https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=205881873

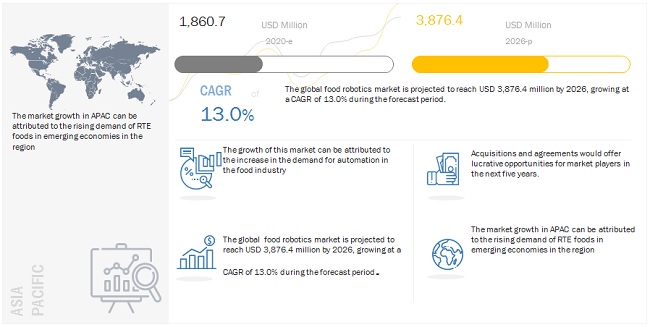

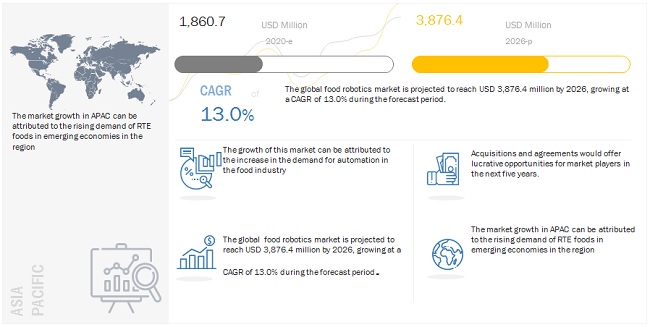

The global Food Robotics Market size is estimated to be valued at USD 1.9 billion in 2020 and projected to reach USD 4.0 billion by 2026, recording a CAGR of 13.1% during the forecast period. The demand for food robotics is increasing significantly owing to surging demand for food with increasing population and increasing demand for enhanced productivity in food processing. Additionally, increasing investments in automation in the food industry is projected to provide growth opportunities for the food robotics market.

Key players in this market include ABB Group (Switzerland), KUKA AG (Germany), Fanuc Corporation (Japan), Kawasaki Heavy Industries Ltd. (Japan), Rockwell Automation Inc. (U.S.), Mitsubishi Electric Corporation (Japan), Yasakawa Electric Corporation (Japan), Denso Corporation (Japan), Nachi-Fujikoshi Corporation (Japan), OMRON Corporation (Japan), Universal Robots A/S (Denmark), Staubli International AG (Switzerland), Bastian Solutions LLC (U.S.), Schunk GmbH (Germany), Asic Robotics AG (Switzerland), Mayekawa Mfg. Co. Ltd. (Japan), Apex Automation & Robotics (Australia), Aurotek Corporation (Taiwan), Ellison Technologies Inc. (U.S.), Fuji Robotics (Japan), and Moley Robotics (U.K.).

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=205881873

Mitsubishi Electric Corporation (Japan) is primary involved in the manufacturing, development, and marketing of different equipment used in industries such as packaging/food and beverage, general manufacturing, automotive, semiconductor, heath care, and education. The company provides solutions for the packaging/ food and beverage segment such as packaging, picking and placing, material handling, and dispensing as robots have the capability to handle products quicker and safer than conventional applications.

The company operates through six business segments-energy and electric systems, industrial automation systems, home appliances, information and communication systems, electronic devices, and others. Mitsubishi Electric Corporation has its operations in Japan, Asia-Pacific, Europe, the Americas, and the Middle East & Africa. Some of the subsidiaries of Mitsubishi Electric include Mitsubishi Electric Automation Korea Co., Ltd (Korea), Mitsubishi Electric Europe B.V. German Branch, Mitsubishi Electric Australia Pty. Ltd. (Australia), and Mitsubishi Electric (China) Co., Ltd.

ABB Group (Switzerland) is a global leader in power and automation technologies enabling utility, industry, and transport and infrastructure sectors to improve their performance while lowering the environmental impact. Its operations are organized into five business segments, namely, power products, power systems, discrete automation and motion, low voltage products, and process automation. The company is a leading supplier of industrial robots and modular manufacturing systems and services. ABB has installed more than 250,000 robots worldwide. Its robotics solutions are used in industries such as automotive, metal fabrication, foundry, plastics, food & beverage, chemicals & pharmaceuticals, consumer electronics, solar, and wood. ABB’s robotic solutions are used in industry applications such as welding, material handling, painting, picking, packing, and palletizing. ABB operates in approximately 100 countries across four regions-Europe, the Americas, Asia, and the Middle East and Africa (MEA). Some of its major subsidiaries are ABB Holdings Limited, Warrington (UK), ABB Norden Holding AB (Sweden), ABB Group., Seoul (South Korea), ABB K.K., Tokyo (Japan), ABB (China) Ltd., Beijing, ABB Group, Osasco (Brazil), and ABB AG, Mannheim (Germany).

Make an Inquiry @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=205881873

The European food robotics market is driven by high investment in research & development with regard to technology, along with the rise in demand for packed, ready-to-cook, and high-quality food products. The European Robotics Association started monitoring in European Union activities, policies, and funding in the new robot technology to strengthen the international market for food & beverage manufacturing, which is likely to impact the adoption of food robotics positively.

According to MarketsandMarkets, The global food robotics market size is estimated to be

valued at USD 1.9 billion in 2020 and projected to reach USD 4.0 billion by

2026, recording a CAGR of 13.1% during the forecast period. The demand for food

robotics is increasing significantly owing to surging demand for food with

increasing population and increasing demand for enhanced productivity in food

processing. Additionally, increasing investments in automation in the food

industry is projected to provide growth opportunities for the food robotics

market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=205881873

Opportunities:

Increasing functionality of robots

Traditionally, the functionality and use of robots was limited

to heavy payload in transportation equipment manufacturing. However, with the

increasing functionality of robots more industries, such as the food processing

industry are adopting automation with mainly low payload robots. Sections such

as dairy and bakery in the food & beverage industry are minimizing human

contact in the production process in order to comply with health authority

standards. There is an opportunity for the food robotics market to grow with

the increase in functionality of robots to include packaging, repackaging, and

palletizing.

Challenges: High

installation cost of robotic system

Most food manufacturers are reluctant to adopt automated

processes due to the installation cost over and above the price of the robot.

The added cost to turn the individual robots into a comprehensive robotic

system, peripheral equipment such as safety barriers, sensors, programmable

logic controllers (PLC), human machine interface (HMI), and safety systems is a

challenge for market growth. Additionally there are engineering costs for

programming, installation, and commissioning. These additional costs pose a

challenge for the growth of the food robotics market. Small- and medium-scale

manufacturers are reluctant to incur high initial costs of installation as it

could extend the period to achieve the break-even point.

Speak

to Analyst:

https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=205881873

The European region dominates the food robotics market with the

largest share in 2020.

The European food robotics market is driven by high investment

in research & development with regard to technology, along with the rise in

demand for packed, ready-to-cook, and high-quality food products. The European

Robotics Association started monitoring in European Union activities, policies,

and funding in the new robot technology to strengthen the international market

for food & beverage manufacturing, which is likely to impact the adoption

of food robotics positively.

This report includes a study on the marketing and development strategies,

along with the product portfolios of leading companies. It consists of profiles

of leading companies, including ABB Group (Switzerland), KUKA AG (Germany),

Fanuc Corporation (Japan), Kawasaki Heavy Industries Ltd. (Japan), Rockwell

Automation Inc. (U.S.), Mitsubishi Electric Corporation (Japan), Yasakawa

Electric Corporation (Japan), Denso Corporation (Japan), Nachi-Fujikoshi

Corporation (Japan), OMRON Corporation (Japan), Universal Robots A/S (Denmark),

Staubli International AG (Switzerland), Bastian Solutions LLC (U.S.), Schunk

GmbH (Germany), Asic Robotics AG (Switzerland), Mayekawa Mfg. Co. Ltd. (Japan),

Apex Automation & Robotics (Australia), Aurotek Corporation (Taiwan),

Ellison Technologies Inc. (U.S.), Fuji Robotics (Japan), and Moley Robotics

(U.K.).

According to MarketsandMarkets, The global food robotics market size is estimated to be valued at USD 1.9 billion in 2020 and projected to reach USD 4.0 billion by 2026, recording a CAGR of 13.1% during the forecast period. The demand for food robotics is increasing significantly owing to surging demand for food with increasing population and increasing demand for enhanced productivity in food processing. Additionally, increasing investments in automation in the food industry is projected to provide growth opportunities for the food robotics market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=205881873

Traditionally, the functionality and use of robots was limited to heavy payload in transportation equipment manufacturing. However, with the increasing functionality of robots more industries, such as the food processing industry are adopting automation with mainly low payload robots. Sections such as dairy and bakery in the food & beverage industry are minimizing human contact in the production process in order to comply with health authority standards. There is an opportunity for the food robotics market to grow with the increase in functionality of robots to include packaging, repackaging, and palletizing.

Most food manufacturers are reluctant to adopt automated processes due to the installation cost over and above the price of the robot. The added cost to turn the individual robots into a comprehensive robotic system, peripheral equipment such as safety barriers, sensors, programmable logic controllers (PLC), human machine interface (HMI), and safety systems is a challenge for market growth. Additionally there are engineering costs for programming, installation, and commissioning. These additional costs pose a challenge for the growth of the food robotics market. Small- and medium-scale manufacturers are reluctant to incur high initial costs of installation as it could extend the period to achieve the break-even point.

Speak to Analyst:

https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=205881873

The European region dominates the food robotics market with the largest share in 2020.

The European food robotics market is driven by high investment in research & development with regard to technology, along with the rise in demand for packed, ready-to-cook, and high-quality food products. The European Robotics Association started monitoring in European Union activities, policies, and funding in the new robot technology to strengthen the international market for food & beverage manufacturing, which is likely to impact the adoption of food robotics positively.

This report includes a study on the marketing and development strategies, along with the product portfolios of leading companies. It consists of profiles of leading companies, including ABB Group (Switzerland), KUKA AG (Germany), Fanuc Corporation (Japan), Kawasaki Heavy Industries Ltd. (Japan), Rockwell Automation Inc. (U.S.), Mitsubishi Electric Corporation (Japan), Yasakawa Electric Corporation (Japan), Denso Corporation (Japan), Nachi-Fujikoshi Corporation (Japan), OMRON Corporation (Japan), Universal Robots A/S (Denmark), Staubli International AG (Switzerland), Bastian Solutions LLC (U.S.), Schunk GmbH (Germany), Asic Robotics AG (Switzerland), Mayekawa Mfg. Co. Ltd. (Japan), Apex Automation & Robotics (Australia), Aurotek Corporation (Taiwan), Ellison Technologies Inc. (U.S.), Fuji Robotics (Japan), and Moley Robotics (U.K.).

The report “Food Robotics Market by Type, Application (Palletizing, Packaging, Repackaging, Pick & Place, Processing), Payload (Low, Medium, Heavy), End-Use Industry, and Region – Trends & Forecast to 2022″, The global food robotics market is estimated at USD 1.37 Billion in 2017 and is projected to reach USD 2.50 Billion by 2022, at a CAGR of 12.80% during the forecast period. The market is driven by factors such as higher demand for packaged foods, increase need to improve productivity, and increase in number of food safety regulations.

Based on type, the market has been segmented into articulated; cylindrical; SCARA; parallel; cartesian; collaborative; and others, including dual arm robots and spherical robots. The articulated segment dominated the market in 2016. Articulated robots have a wide variety of payload capacities. Due to benefits such as increased payload capacity, work envelope, reliability, and speed, articulated robots are used in many different applications; including welding, painting, assembly, packaging, palletizing, depalletizing, machine tending, sealing, gluing, cutting, cleaning, deburring, die casting, grinding, polishing, material handling, case packing, pick & place, pre-machining, and press brake tending.

The report “Food Robotics Market by Type, Application (Palletizing, Packaging, Repackaging, Pick & Place, Processing), Payload (Low, Medium, Heavy), End-Use Industry, and Region – Trends & Forecast to 2022″, The global food robotics market is estimated at USD 1.37 Billion in 2017 and is projected to reach USD 2.50 Billion by 2022, at a CAGR of 12.80% during the forecast period. The market is driven by factors such as higher demand for packaged foods, increase need to improve productivity, and increase in number of food safety regulations.

Based on type, the market has been segmented into articulated; cylindrical; SCARA; parallel; cartesian; collaborative; and others, including dual arm robots and spherical robots. The articulated segment dominated the market in 2016. Articulated robots have a wide variety of payload capacities. Due to benefits such as increased payload capacity, work envelope, reliability, and speed, articulated robots are used in many different applications; including welding, painting, assembly, packaging, palletizing, depalletizing, machine tending, sealing, gluing, cutting, cleaning, deburring, die casting, grinding, polishing, material handling, case packing, pick & place, pre-machining, and press brake tending.

The report “Food Robotics Market by Type, Application (Palletizing, Packaging, Repackaging, Pick & Place, Processing), Payload (Low, Medium, Heavy), End-Use Industry, and Region – Trends & Forecast to 2022″, The global food robotics market is estimated at USD 1.37 Billion in 2017 and is projected to reach USD 2.50 Billion by 2022, at a CAGR of 12.80% during the forecast period. The market is driven by factors such as higher demand for packaged foods, increase need to improve productivity, and increase in number of food safety regulations.