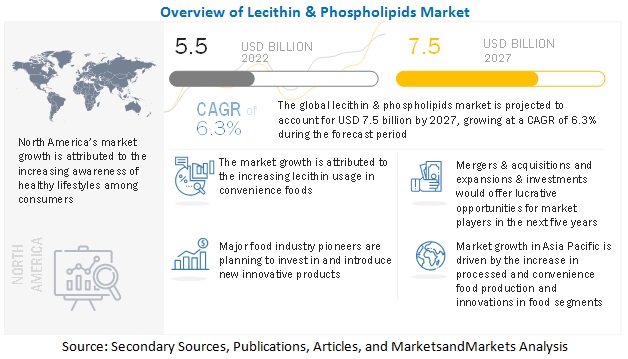

According to MarketsandMarkets "Lecithin & Phospholipids Market by Source (Soy, Sunflower, Rapeseed, Egg), Type (Fluid, De-Oiled, Modified), Application (Feed, Food (Confectionery Products, Convenience Food, Baked Goods) Industrial, Healthcare), Nature & Region - Global Forecast to 2027", the Lecithin & phospholipids market size is estimated to be valued at USD 5.5 billion in 2022 and is projected to reach USD 7.5 billion by 2027, recording a CAGR of 6.3% during the forecast period in terms of value. The market is driven by shifting consumer preferences to the natural and healthy food products. Moreover, it has also witnessed that the increasing vegan and flexitarian population across the globe is promoting the plant-based and natural ingredients in food products. These consumer trends are anticipated to fuel the demand for Lecithin & phospholipids in the global market over foreseeable future.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=259514839

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=259514839

Soy was the largest source segment in the global lecithin & phospholipids market and is expected to maintain the dominance over the forecast period

Soy based Lecithin & phospholipids are the wide consumed across different applications including animal feed, food & beverage, industrial, and healthcare. The ample availability of soy crop and easy extraction process makes the soy lecithin more convenient to the manufacturers in different industry. A wide range of regular food items contains soy lecithin such as bread, ice creams, infant products, dairy products, and some convenience food.

De-oiled segment is anticipated to be the fastest-growing lecithin & phospholipids type segment across the globe over the forecast period

De-oiled Lecithin or powdered Lecithin has almost no oil. It is practically free of oil and contains a particularly high concentration of polyunsaturated fatty acids. The powder lecithin is a more compact, easy-to-handle concentrated lecithin product which makes is perfect for transportation and store with higher shelf-life than liquid Lecithin. In addition to its improved functional properties, de-oiled lecithin products are essentially ready nutraceuticals with immense nutritional benefits for consumers.

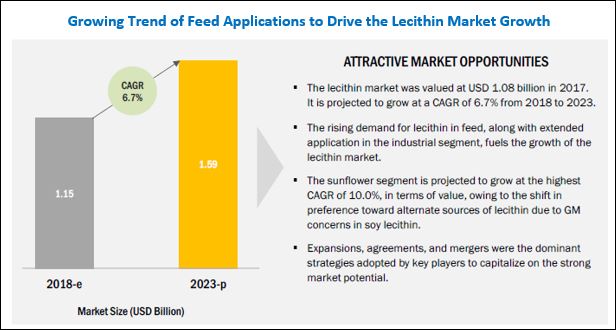

Animal feed was the largest application segment for the lecithin & phospholipids market and anticipated to maintain the dominance over the forecast period.

Lecithin is one of the important ingredient used to enrich fat, protein, and improves palletization in animal feed. Various studies have shown that crustaceans & fish cannot adequately synthesize the phospholipids they require for maximum performance. Therefore, phospholipids are recommended in their diet. In 2016, the European Food Safety Authority (EFSA) approved the use of Lecithin in the feed for all animal species. This has created opportunities for manufacturers at a global level.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=259514839

Asia Pacific is anticipated to be the fastest-growing region in the Lecithin & phospholipids market over the forecast period

The thriving food industry in developing economies as well as world’s top two most populous Asian countries including China and India which comprises a wide variety of bakery products, meat, dairy, and convenience foods is anticipated to fuel the demand for Lecithin & phospholipids. Moreover, growing popularity and adoption of food trends like veganism and natural plant-based foods among consumers is anticipated to promote the demand for Lecithin & phospholipids in the regional market.

This report includes a study on the marketing and development strategies, along with the product portfolios of leading companies. It consists of profiles of leading companies, such as Cargill (US), ADM (US), DuPont (US), IMCD Group B.V. (US), Bunge Limited (US), STERN-WYWIOL GRUPPE (Germany), Wilmar International Ltd. (Singapore), Sonic Biochem (India), Avril Group (France), American Lecithin Company (US), and VAV Life Sciences Pvt. Ltd. (India).