The food-grade gases market is anticipated to increase rapidly, rising from a projected value of USD 7.6 billion in 2022 to an astounding USD 10.6 billion by 2027. Over the forecast period, this substantial growth is anticipated to occur at a CAGR of 6.9%. The food-grade gases market is seeing a surge in demand due to several key factors such as the increasing popularity of convenience food and carbonated drinks. Consumers are becoming more concerned about the safety of their food, which has resulted in food manufacturers turning to advanced packaging technologies like oxygen scavenging, MAP, CAP, and active packaging. These technologies create a controlled environment within the packaging, preserving the freshness of food products and reducing the need for additives while ensuring the quality of the food is not compromised.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=9473111

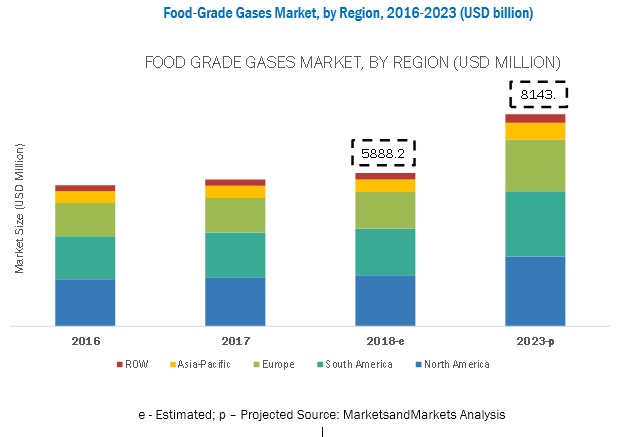

Food-grade gas manufacturers find attractive opportunities for growth in the emerging economies of the Asia Pacific and South America. Due to the rising demand for frozen and packaged food products by the youth in these regions, the demand for food-grade gases is witnessing growth. Also, due to the developing retail channels and cold chain infrastructure and rise in disposable incomes and the number of working women, there has been a growing demand for convenience food products in these regions, which, in turn, results in an increased demand for food-grade gases. Also, because of the continuous new product launches and advancements in packaging technologies, there has been a growing need for food-grade gases for various end uses.

Challenges: Need to provide right mixture of gases in controlled environment packaging

The need to provide the right mix of gases in controlled environment packaging technologies such as modified atmosphere packaging and active packaging is a key challenge faced by packaging technology equipment manufacturers. For example, ready-to-eat meals contain a complex mixture of ingredients that require the right mix of different gases to prolong their shelf-life; MAP packaging includes providing the right mix of gases in the packaging. The gases used in MAP include oxygen, nitrogen, and carbon dioxide. For example, in the packaging of meat products, the mix of 20% carbon dioxide and 80% oxygen is a good proportion that balances the attractive colour of meat and increases the visual appeal; any discrepancy otherwise can deteriorate the product quality.

Technological Advancements for Gas Sensors is one of the Major Trends

Toxic gas sensors play an important role in food production and control. Therefore, researchers have recently devoted significant attention to various gas sensing materials to achieve high-performance gas sensors. The prospects for the use of sensor technology in food production and monitoring are: (1) Development of simple sensors that operate at low temperatures and preferably Real time to save energy consumed during the monitoring process and the lifespan of the sensing material and accordingly, (2) the design of high-precision sensors to monitor the strategic stock of foodstuffs, especially C2H4 gas, to monitor the quality of stored fruits and vegetables and control their ripening. Researchers are interested in obtaining improvements in the sensitivity, selectivity, limit of detection, and operating temperature using a new mixture of nanomaterials that display different shapes.

Request for Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=9473111

North America dominated the food grade gases market

Canada and Mexico witness the largest import of meat, fish, and seafood. In 2018, Canada was the largest export market for US agricultural products and accounted for 17% of the total exports. The major commodities exported to Canada are prepared foods, fresh processed vegetables, fresh processed fruit, meat meat products, snack foods, certain non-alcoholic beverages, chocolate cocoa products, condiments sauces, coffee, wine, beer, and pet food.