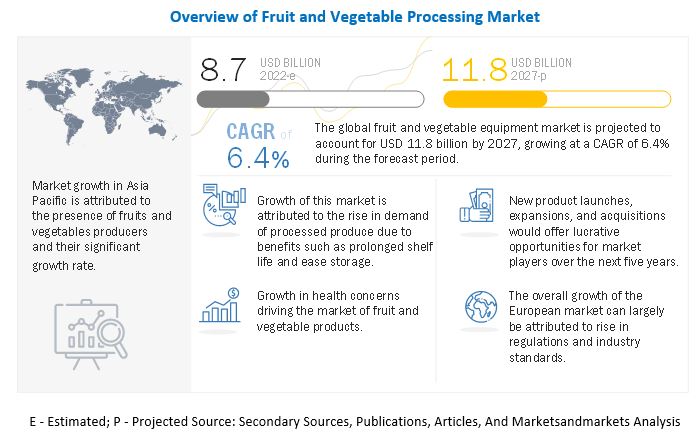

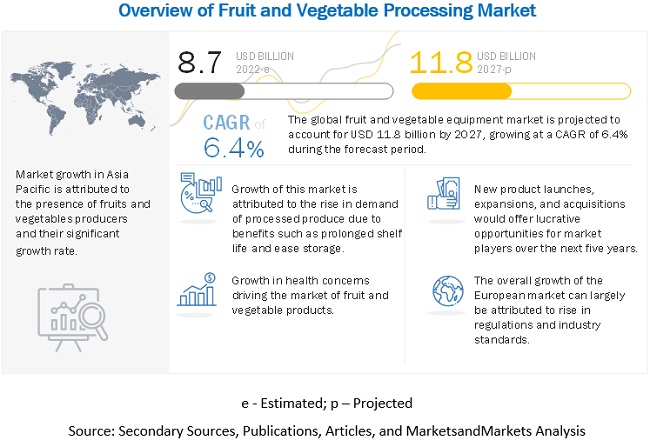

The fruit and vegetable processing market is estimated to account for nearly USD 8.7 billion in 2022 and is projected to reach a value of nearly USD 11.8 billion by 2027, growing at a CAGR of 6.4% from 2022. The demand for fruit and vegetable processing is increasing significantly, due to the increasing consumption of processed fruit and vegetable products in developing countries such as China, India, South Africa, and Brazil.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=140232885

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=140232885

Key players in this market include GEA Group (Germany), Alfa Laval (Sweden), JBT Corporation (US), Heat & Control Inc. (Sweden), Krones AG (Germany), Bühler (Switzerland), Marel (Iceland), Bigtem Makine A.S. (Turkey), Fenco Food Machinery S.R.L (Italy), Anko Food Machine co., Ltd (Taiwan), Syntegon Technology GmbH (Germany) and Finis (US).

The companies are focusing on offering a diverse range of fruit and vegetable processing equipment technologies that comply with government regulations and policies across regions. For example, Gea has extended homogenizer range with GEA Ariete Homogenizer 3160 for food industry. GEA Ariete Homogenizer 3160, It features up to 1500 bar, with significantly increased flow rate capacity between 200 and 1200 bar. Additionally March 2021, Buhler has introduced CHRONOS OML-1060 fully automated machine, it a automated solution for food & feed industries.

GEA Group is one of the leading technology suppliers for the food processing industry. The company provides customized solutions in food, dairy processing, dairy farming, beverage processing, pharma, chemical, marine, leisure & sport, land-based transportation, and utilities. The company’s international level industrial technology specializes in machinery and plants as well as process technology, components, and comprehensive services. The company operates through five segments, namely separation & flow technologies, liquid & powder technologies, food & healthcare technologies, refrigeration technologies, and farm technologies.

The company has its presence in more than fifty countries across the globe, spanning North America, South America, Europe, Africa, and Asia Pacific. The group operates through its subsidiaries, which include GEA Procomac S.p.A (Italy), GEA Process Engineering Private Limited (India), GEA Food Solutions Brasil Comércio de Equipments Ltd (Brazil), GEA Food Solutions North America, Inc. (US), and GEA Food Solutions UK & Ireland Limited (UK).

Bühler is primarily engaged in providing industrial solutions for processed food, commodity food, die casting, renewable energy, and feed. Bühler operates through four business segments—grains & food, consumer foods, advanced materials, and corporate functions. The company, through its subsidiaries, manufactures and markets food and chemical processing, die casting, and material handling machinery. It offers products for various industrial applications, such as cleaning, optical sorting, milling, grinding, sifting & grading, mixing, wet grinding, extrusion & dough preparations, and ingredient handling.

The company’s core technologies are in the areas of mechanical and thermal process engineering. Bühler also offers industrial services, such as machinery repair, strategic consulting, process plant optimization services, energy consulting, and manufacturing & logistics services. The company has its presence in 140 countries around the world, including North America and Europe.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=140232885

The Asia Pacific is estimated to account for the largest market share in the processed fruits & vegetables market in 2022. The fruit & vegetable processing industry in developing economies such as Asia Pacific and South American countries has developed due to factors such increasing number of working women and middle-class population, bulk production of various agricultural products, and government subsidies in countries such as India, coupled with trade liberation.