The organic acids market is estimated to be USD 15.15 billion in 2025 and is projected to reach USD 19.54 billion by 2030, at a CAGR of 5.2%. The organic acids market is experiencing strong growth as food and beverage manufacturers increasingly adopt bio-based and naturally derived acids to enhance product safety, flavor, preservation, and nutritional quality. With applications spanning food processing, feed, pharmaceuticals, and industrial uses, organic acids play a critical role in extending shelf life, improving texture, and maintaining product stability. This rising demand is further supported by advancements in fermentation technology, increasing preference for clean-label and eco-friendly ingredients, and regulatory encouragement for sustainable production practices. Moreover, the growing focus on reducing chemical preservatives and embracing natural alternatives has positioned organic acids as essential ingredients in modern food innovation. As consumers and industries continue to prioritize health-conscious, environmentally sustainable, and high-quality products, the organic acids market is expected to remain a key driver of innovation and efficiency across multiple application sectors.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=30190158

By source, the synthetic segment to account for the largest market share.

By source, the synthetic segment is set to account for the largest share of the global organic acids market. Synthetic organic acids, derived primarily through petrochemical and chemical synthesis processes, continue todominate due to their cost efficiency, consistent quality, and large-scale production capabilities. These acids are widely used in food and beverage, pharmaceutical, and industrial applications where uniform purity and stability are critical.

The production of key acids such as acetic acid, formic acid, and adipic acid remains largely dependent on chemical synthesis, as bio-based alternatives have yet to achieve comparable economies of scale. Synthetic routes also enable manufacturers to maintain reliable supply chains, meeting the high-volume demand from downstream industries. While environmental concerns and sustainability initiatives are encouraging the development of bio-based acids, synthetic sources remain more competitive in terms of production cost and technological maturity. Established infrastructure and raw material availability further strengthen their position in the market. However, the segment faces gradual competitive pressure from fermentation-based processes, particularly for acids like citric and lactic acid, which are increasingly preferred in clean-label food applications. Despite this shift, the synthetic segment is expected to maintain its dominance over the forecast period, supported by industrial demand and manufacturing efficiency.

By type, the acetic acid segment is estimated to account for the largest market share.

By type, acetic acid is estimated to account for the largest share of the global organic acids market. Acetic acid is one of the most widely produced and consumed organic acids globally, primarily driven by its extensive use across multiple industries, including food and beverage, chemical manufacturing, pharmaceuticals, and textiles. In the food sector, it is commonly utilized as a preservative, flavoring agent, and acidity regulator, contributing to the extended shelf life and sensory profile of processed foods, condiments, and beverages.

Industrial applications further strengthen its market dominance. Acetic acid serves as a key raw material in the production of vinyl acetate monomer (VAM), acetic anhydride, and various ester derivatives, which are used in paints, adhesives, coatings, and packaging materials. Its versatility, high demand in downstream sectors, and well-established production infrastructure make it the most commercially significant organic acid.

While bio-based acetic acid production through fermentation is gaining traction for sustainability reasons, synthetic production from methanol carbonylation continues to account for the majority share due to cost efficiency and scalability. The compound’s broad utility, coupled with growing industrialization and rising processed food consumption, particularly in the Asia Pacific region, ensures that acetic acid will maintain its leading position in the organic acids market over the forecast period.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=30190158

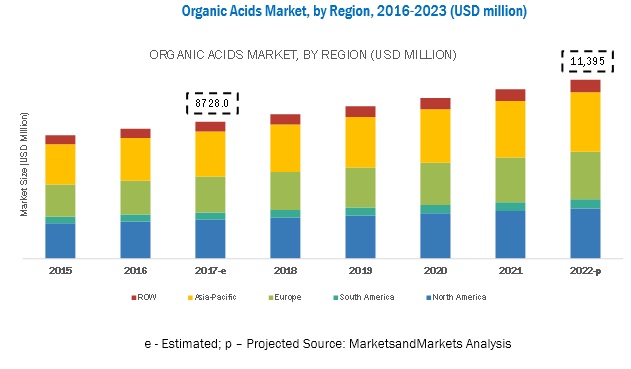

Asia Pacific is set to be the largest regional market.

By region, the Asia Pacific region is estimated to account for the largest share of the global organic acids market, driven by rapid industrialization, expanding food and beverage production, and growing demand for processed and convenience foods. Countries such as China, India, Japan, and South Korea are key contributors, supported by strong manufacturing bases, availability of raw materials, and rising consumer expenditure on packaged food products.

China dominates regional production due to its large-scale facilities for acetic, citric, and lactic acids, benefiting from low production costs and export-oriented operations. India, meanwhile, is witnessing steady growth as local food processing and pharmaceutical industries increasingly adopt organic acids as preservatives, acidulants, and intermediates. The expanding livestock and animal feed industries across Southeast Asia further contribute to demand, particularly for propionic and formic acids used in feed preservation. Additionally, Asia Pacific’s supportive regulatory environment and growing inclination toward bio-based and naturally derived acids align with the global shift toward sustainable production. Increasing investments in fermentation-based manufacturing and the presence of leading global and regional suppliers strengthen the region’s position in the value chain. With ongoing economic growth, urbanization, and rising consumption of processed foods, the Asia Pacific region is expected to maintain its dominance in the organic acids market over the forecast period.

The report profiles key players such as BASF SE (Germany), Cargill, Incorporated (US), ADM (US), Celanese Corporation (US), Eastman Chemical Company (US), Corbion (Netherlands), Tate & Lyle PLC (UK), Henan Jindan Lactic Acid Technology Co., Ltd. (China), Myriant Corporation (US), and Jungbunzlauer Suisse AG (Switzerland).