The report "Fruit & Vegetable Processing Market by Product Type (Fresh, Fresh-cut, Canned, Frozen, Dried & Dehydrated, Convenience), Equipment (Pre-processing, Processing, Washing, Filling, Seasoning, Packaging), Operation, and Region - Global Forecast to 2022", The global fruit & vegetable processing market is estimated to be valued at USD 245.97 Billion in 2017 and is projected to grow at a CAGR of 7.1% from 2017, to reach USD 346.05 Billion by 2022. The global fruit & vegetable processing market comprises the global fruit & vegetable processing equipment market and processed fruits & vegetables market. The market for fruit & vegetable processing is showing significant growth with the increase in the number of distribution channels such as supermarkets and hypermarkets and rising middle-class population & disposable income in developing economies such as China, India, and Mexico. The growing investments in automation development of processing technology along with freezing and packaging technology across the globe are the leading factors that contribute to the demand for fruit & vegetable processing equipment, worldwide.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=140232885

Based on type, the market has been segmented into fruits, vegetables, and others (jams, pickles, and preserved produce). The vegetables segments dominated the global processed fruits & vegetables market, in terms of both, value and volume. The increase in health consciousness among consumers and growing vegetarian population is expected to drive the demand for the vegetables segment.

Based on type, the fruit & vegetable processing equipment market has been segmented into pre-processing, peeling/inspection/slicing, washing & dewatering, fillers, packaging & handling, seasoning systems, and others (control & information systems, metal detectors, and fryer & oven systems, homogenizers, and weighers). The fillers and packaging & handling segments are projected to grow at the highest CAGR during the forecast period. The increase in innovations and technological advancements in the processing equipment industry is expected to drive this market during the forecast period.

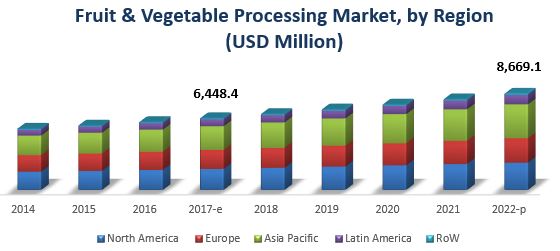

North America is estimated to occupy the largest share of the global fruit & vegetable processing market, in terms of value, in 2017, owing to the mature fruit & vegetable processing industry and the presence of major companies such as JBT Corporation, Conagra Brands, and Dole Food. In the Asia Pacific region, India is projected to be the fastest-growing market during the forecast period. The changing lifestyles and preferences, increasing awareness regarding the benefits of processed fruits & vegetables, the growing health-conscious population, higher disposable incomes, and growth of the middle-class population are some of the factors driving the growth of the fruit & vegetable processing market in India. India has a varied agricultural climate, relatively inexpensive labor, and according to the FAOSTAT, it accounted for the second-largest population in the world in 2017, which is expected to support the growth of this industry. Key players in Europe and the US focus on tapping the market in countries such as India and China, owing to which Asia Pacific is expected to witness high growth in the coming years.

The food recall incidences, coupled with complex supply chain and high inventory carrying cost are the major factors restraining the growth of the processed fruits & vegetables market, globally. The major challenges faced by the processors/manufacturers are high capital investments for equipment and strict regulations that ensure consumer safety.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=140232885

The market for fruit & vegetable processing equipment is dominated by key players such as Bosch (Germany), Buhler (Switzerland), GEA Group (Germany), JBT Corporation (US), and Krones (Germany), while the market for processed fruits & vegetables is dominated by Conagra Brands (US), Dole Food (US), Kroger (US), Olam International (Singapore), The Kraft Heinz Company (US), Albertsons (US) Greencore Group (Ireland), and Nestlé (Switzerland). These leading players have adopted various strategies such as expansions, acquisitions, new product launches, and joint ventures/partnerships/collaborations to explore new and untapped markets, expand in local areas of emerging markets, and develop a new customer base for long-term client relationships. This has not only enabled the key players to expand their geographical reach but has also reinforced their market position by gaining a larger share in terms of revenue and product portfolios.

Small-scale players have also adopted these strategies to expand their businesses globally by investing in the establishment of manufacturing facilities and technical service centers in various regions. Inorganic growth strategies enable them to improve their technical expertise through intensive R&D infrastructure offered by bigger players.