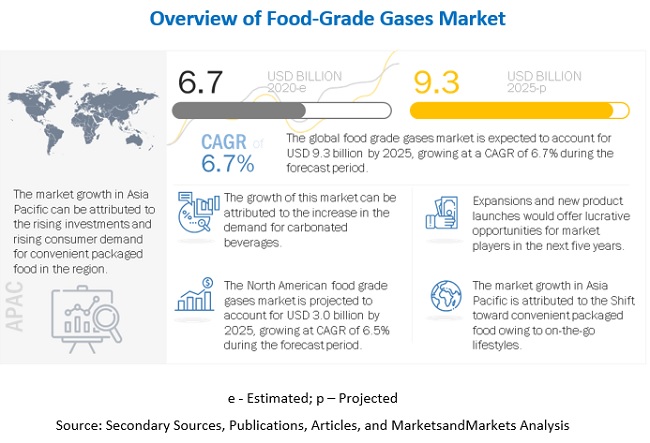

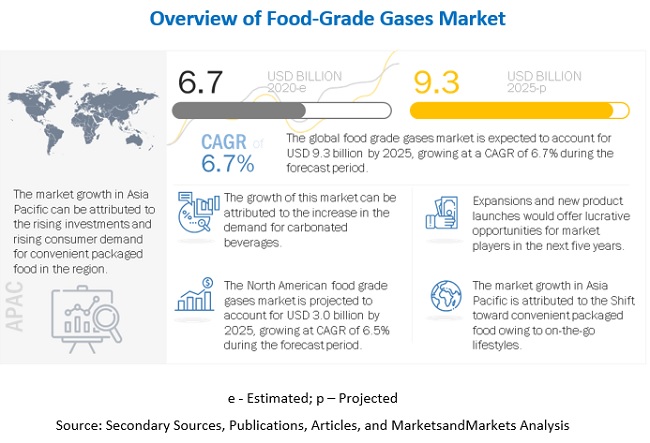

The report "Food-Grade Gases Market by Type (Carbon Dioxide, Nitrogen, Oxygen), Application (Freezing & Chilling, Packaging, Carbonation), End-Use (Dairy & Frozen Products, Beverages, Meat, Poultry & Seafood), and Region - Global Forecast to 2025", is estimated to be valued at USD 6.7 billion in 2020 and is projected to reach USD 9.3 billion by 2025, at a CAGR of 6.7% from 2020 to 2025. Shifting consumer preferences toward convenient food packaging owing to their on-the-go lifestyles and the growing number of microbreweries across all regions are some of the factors driving the growth of the food-grade gases market.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=9473111

The carbon dioxide segment is estimated to account for the largest

share, in terms of value, by type, in 2020.

Based on type, the food-grade gases market is segmented into carbon dioxide, nitrogen, oxygen, and others. The carbon dioxide segment is estimated to account for the largest market share in 2020 as carbon dioxide is used for almost all major applications like packaging, freezing & chilling, and carbonation.

Further, carbon dioxide is being used in the softening of water to avoid corrosion problems in long water distribution lines and also in producing potable drinking water. Due to the huge demand from the microbreweries and other carbonated beverage manufacturers, the carbon dioxide segment holds the largest market share.

The beverages segment, by end-use, is estimated to witness the fastest

growth in the food-grade gases market in 2020

By end-use, the food-grade gases market is segmented into meat, poultry, and seafood products; dairy & frozen products; beverages; fruits & vegetables; convenience food products; bakery & confectionery products; and others. The beverages segment is estimated to grow at the highest CAGR due to the use of large volumes of food-grade gases, especially carbon dioxide and nitrogen, for carbonation and blanketing. As the demand for carbonated beverages increases, there is a simultaneous growth in the market for food-grade gases.

North America is estimated to dominate the food-grade gases market, in

terms of value, in 2020

The microbrewery culture is also on the rise in the North American market. There are multiple microbreweries present in the region. These microbreweries require carbon dioxide for beer dispensing. Also, the North American soft drinks market is one of the largest, with the presence of all the big brands such as Coca-Cola and PepsiCo. The soft drinks industry is one of the largest users of food-grade carbon dioxide for the carbonation of beverages.

Make an Inquiry @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=9473111

The large beverage industry and rising trends of microbreweries create a huge demand for carbon dioxide in the North American region, with the US being the largest and fastest growing market. Also, because of the presence of highly organized retail chains and cold chain infrastructure, the North American market holds the largest market share in the food-grade gases market.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies. It includes the profiles of leading companies such as The Linde Group (Germany), Air Products & Chemicals (US), Air Liquide (France), The Messer Group (Germany), Taiyo Nippon Sanso (Japan), Wesfarmers Ltd. (Australia), SOL Group (Italy), Gulf Cryo (Kuwait), Air Water, Inc. (Japan), Massy Group (Caribbean), PT Aneka Industri (Indonesia), National Gases Limited (Pakistan), SIAD (Italy), Cryogenic Gases (US), Les Gaz Industriels Ltd. (East Africa), Aditya Air Products (India), Sidewinder Dry Ice & Gas (South Africa), Axcel Gases (India), Chengdu Taiyu Industrial Gases Co., Ltd (China), Yingde Gas Group Ltd (China), Siddhi Vinayak Industrial Gases Pvt Ltd (India), American Welding & Gas (US), Ijsbariek Strombeek N.V (Belgium), Air Source Industries (US), and Purity Cylinder Gases Inc. (US).

The report "Food-Grade Gases Market by Type (Carbon Dioxide, Nitrogen, Oxygen), Application (Freezing & Chilling, Packaging, Carbonation), End-Use (Dairy & Frozen Products, Beverages, Meat, Poultry & Seafood), and Region - Global Forecast to 2025", is estimated to be valued at USD 6.7 billion in 2020 and is projected to reach USD 9.3 billion by 2025, at a CAGR of 6.7% from 2020 to 2025. Shifting consumer preferences toward convenient food packaging owing to their on-the-go lifestyles and the growing number of microbreweries across all regions are some of the factors driving the growth of the food-grade gases market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=9473111

The carbon dioxide segment is estimated to account for the largest

share, in terms of value, by type, in 2020.

Based on type, the food-grade gases market is segmented into carbon dioxide, nitrogen, oxygen, and others. The carbon dioxide segment is estimated to account for the largest market share in 2020 as carbon dioxide is used for almost all major applications like packaging, freezing & chilling, and carbonation.

Further, carbon dioxide is being used in the softening of water to avoid corrosion problems in long water distribution lines and also in producing potable drinking water. Due to the huge demand from the microbreweries and other carbonated beverage manufacturers, the carbon dioxide segment holds the largest market share.

Drivers: Growing Number of Microbreweries Across all Regions

Carbon dioxide is used for the carbonation of beers and renders a sparkle and tangy taste while also preventing spoilage. Large-scale breweries typically install CO2 reclamation equipment in their breweries that capture the carbon dioxide generated during fermentation process. According to The Brewers of Europe, the European beer production in 2017 reached its eight-year high. The growing number of independent and microbreweries wis contributing to the growth of market.

Restraints: Strict Government Regulations to Meet Quality Standards

Legislations have been sanctioned in most countries in North America and Europe to protect food products from spoilage and contamination due to inferior manufacturing and refrigerated storage processes. Therefore, each country has appointed agencies to inspect consumer health issues and also inspect the type of material used to make sure they are safe for food & beverage operations. Also, by law, all gas cylinders supplied for beverage manufacturers must have a product traceability label on the gas cylinder, valve, or valve guard. Food-grade gas manufacturers need to abide by these laws.

Request for

Customization:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=9473111

North America is estimated to dominate the food-grade gases market, in

terms of value, in 2020

The microbrewery culture is also on the rise in the North American market. There are multiple microbreweries present in the region. These microbreweries require carbon dioxide for beer dispensing. Also, the North American soft drinks market is one of the largest, with the presence of all the big brands such as Coca-Cola and PepsiCo. The soft drinks industry is one of the largest users of food-grade carbon dioxide for the carbonation of beverages.

The large beverage industry and rising trends of microbreweries create a huge demand for carbon dioxide in the North American region, with the US being the largest and fastest growing market. Also, because of the presence of highly organized retail chains and cold chain infrastructure, the North American market holds the largest market share in the food-grade gases market.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies. It includes the profiles of leading companies such as The Linde Group (Germany), Air Products & Chemicals (US), Air Liquide (France), The Messer Group (Germany), Taiyo Nippon Sanso (Japan), Wesfarmers Ltd. (Australia), SOL Group (Italy), Gulf Cryo (Kuwait), Air Water, Inc. (Japan), Massy Group (Caribbean), PT Aneka Industri (Indonesia), National Gases Limited (Pakistan), SIAD (Italy), Cryogenic Gases (US), Les Gaz Industriels Ltd. (East Africa), Aditya Air Products (India), Sidewinder Dry Ice & Gas (South Africa), Axcel Gases (India), Chengdu Taiyu Industrial Gases Co., Ltd (China), Yingde Gas Group Ltd (China), Siddhi Vinayak Industrial Gases Pvt Ltd (India), American Welding & Gas (US), Ijsbariek Strombeek N.V (Belgium), Air Source Industries (US), and Purity Cylinder Gases Inc. (US).

The report "Food-Grade Gases Market by Type (Carbon Dioxide, Nitrogen, Oxygen), Application (Freezing & Chilling, Packaging, Carbonation), End-Use (Dairy & Frozen Products, Beverages, Meat, Poultry & Seafood), and Region - Global Forecast to 2025", is estimated to be valued at USD 6.7 billion in 2020 and is projected to reach USD 9.3 billion by 2025, at a CAGR of 6.7% from 2020 to 2025. Shifting consumer preferences toward convenient food packaging owing to their on-the-go lifestyles and the growing number of microbreweries across all regions are some of the factors driving the growth of the food-grade gases market.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=9473111

The carbon dioxide segment is estimated to account for the largest share, in terms of value, by type, in 2020.

Based on type, the food-grade gases market is segmented into carbon dioxide, nitrogen, oxygen, and others. The carbon dioxide segment is estimated to account for the largest market share in 2020 as carbon dioxide is used for almost all major applications like packaging, freezing & chilling, and carbonation.

Further, carbon dioxide is being used in the softening of water to avoid corrosion problems in long water distribution lines and also in producing potable drinking water. Due to the huge demand from the microbreweries and other carbonated beverage manufacturers, the carbon dioxide segment holds the largest market share.

Drivers: Growing Number of Microbreweries Across all Regions

Carbon dioxide is used for the carbonation of beers and renders a sparkle and tangy taste while also preventing spoilage. Large-scale breweries typically install CO2 reclamation equipment in their breweries that capture the carbon dioxide generated during fermentation process. According to The Brewers of Europe, the European beer production in 2017 reached its eight-year high. The growing number of independent and microbreweries wis contributing to the growth of market.

Restraints: Strict Government Regulations to Meet Quality Standards

Legislations have been sanctioned in most countries in North America and Europe to protect food products from spoilage and contamination due to inferior manufacturing and refrigerated storage processes. Therefore, each country has appointed agencies to inspect consumer health issues and also inspect the type of material used to make sure they are safe for food & beverage operations. Also, by law, all gas cylinders supplied for beverage manufacturers must have a product traceability label on the gas cylinder, valve, or valve guard. Food-grade gas manufacturers need to abide by these laws.

Request for Customization:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=9473111

North America is estimated to dominate the food-grade gases market, in terms of value, in 2020

The microbrewery culture is also on the rise in the North American market. There are multiple microbreweries present in the region. These microbreweries require carbon dioxide for beer dispensing. Also, the North American soft drinks market is one of the largest, with the presence of all the big brands such as Coca-Cola and PepsiCo. The soft drinks industry is one of the largest users of food-grade carbon dioxide for the carbonation of beverages.

The large beverage industry and rising trends of microbreweries create a huge demand for carbon dioxide in the North American region, with the US being the largest and fastest growing market. Also, because of the presence of highly organized retail chains and cold chain infrastructure, the North American market holds the largest market share in the food-grade gases market.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies. It includes the profiles of leading companies such as The Linde Group (Germany), Air Products & Chemicals (US), Air Liquide (France), The Messer Group (Germany), Taiyo Nippon Sanso (Japan), Wesfarmers Ltd. (Australia), SOL Group (Italy), Gulf Cryo (Kuwait), Air Water, Inc. (Japan), Massy Group (Caribbean), PT Aneka Industri (Indonesia), National Gases Limited (Pakistan), SIAD (Italy), Cryogenic Gases (US), Les Gaz Industriels Ltd. (East Africa), Aditya Air Products (India), Sidewinder Dry Ice & Gas (South Africa), Axcel Gases (India), Chengdu Taiyu Industrial Gases Co., Ltd (China), Yingde Gas Group Ltd (China), Siddhi Vinayak Industrial Gases Pvt Ltd (India), American Welding & Gas (US), Ijsbariek Strombeek N.V (Belgium), Air Source Industries (US), and Purity Cylinder Gases Inc. (US).