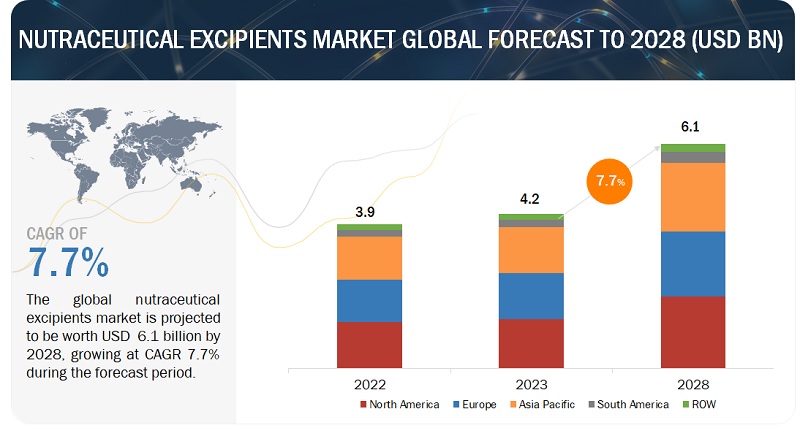

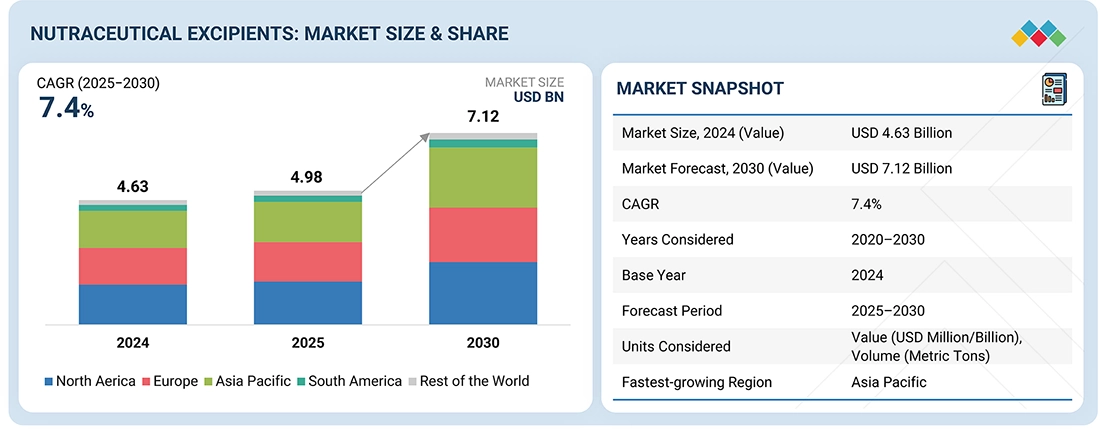

The global nutraceutical excipients market is projected to experience significant expansion, growing from an estimated USD 4.98 billion in 2025 to USD 7.12 billion by 2030, at a compound annual growth rate (CAGR) of 7.4%, according to the latest market insights.

Driven by increasing adoption of advanced excipients by dietary supplement and functional food manufacturers, the market is witnessing heightened demand for solutions that enhance product stability, bioavailability, taste, and shelf life. Nutraceutical excipients play a critical role across a wide range of applications, including vitamins, minerals, probiotics, herbal extracts, and protein-based supplements, ensuring effective delivery, ingredient integrity, and consumer acceptability.

Innovations in encapsulation, modified-release technologies, and natural or plant-based excipients, combined with regulatory encouragement for safe and high-quality formulations, are further propelling market growth. In addition, growing consumer preference for clean-label, environmentally sustainable, and high-performance nutraceutical products has positioned excipients as essential components in product development.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=247060367

Coating Agents Lead by Functionality

The coating agents segment is expected to maintain a dominant position within the functionality category. Increasing demand for improved product stability, enhanced swallowability, and visually appealing supplement formats is driving this growth. Industry leaders such as Roquette have introduced advanced coating platforms, including Tabshield® and ReadiLYCOAT®, which provide titanium dioxide-free film coatings and plant-based, ready-to-use solutions for tablets and nutraceutical applications. These innovations offer faster processing, superior finish, and alignment with regulatory and consumer expectations. Natural polymer-based coatings and sugar-free systems are also gaining traction, supporting vegan, allergen-free, and clean-label trends.

Modified-Release Functionality Gains Momentum

The modified-release segment is emerging as a leading functionality application, fueled by demand for controlled and sustained delivery of bioactive compounds. Modified-release excipients improve bioavailability, therapeutic efficacy, and dosing convenience for vitamins, minerals, probiotics, and herbal actives. Cutting-edge technologies, such as hot-melt extrusion and granulation-based methods, are enabling scalable production of sustained- or delayed-release formulations. Leading manufacturers continue to focus on excipients with GRAS status and compatibility with diverse manufacturing processes, reinforcing the adoption of modified-release systems across the nutraceutical industry.

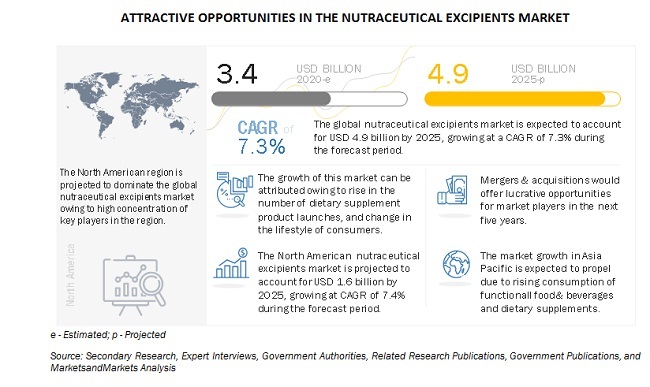

Asia Pacific Emerges as Fastest-Growing Region

Asia Pacific is projected to be the fastest-growing market for nutraceutical excipients, supported by rising health awareness, increasing dietary supplement consumption, and expanding manufacturing capabilities. Strategic investments by global excipient manufacturers underscore this growth trend. Notably, Colorcon inaugurated a film coating facility in Johor, Malaysia, on July 28, 2025, to support advanced excipient and controlled-release formulations for pharmaceutical and nutraceutical applications. Similarly, IFF showcased its comprehensive excipient portfolio at CPhI China 2023, offering polymer-based solutions for controlled-release, solubility enhancement, and novel oral dosage formats. These developments highlight the region’s growing prominence as a hub for formulation innovation.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=247060367

Leading Nutraceutical Excipients Companies:

The nutraceutical excipients market features prominent players such as International Flavors & Fragrances Inc. (US), Kerry Group plc (Ireland), Ingredion (US), Sensient Technologies Corporation (US), Associated British Foods plc (UK), BASF SE (Germany), Roquette Frères (France), MEGGLE GmbH & Co. KG (Germany), Cargill, Incorporated (US), Ashland (US), IMCD (Netherlands), Hilmar Cheese Company, Inc. (US), SEPPIC (US), Azelis Group (Luxembourg), and Biogrund GmbH (Germany).