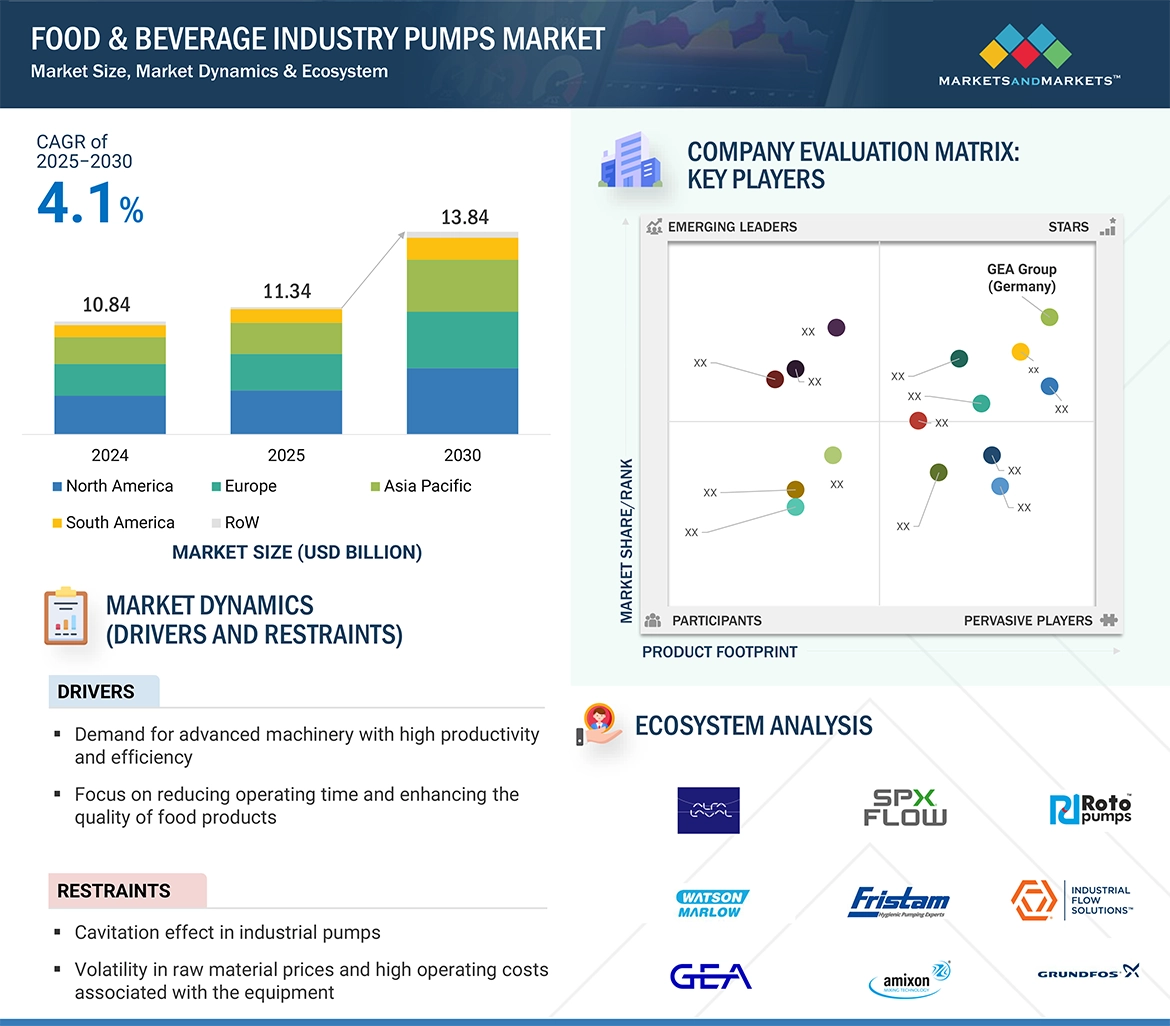

The food and beverage industry pumps market is projected to grow from USD 11.34 billion in 2025 to USD 13.84 billion by 2030, at a CAGR of 4.1% during the forecast period. This growth is driven by the increasing consumer demand for diverse food products, including plant-based and specialty items, necessitating advanced pumping systems capable of handling various ingredient viscosities and properties. These systems ensure efficient processing while maintaining product quality. Additionally, rising concerns over hygiene and contamination control in food processing are accelerating investments in sanitary pumps. Innovations in touch-free cleaning, bacteria-resistant materials, and high-standard hygiene solutions are shaping the competitive landscape of the industry.

Food

& Beverage Industry Pumps Market Trends

The food & beverage

industry pumps market is witnessing significant growth, driven by technological

advancements, regulatory requirements, and evolving consumer demands. Below are

some key trends shaping the market:

Increased Demand for

Hygienic and Sanitary Pumps: Food safety regulations and

consumer preferences for high-quality, contamination-free food products are

pushing manufacturers to invest in hygienic and sanitary pump solutions.

Stainless steel, CIP (Clean-in-Place), and SIP (Sterilize-in-Place) pumps are

becoming the industry standard.

Growth in the Plant-Based

and Specialty Food Segments: The rising demand for

plant-based, organic, and specialty foods has led to the development of pumps

that can handle viscous and delicate ingredients without compromising product

integrity. This includes specialized pumps for dairy alternatives, protein-based

beverages, and natural fruit fillings.

Adoption of Smart Pump

Technologies: The integration of IoT (Internet of Things),

automation, and AI is revolutionizing pump systems. Smart pumps with real-time

monitoring, predictive maintenance, and energy-efficient operations are gaining

traction, reducing downtime and operational costs for food manufacturers.

Focus on Energy-Efficient

and Sustainable Solutions: Manufacturers are prioritizing

eco-friendly and energy-efficient pumping systems to reduce their carbon

footprint. Pumps with variable frequency drives (VFDs) and optimized energy

consumption are becoming essential for sustainability goals in the food &

beverage industry.

Expansion of Cold Chain and

Dairy Processing: With the rising demand for dairy, frozen

foods, and cold beverages, the market for high-performance and

temperature-resistant pumps is growing. These pumps are designed to handle

refrigerated and frozen products efficiently.

Rising Investments in Food

& Beverage Infrastructure: The expansion of food

processing facilities and beverage production plants worldwide is driving the

demand for advanced pumping solutions. Developing markets, especially in

Asia-Pacific and Latin America, are witnessing increased investments in modern

food processing systems.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=211704387

Alcoholic Beverages has a

significant share within the Application of the food & beverage industry

pumps market.

The global demand for

alcoholic beverages is rising, driving the need for highly efficient production

processes. The manufacturing of beer, wine, spirits, and ready-to-drink

cocktails requires large-scale fluid transfer across various stages, including

fermentation, filtration, and bottling. Pumps play a critical role in handling

different viscosities, alcohol concentrations, and carbonation levels, ensuring

the safe and contamination-free movement of liquids.

For example, in beer

production, pumps transfer wort through multiple processing stages, including

filtration. In winemaking, they facilitate the gentle transfer of wine between

barrels while leaving sediment behind. The expansion of craft breweries, microbreweries,

and premium spirits brands has further increased the demand for specialized

pump designs catering to both large-scale and artisanal production.

Additionally, stringent food

safety and hygiene regulations in the alcoholic beverage industry are driving

the adoption of sanitation-focused pump solutions. These pumps are designed for

easy cleaning and maintenance while ensuring compliance with industry

standards. The combination of increasing demand, operational efficiency, and

regulatory requirements is fueling the growth of the pump market within the

alcoholic beverage sector.

North America Dominates the food

and beverage industry pumps market share.

Some key names such as JBT

(US), Graco Inc. (US), Wastecorp Pumps (US), Sonic Corporation (US), Unibloc

Hygienic Technologies US LLC (US), Ampco Pumps Company (US), Industrial Flow

Solutions (US) and SPX FLOW (US)et al., all manufacture a plethora of pumps

that meet diverse production techniques across the countries. They manufacture

pumps that will handle all liquids and ingredients while assuring quality,

hygiene, and performance in the pumping and processing of foods and drinks.

The U.S. houses the largest

number of food and beverage manufacturing facilities. According to the reports

from the U.S. Department of Agriculture in January 2025, these establishments

accounted for 16.8 % of total manufacturing sales and 15.4 % of manufacturing

employment in 2021. The largest group among these industries is meat

processing, whose sales accounted for 26.2% in 2021, followed by dairy articles

such as cheese and condensed milk (12.8%), other foods (12.4%), beverages

(11.3%), and grains and oilseeds (10.4%). Meat processing, including livestock

and poultry slaughter, remains the major contributor to pump demand because of

the high volume involved and the complexity of processing in factories.

The boosting demand for

advanced pumping systems for hygienic and contamination-free processing is an

inevitable hallmark of an expanding food manufacturing sector and the

increasing rigors of food safety standards in North America from time to time,

along with a growing production capacity. So, the market share of the region

remains huge and increasing within the food & beverage industry pumps

segment.

Top

10 Companies in the Food & Beverage Industry Pumps Market

- GEA Group (Germany)

- ALFA LAVAL (Germany)

- KSB SE & Co. KGaA (Germany)

- JBT (US)

- Atlas Copco (Sweden)

- Graco Inc. (US)

- Grundfos Holding A/S (Denmark)

- Verder Liquids (Netherlands)

- PCM (France)

- Roto Pumps Limited (India)