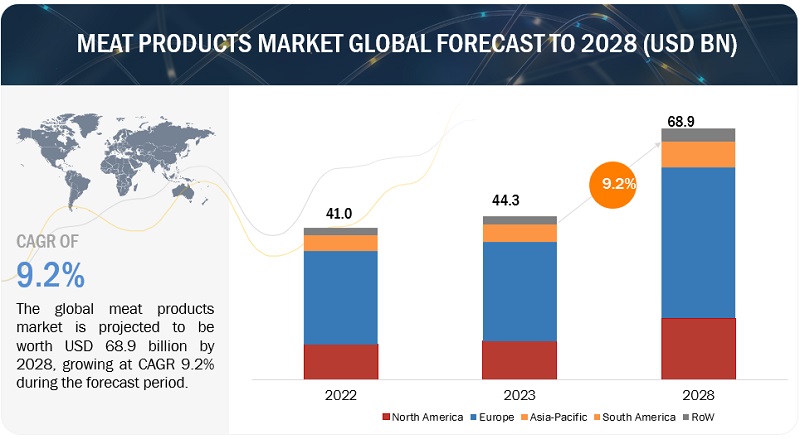

The global meat products market, valued at USD 44.3 billion in 2023, is projected to grow at a robust 9.2% CAGR, reaching USD 68.9 billion by 2028. This sector, which includes beef, poultry, pork, lamb, and processed meats, is undergoing significant changes and innovations. The rising demand for meat products is driven by various factors, with no signs of slowing down.

A key driver of this growth is the expanding global population, particularly in emerging markets. As populations grow and disposable incomes rise, meat consumption increases, especially as a primary protein source. Urbanization also plays a crucial role, influencing dietary habits as people move to cities and seek out more convenient, processed meat options that cater to fast-paced lifestyles.

Meat Products Market Drivers: Demand for Convenience in Meat Products

The trend of urbanization, with more people migrating from rural areas to cities, has substantially impacted the meat products market. Urban living, characterized by busy schedules and limited time for meal prep, has led to a preference for processed and pre-packaged meat items. These products are highly appealing due to their convenience—such as pre-cut, marinated, and ready-to-cook options—making them ideal for urban consumers who prioritize time-saving meals. The compact living spaces and on-the-go nature of city life further boost the demand for these products, as they require minimal kitchen equipment and suit fast, portable meal preferences. Additionally, urban areas’ diverse culinary scene fuels the demand for processed meats that meet the varied tastes of multicultural populations. The assurance of food safety and quality also addresses urban consumers' concerns about access to fresh, locally sourced meat. In short, the convenience of processed and pre-packaged meats is a significant market driver, particularly in urban environments.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=53140407

Processed Meat Products Lead Market Share

In 2022, processed meat products, including cured, dried, smoked, roasted, and fermented varieties, accounted for the largest share of the meat products market. The growing demand for processed meats is influenced by multiple factors, including increasingly busy lifestyles. These products require little to no preparation, making them a popular choice for consumers looking for quick, easy meal solutions. Additionally, the variety of flavors and textures achieved through curing, smoking, and fermentation has attracted more adventurous consumers seeking new culinary experiences.

The globalization of food culture has further fueled this trend, exposing consumers to a wider range of culinary traditions and boosting demand for exotic flavors. Rising disposable incomes worldwide have made convenience foods like processed meats even more appealing, as they provide ready-to-eat or easy-to-prepare options. While health concerns may impact some purchasing decisions, the indulgent, savory nature of processed meats continues to attract consumers. Manufacturers are responding to these demands by offering healthier options, reflecting the market's evolving needs. Ultimately, the growing appetite for processed meats is a result of convenience, diverse culinary preferences, economic factors, and shifting consumer tastes.

Europe: The Fastest-Growing Meat Products Market

Europe is emerging as the fastest-growing market for meat products, driven by increasing health consciousness across the region. This rising awareness has spurred demand for meat products, with more manufacturers entering the market to meet this need. Sustainability concerns and a growing focus on healthier eating habits are key factors propelling this shift.

Health-conscious trends and new dietary preferences are shaping the European meat products market. The region is home to a large number of meat industry players, who are actively working to strengthen their market positions. These companies are employing strategies such as launching new products, expanding production capacities, and forming partnerships or acquiring competitors to enhance their regional presence. For example, Vion Group from the Netherlands has made significant investments to expand operations in eastern Germany, focusing on providing fresh, locally sourced beef and pork products. This approach supports regionalism in food retail, with an emphasis on organic options and sustainability through reduced carbon footprints and improved animal welfare by shortening transportation distances.

Key Players in the Meat Products Industry

Leading companies in the meat products market include Cargill, Incorporated (USA), JBS SA (Brazil), Tyson Foods, Inc. (USA), Hormel Foods Corporation (USA), and Vion Group (Netherlands). These industry giants are continuously innovating and adapting to meet the changing demands of the global market.