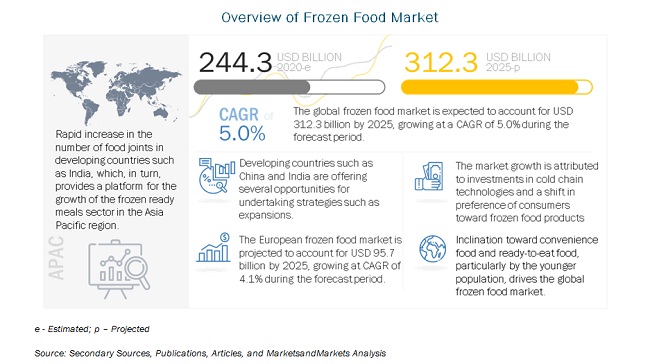

The frozen food market size was valued at USD 244.3 billion in 2020 and is projected to reach a value of about USD 312.3 billion by 2025, at a CAGR of 5.0%. Developments in the retail landscape, rising demand for convenience food, and technological advancements in the cold chain market are the major driving factors for the market. On the other hand, the rising preference for fresh and natural food products is a restraining factor for the frozen food market.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=130

Drivers: Rising demand for convenience food

The increasing consumer preference toward convenience foods indirectly favors the increasing demand for frozen products as they require less time and effort as compared to cooking from scratch. The processed food market is driven by the greater need for convenience due to the busy lifestyles of consumers. This, in turn, increases the demand for frozen products. Increasing disposable income is also one such factor that has a huge influence on the growth of the frozen food market as it increases the buying power of consumers.

Restraints: Rising preference for fresh and natural food products

To some consumers, frozen food is thought of as a product that is an inferior substitute for fresh food, which is one of the major restraints for this market. There is a notion that food processed a year or more before it is consumed could not be nutritious. However, statements such as “frozen produce can be just as good as the fresh stuff in terms of nutrition” from the US Food and Drug Administration (FDA) and the International Food Information Council (IFIC) about the nutrient content of frozen food are changing the consumer perception. Nutrients such as vitamin C and folate can change with the change in temperature while food items stored at varying temperatures can lose their nutrients. Since frozen foods are stored at a constant low temperature, they do not lose such essential nutrients.

The convenient & ready meals segment is estimated to dominate the global market in 2020.

By product, the convenient & ready meals segment is estimated to dominate the global market in 2020. This is due to the changing and busy lifestyles of people, globally, which has increased the consumption of frozen foods, globally. Frozen foods are easy to prepare and take less time for preparation. They are healthy and have high nutritional value. Frozen food export business has also increased in recent times due to the high acceptance of these products among consumers and brand awareness among developing countries.

Request Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=130

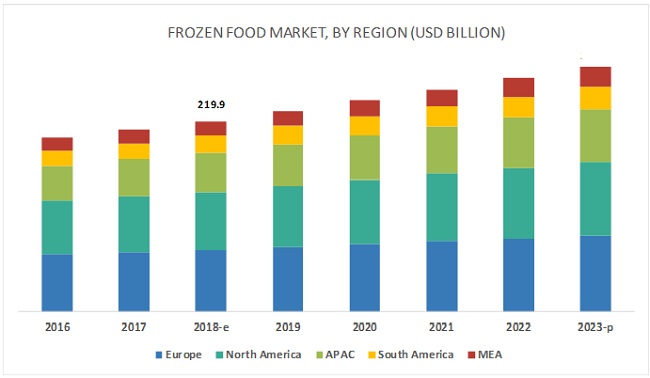

Europe accounted for the largest share in the frozen food market

Europe accounted for the largest market share in the market. Population growth, rapid urbanization, and the rise in consumer awareness about the benefits of frozen food are the key factors driving the demand for frozen food in the region.

The key players in this market include General Mills Inc (US), Conagra Brands, Inc. (US), Grupo Bimbo S.A.B. de C.V. (Mexico), Nestle SA (Switzerland), Unilever (Netherlands), Kellogg Company (US), McCain Foods Limited (Canada), Kraft Heinz Company (US), Associated British Foods plc (UK), Ajinomoto (Japan), Vandemoortele NV (Belgium), Lantmannen Unibake International (Denmark), Cargill (US), Europastry S.A. (Spain), JBS (Brazil), Kidfresh (US), Aryzta (US), Kuppies (India), OOB Organics (New Zealand), Omar International Pvt Ltd (India), Bubba Foods (US), Shishi He Deming (China), and Smart Price Sales & Marketing (US), Chevon Agrotech Pvt Ltd (India), and Omar International Pvt Ltd (India).