike in the pricing of raw materials used for snack pellets, manufacturers are experiencing a declining trend in their profit margins.

Make an Inquiry:

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=221423108

Single screw extruder has uniform expansion of raw materials

A single screw extruder consists of a live bin, feeding screw, preconditioning cylinder, extruder barrel, die, and knife. It uses one single screw in the barrel of the extruder to transport and shape multiple ingredients into a uniform product type by forcing the ingredient mix through a shaped die to produce a uniform shape. Single screw extruders typically consist of three zones: feeding zone, kneading zone, and the cooling zone. In contrast to twin screw extruders, single screw extruders have poor mixing ability, owing to which the materials are required to be pre-mixed or preconditioned.

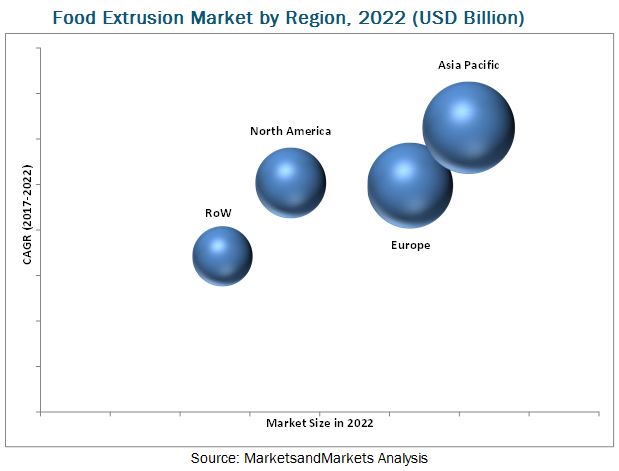

The European region dominated the food extrusion market.

The presence of a developed snack food market offers the European food extrusion market a prominent consumer base with opportunistic growth prospects. The growth of the food industry in this region is estimated to be driven by increasing consumption of processed product types in the Eastern & Southeastern European countries. Increasing consumption of snack product types in this region has also compelled manufacturers to source extruded snack products from other parts of the world for an uninterrupted supply of raw materials, as domestic production is not sufficient to meet the demand from the food industry of Europe.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=221423108

Key Market Players:

The key service providers in this market include Bühler (Switzerland), Akron Tool & Die (US), Baker Perkins (UK), Coperion (Germany), GEA (Germany), KAHL Group (Germany), Triott Group (Netherlands), Flexicon (US), Groupe Legris Industries (Belgium), The Bonnot Company (US), American Extrusion International (US), Shandong Light M&E Co., Ltd (China), Snactek (India), Doering systems, inc. (US), PacMoore (US), Egan Food Technologies (US), Schaaf Technologie GmbH (Germany), Wenger Manufacturing, Inc. (US), Brabender GmbH & Co. KG (Germany), and Jinan Darin Machinery Co., Ltd., (China).