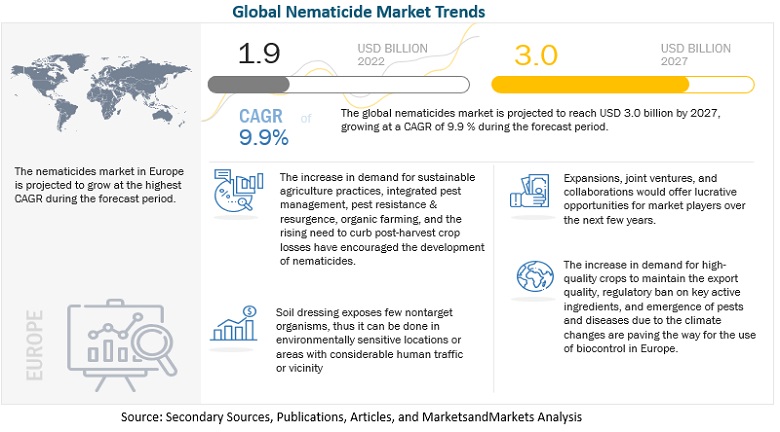

The nematicide market is projected to reach USD 3.0 billion by 2027, recording a CAGR of 9.9% during the forecast period. The global industry is estimated to be valued at USD 1.9 billion in 2022. Nematodes are non-segmented, bilaterally symmetric worm-like invertebrates that lack respiratory and circulatory systems but have a body cavity and a fully functional digestive system. It is difficult to create chemical countermeasures against worms that infests plants. It is challenging to administer a chemical to a nematode's immediate surroundings since most Phyto-parasitic nematodes spend their whole lives isolated to the soil or inside plant roots.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=193252005

Drivers: Economic damage such as crop production losses which leads to monetary losses, caused by Phyto parasitic nematodes continues to maintain the interest of private and public research institutes

According to CropLife India, food crops are damaged by more than 10,000 species of insects, 30,000 species of weeds, 100,000 diseases (caused by fungi, viruses, bacteria, and other microorganisms), and 1,000 species of nematodes, globally. The losses caused need to be contained to meet the food requirements to keep crop production from stagnating.

According to the FAO, approximately 20%–40% of crop yield is lost every year due to pest infestation. Crop pests include fungi, bacteria, viruses, insects, nematodes, viroid, and oomycetes. The diversity of crop pests continues to expand, and new strains are continually evolving. The effect of global warming would increase pest infestation further, as most of them thrive in warmer climates. Losses of major crops due to fungi, nematodes, and other such microorganisms are also on the rise. The study suggests that these figures would increase due to an increase in global temperatures, increased cropping intensity, and reduced crop rotations; this will lead to an increased demand for crop protection products such as nematicides.

Opportunities: Providing customized solutions targeted toward specific pests

With the growing environmental and pollution concerns and health hazards from many conventional agrochemicals, the demand for natural biologicals is rising steadily across regions. Customers are witnessing a high demand for new biological products such as bionematicides to use against nematodes on standing crops, which cause crop damages, thereby reducing the overall farm yield and quality. One such innovative method is seed treatment, which is gaining traction due to its less or non-toxic nature, reduced cost of cultivation, and favourable effect on the yield and quality of crops. Moreover, seed treatment is targeted toward the desired pests and improve efficiency in nutrient uptake.

Organic acid-based plant extract biocontrol is one of the major trends

Various key players and start-ups are focusing on developing bionematicides through alternate sources which were previously unexplored. A variety of organic acids, including amino, acetic, butyric, formic, and propionic acids have been shown to be toxic to certain species of plant parasitic nematodes. These are either the result of microbial decomposition of various compounds in the soil or metabolites produced by microorganisms. Several acids, including heptalic acid and hydroxamic acid, have been used successfully against nematodes.

Request for Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=193252005

North America dominated the nematicide market, with a value of USD 0.54 billion in 2021; it is projected to reach USD 0.91 billion by 2027, at a CAGR of 9.4 % during the forecast period.

The US is one of the largest soybean producers and its by-products and contributes to a significant share in the oilseeds market. While a major portion of the demand for oilseeds is from the food and feed industries, the regulatory framework for the biofuel sector of Mexico has been changing. The scope for oilseeds in the biofuel sector is also changing. Canada has been experiencing a high demand for grains, stemming from the livestock industry. The countries are not self-sufficient entirely and depend on imports from the South American countries such as Brazil and Argentina.